Crypto Weekly Wrap: 10th January 2025

Bitcoin’s Slide Below $92K Amid Strong U.S. Economic Data

The cryptocurrency market experienced notable turbulence this week, with Bitcoin (BTC) dropping below $92,000. This decline came on the heels of strong U.S. economic indicators, including a rise in job openings and accelerated services sector activity in December. These figures pointed to a robust economy, driving benchmark 10-year Treasury yields to their highest levels since April. For Bitcoin and other cryptocurrencies, this strengthened economic outlook raised concerns about delayed Federal Reserve rate cuts, which could maintain upward pressure on borrowing costs and make riskier assets less appealing. As a result, the total cryptocurrency market cap fell 7.2%, with Ethereum, XRP, and Solana seeing significant losses alongside Bitcoin.

$555M Liquidated in Bitcoin Long Positions

The rapid price drop in Bitcoin led to the liquidation of $555 million in long positions. Traders who had bet on price increases were caught off guard, intensifying market volatility. Analysts suggest this liquidation flush might lead to a phase of consolidation, depending on market sentiment. With key upcoming events like Donald Trump’s inauguration and the Federal Reserve’s interest rate decision, the market remains highly sensitive to macroeconomic triggers, which could further shape Bitcoin’s trajectory.

Regulatory Shifts: Gensler’s Departure and Atkins’ Appointment

Outgoing SEC Chair Gary Gensler reiterated his skepticism about the crypto industry in his final remarks, warning of the speculative nature of many projects and calling for stricter regulations. Under Gensler's tenure, the SEC brought over 100 enforcement actions against crypto firms, targeting major platforms like Coinbase and Binance. However, the crypto landscape is set to shift with the incoming administration. President-elect Donald Trump’s appointment of Paul Atkins as the new SEC Chair signals a potential pivot toward more crypto-friendly policies. Atkins, known for advocating clear and balanced regulations, is expected to reduce enforcement actions and encourage innovation in the sector, fostering optimism among market participants.

Source: X

Dogecoin and Meme Coin Volatility

Meme coins like Dogecoin (DOGE) also faced challenges this week, with DOGE experiencing a sharp price decline amid whale movements and broader market uncertainties. A large transfer of 70 million DOGE to Binance raised concerns about potential sell-offs. Despite holding above its 21-day moving average, the technical outlook for Dogecoin remains bearish, with risks of further declines if key support levels fail. However, the upcoming Trump administration's pro-crypto policies could create favorable conditions for meme coins and the broader crypto market in 2025.

Source: X

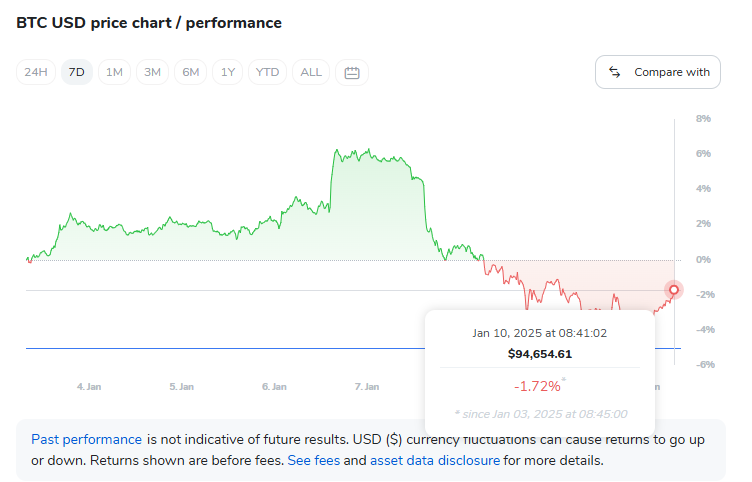

Technical Analysis: Bitcoin Finds Support Amid Market Volatility

Bitcoin's recent drop to $91,000 tested critical support levels before rebounding to its current trading price of $94,485. The cryptocurrency has yet to reclaim the psychological $100,000 mark, facing resistance at $95,772.66 and $96,983.49. The rebound is accompanied by an RSI of 61.55, suggesting a shift towards bullish momentum but not yet overbought conditions.

Key support levels are now at $90,534.01 and $88,886.87, with a break below potentially driving Bitcoin toward $87,000. Conversely, sustained buying interest at current levels could lead to a retest of resistance zones. Macroeconomic factors, including rising Treasury yields and the Federal Reserve's interest rate policies, remain critical variables influencing Bitcoin's price trajectory. Market participants will also monitor global economic indicators and investor sentiment as Bitcoin navigates this pivotal period.

Source: TradingView

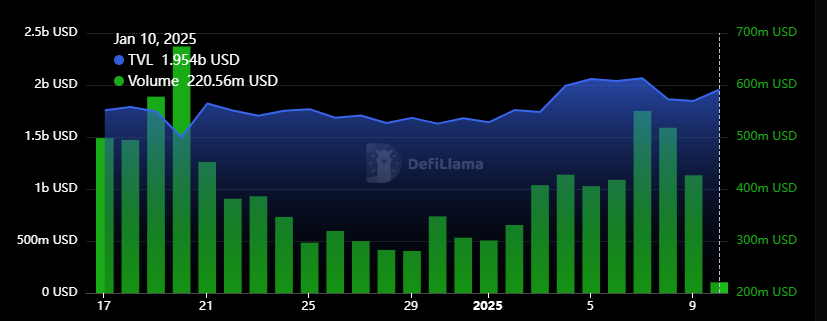

SUI: A Rising Star in the Layer-1 Ecosystem

Sui (SUI) has emerged as one of the fastest-growing Layer-1 blockchains, with its price hitting an all-time high of $5.35 in early January 2025. Bolstered by increasing trading volumes and innovative developments like liquid staking protocols, Sui's total value locked (TVL) has surpassed $2 billion. With strategic partnerships, including integrations with wallets and DeFi platforms, and growing institutional interest, Sui is poised to become a significant player in the decentralized finance (DeFi) landscape, drawing comparisons to the success of Solana.

Source: TradingView

Source: DefiLlama

XRP: Poised for Another Bullish Breakout

XRP has captured investor attention with its recent price consolidation near $2.27, forming a bullish triple bottom pattern. Analysts anticipate a potential breakout to the $4-$5 range in the coming weeks, fueled by the positive outcome of Ripple’s SEC case and the prospect of a spot XRP ETF approval under the new SEC leadership. As the third-largest digital asset by market cap, XRP continues to benefit from institutional interest and regulatory clarity, reinforcing its position as a leading cryptocurrency in the global market.

Source: TradingView

Source: TradingView

RLUSD Gains Traction as MiCA-Compliant Stablecoin

Ripple’s RLUSD stablecoin has emerged as a strong contender in the European market, processing over 33,000 transactions on the XRP Ledger since June 2024. Its MiCA-compliance offers a strategic advantage, particularly as USDT faces delisting from EU exchanges due to regulatory issues. By filling the gap left by Tether, RLUSD has positioned itself as a reliable and compliant alternative, gaining support from major exchanges and bolstering Ripple’s cross-border payment ecosystem. This aligns with Ripple’s broader strategy to strengthen its foothold in the evolving regulatory landscape.

Source: X

The Outlook Ahead: Opportunities and Risks

Looking forward, the crypto market faces a mixed outlook. While macroeconomic pressures weigh on Bitcoin and other digital assets, regulatory developments under the incoming Trump administration could provide a much-needed boost. Proposals like incorporating Bitcoin into the U.S. strategic reserves and creating a supportive regulatory environment for cryptocurrencies could catalyze further adoption and price growth.

At the same time, the competition between Bitcoin miners and AI companies for energy resources underscores the importance of innovation and adaptation in the industry. Additionally, the growing interest in altcoins like Ripple (XRP) and Solana (SOL) highlights the expanding diversity of investment opportunities in the crypto market.

In conclusion, while Bitcoin faces immediate challenges, the long-term prospects remain promising, driven by regulatory clarity, institutional interest, and technological advancements. As the market continues to evolve, both risks and opportunities will shape the trajectory of digital assets in 2025.

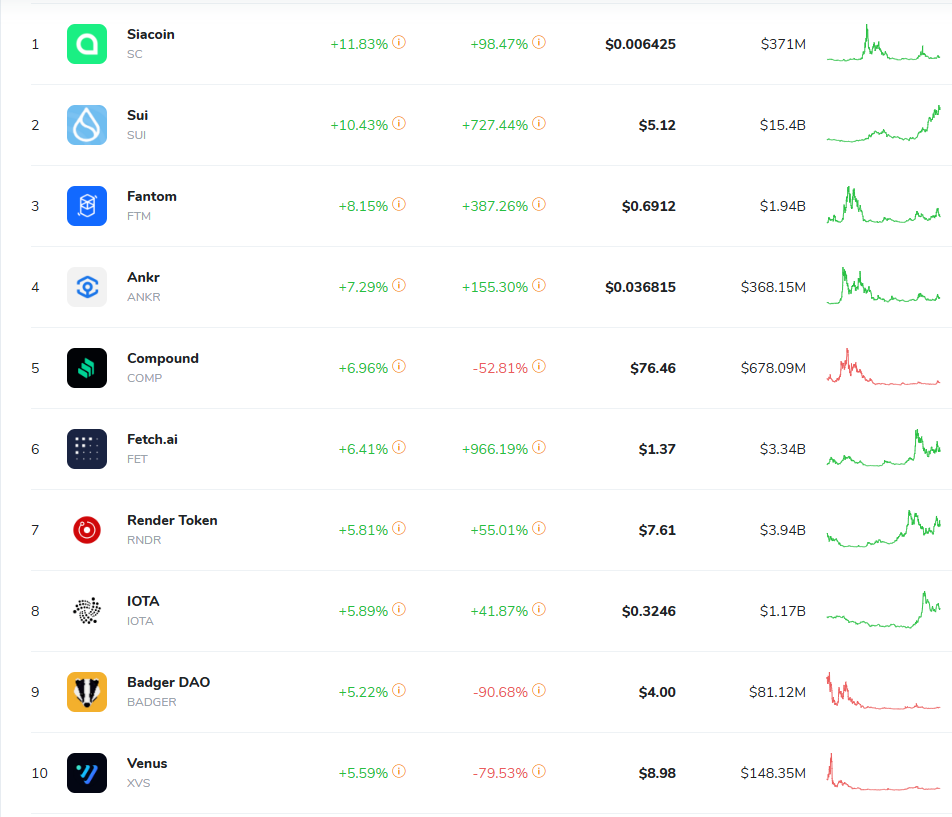

Cryptocurrencies by 24H Return