THORChain (RUNE): Latest Developments, Price Trends, and Technical Analysis

THORChain Faces Scrutiny Over Decentralization and Illicit Activity

THORChain, a cross-chain liquidity protocol, has recently found itself at the center of controversy as reports emerge linking the platform to illicit activity. North Korean hacking group Lazarus allegedly used THORChain to swap $1.4 billion worth of stolen ETH into Bitcoin following the Bybit hack.

While the protocol’s supporters argue that it remains a decentralized, non-custodial service, critics suggest that its failure to take action against illicit transactions raises concerns about selective governance. This debate has led to internal conflicts among developers, with resignations and disputes over whether THORChain should implement controls to prevent bad actors from exploiting its platform.

Governance Struggles and the Question of Decentralization

THORChain presents itself as a fully decentralized network, but recent governance actions suggest otherwise. When concerns over illicit fund transfers surfaced, some validators attempted to halt ETH trading on the platform. However, this decision was swiftly overturned by others, exposing a governance dilemma—should THORChain take action in certain cases, or remain fully neutral?

The contradiction became even clearer when THORChain previously paused its lending feature due to insolvency risks, proving that intervention is possible under specific conditions. This has led to criticism of selective decentralization, where intervention only happens when it benefits the protocol itself.

Surge in THORChain’s Trading Volume and RUNE Price Jump

Despite the controversy, THORChain's trading volume has soared. In the past seven days, the platform’s decentralized exchange (DEX) activity increased by 300%, bringing significant market attention. The RUNE token surged 22% in 24 hours, reaching $1.63, with a total market cap of $574 million. Analysts suggest that the rise in volume is partially driven by the Bybit hack, as hackers move funds through the network. However, there is also renewed interest in THORChain’s TCY debt token, which aims to help the protocol pay off a $200 million debt after it shut down THORFi services.

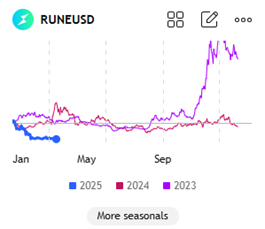

Source: TradingView

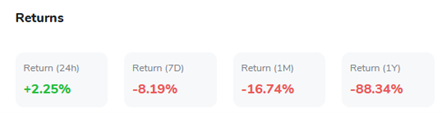

RUNE’s Price History and Market Performance

RUNE has experienced substantial volatility since its inception. Initially launched in 2019, it gained attention for its cross-chain trading capabilities. Its price surged during the 2021 bull run, reaching an all-time high above $20, before declining significantly in the 2022 bear market. In 2023-2024, the token saw periodic recoveries, driven by:

Expanding ecosystem partnerships

Rising demand for cross-chain swaps

Growth in DeFi adoption However, regulatory concerns and governance disputes have weighed on its long-term growth. RUNE’s recent 22% surge suggests renewed optimism, but traders remain cautious about potential risks.

Understanding THORChain’s Role in the DeFi Ecosystem

THORChain is a non-custodial, cross-chain liquidity protocol that allows users to swap assets across different blockchains without relying on wrapped tokens. Unlike Uniswap or PancakeSwap, which operate within a single blockchain, THORChain enables native asset swaps across multiple networks. Key features include:

Automated Market Maker (AMM) model for efficient liquidity pooling.

Decentralized governance via validators who secure the network.

No need for wrapped assets, ensuring transactions remain natively secure.

Continuous Liquidity Pools (CLP), where RUNE serves as the settlement asset.

THORChain has been widely adopted as a decentralized exchange (DEX) backend, powering platforms like THORSwap. However, its neutrality in the face of illicit transactions has become a hotly debated issue.

Source: Thorchain.org

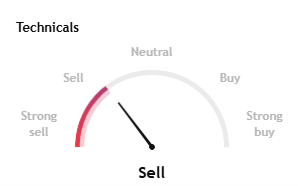

THORChain (RUNE) Technical Analysis: Cautious Recovery Amid Volatility

RUNE's price action reflects a mixed sentiment, with recent recovery attempts following a sharp drop. The asset is trading around $1.12, suggesting an ongoing consolidation phase after a period of heightened volatility.

Resistance and Support Levels

Immediate resistance: $1.20-$1.25 – A breakout above this zone could indicate further bullish continuation.

Major support: $1.05-$1.00 – If selling pressure increases, RUNE could test these lower levels before a potential rebound.

Relative Strength Index (RSI)

Current RSI: 48.96, indicating neutral market conditions with neither overbought nor oversold levels.

The RSI has shown fluctuations, suggesting indecision among traders. A move above 60 would confirm bullish momentum, while a drop below 40 could indicate further declines.

Volume Trends and Market Sentiment

24H Trading Volume: 247.62K, reflecting reduced trading activity after previous spikes.

A decline in volume suggests market indecision, meaning traders should watch for a volume surge to confirm the next major price movement.

Price Outlook

If bullish momentum builds, RUNE could push toward $1.20-$1.25, with a potential breakout targeting $1.30.

If bears regain control, the price might retest $1.05-$1.00, with a breakdown possibly leading to further downside.

Overall, RUNE is currently stabilizing, and traders should watch for a breakout confirmation before entering long or short positions.

Source: TradingView

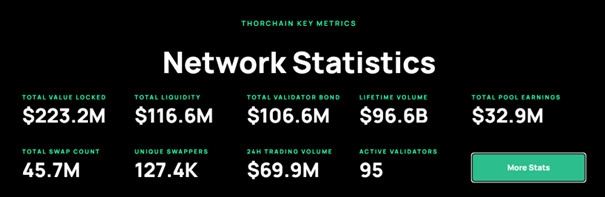

Thorchain Key Metrics

THORChain’s latest network statistics highlight its significant role in the decentralized finance (DeFi) ecosystem. The protocol currently boasts a total value locked (TVL) of $223.2 million, with total liquidity of $116.6 million, reinforcing its strong liquidity depth. The total validator bond stands at $106.6 million, ensuring network security and decentralization, supported by 95 active validators. Since its inception, THORChain has processed an impressive $96.6 billion in lifetime trading volume, with 45.7 million total swaps executed by 127.4K unique swappers. The platform also maintains a 24-hour trading volume of $69.9 million, with total pool earnings reaching $32.9 million, underscoring the profitability of liquidity provision. These figures demonstrate THORChain’s growing adoption and sustained activity, even amid market fluctuations and regulatory scrutiny.

Source: Thorchain.org

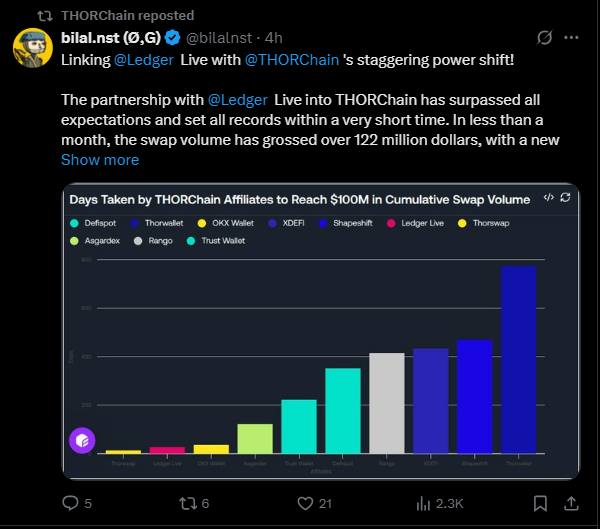

THORChain and Ledger Partnership

The recent partnership between THORChain and Ledger Live has driven unprecedented growth in swap volume, setting new records within a short period. According to the latest update, Ledger Live’s integration with THORChain has facilitated over $122 million in swaps in less than a month, showcasing the increasing adoption of decentralized, cross-chain liquidity solutions. A chart illustrates the rapid milestone achievement compared to other THORChain affiliates, highlighting Ledger Live as one of the fastest-growing integrations. This surge in activity underscores the growing demand for seamless, self-custodial trading solutions and further cements THORChain’s role as an important player in decentralized liquidity infrastructure.

Source: X

Conclusion: What’s Next for THORChain?

THORChain is currently at a critical juncture. Its decentralization ethos is being tested by its involvement in illicit transactions, putting it under potential regulatory scrutiny. However, strong market activity and increased trading volume indicate that the protocol is still attracting significant interest. The RUNE token has rebounded strongly, and if it maintains support levels, it could push toward $2.00.

Investors should remain cautious of potential regulatory crackdowns, but THORChain’s unique cross-chain capabilities continue to make it an important player in the DeFi space. As the protocol navigates these challenges, its governance and response to illicit activity will likely determine its long-term success or downfall.