Crypto Weekly Wrap: 7th March 2025

The cryptocurrency market has seen significant price movements, institutional activity, and regulatory shifts in recent days. From Bitcoin's surge past $92K following Trump’s tariff delay to major partnerships shaping the industry, the landscape continues to evolve. Additionally, technical indicators suggest potential price breakouts for key assets like Bitcoin, Solana, and Cardano. Let’s break down the latest news and technical analysis.

Bitcoin Surges Above $92K After Trump Delays Tariffs

Bitcoin (BTC) experienced a strong rally, climbing over 6% in a day and surpassing the $92,500 mark. The price jump followed former U.S. President Donald Trump’s decision to postpone new auto tariffs on Canada and Mexico for an additional month.

While the delay offers temporary relief to the auto industry under the USMCA agreement, reciprocal tariffs are still set to take effect on April 2. Analysts suggest that the postponement has eased short-term economic uncertainty, leading to an increase in risk appetite for assets like Bitcoin and stocks.

Investors now shift their focus to the upcoming White House Crypto Summit, where major industry figures are expected to discuss policy and institutional adoption.

Source: X

Bitcoin Technical Analysis: Key Levels and Market Outlook

Bitcoin (BTC) is currently trading around $89,140, showing slight bullish momentum but struggling to sustain a breakout above key resistance levels. After failing to hold above $92,500, BTC saw increased volatility, with sharp swings between $84,000 and $92,000 over the past few days. The 24-hour trading volume is at 171.14M, indicating moderate market activity as investors await the next major move.

Bitcoin Price Targets and Key Levels

Resistance Levels:

$90,500 - $91,000: Immediate resistance, where BTC has faced repeated rejections.

$92,500 - $94,381: Strong resistance zone that needs to be cleared for further upside.

$96,999 - $99,543: If BTC breaks past $94,381, it could push toward these levels.

Support Levels:

$88,000 - $88,500: Immediate support, currently holding but under pressure.

$87,000 - $87,589: If BTC loses momentum, this level could be the next target.

$84,000 - $84,351: Major downside risk, marking the lowest point in recent volatility.

Technical Indicators

Relative Strength Index (RSI)

Current RSI: 43.69

Indicates that BTC is in neutral to slightly bearish territory, meaning that selling pressure has not yet exhausted.

If RSI drops below 40, it could signal further downside risk.

If RSI climbs above 50, BTC may regain bullish momentum.

Volume Trends

24H Volume: 171.14M

A decline in volume suggests less buying pressure, making BTC susceptible to further pullbacks.

A spike in volume with price above $91K could confirm a breakout attempt toward $94K+.

50-Day EMA Analysis

The 50-day Exponential Moving Average (EMA) is near $88,332, which has been acting as dynamic support.

BTC must hold above this level to prevent a further drop into the mid-$80,000 range.

Market Sentiment and Outlook

If BTC reclaims $91,000 with strong volume, a push toward $94K+ is possible.

Failure to hold above $88,500 could trigger a retest of the $84,000 support zone.

Macroeconomic factors, such as regulatory updates and institutional movements, continue to influence BTC’s price swings.

Traders should watch for increased volatility leading into the upcoming White House Crypto Summit.

Conclusion: BTC remains in a consolidation phase, with $88,000 as a key support level and $92,500+ as a crucial breakout point. Until a decisive move occurs, traders should exercise caution and monitor volume, RSI, and resistance levels for the next big price shift.

Source: TradingView

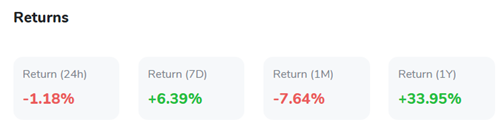

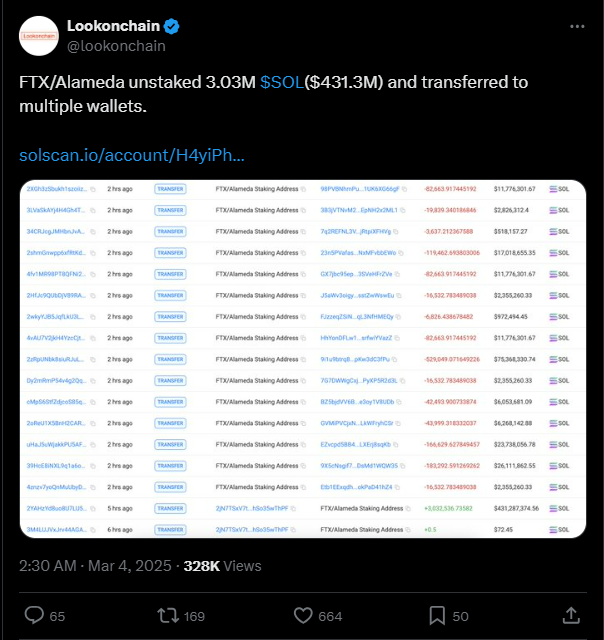

Sui (SUI) Surges 16% Following Partnership With World Liberty Financial

In another major development, World Liberty Financial, a Trump-affiliated crypto platform, has announced a partnership with Sui (SUI). The layer-1 blockchain will now play a role in a strategic reserve deal, aimed at expanding decentralized finance (DeFi) adoption in the U.S.

The announcement immediately boosted SUI’s price by over 16%, highlighting the market’s confidence in the partnership. World Liberty Financial recently acquired $21.5 million worth of cryptocurrencies, including ETH, WBTC, and MOVE, in preparation for the March 7 White House Crypto Summit.

Source: X

According to Zak Folkman, co-founder of World Liberty Financial, the partnership with Sui aligns with the company’s vision to bring DeFi solutions to mainstream users. Analysts believe this move could enhance Sui’s long-term value proposition.

Source: TradingView

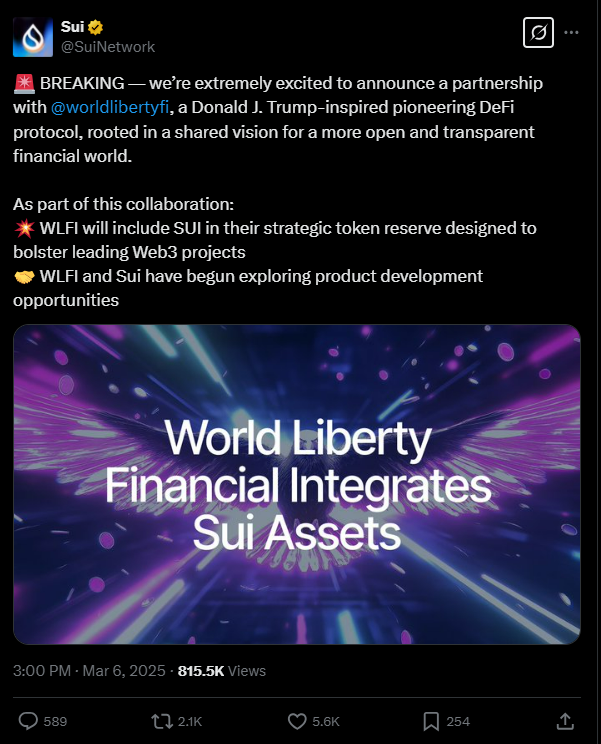

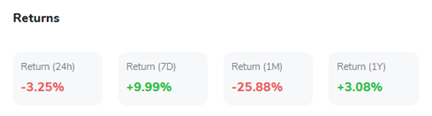

FTX & Alameda Move SOL to Binance – Market Fears Dumping Pressure

Solana (SOL) has faced uncertainty due to a large transfer of tokens from wallets linked to the collapsed FTX exchange & Alameda Research. Over $431 million worth of SOL was unstaked, with $3.4 million transferred to Binance. This has sparked speculation about a potential sell-off.

Although the moved amount represents a small fraction of SOL’s $4.47 billion daily trading volume, traders remain cautious about further liquidations. However, analysts suggest that if large sales occur via over-the-counter (OTC) deals, the market impact could be minimized.

Source: X

Solana Price Outlook: Key Levels to Watch

Resistance: The primary level to break is $156—if SOL surpasses this, it could retest Sunday’s highs.

Support: A decline below $134 could trigger a drop toward the low $120s.

Despite short-term volatility, momentum indicators remain bullish. The RSI has climbed above the signal line, and MACD shows positive momentum, hinting at continued upside potential.

XRP Tests Resistance After Major Rally

XRP has shown strong upward momentum following a sharp price surge, currently stabilizing around $2.56 after reaching a high of $2.70. The asset remains in bullish territory, with technical indicators suggesting the potential for further upside.

Key Technical Indicators

RSI: At 72.76, XRP is approaching overbought conditions, which could lead to short-term consolidation before the next move.

MACD: Bullish momentum remains intact, with buying pressure sustaining the current uptrend.

Volume: 24-hour trading volume stands at 587.46M, indicating strong investor interest.

For XRP to continue its rally, it must break past the $2.70–$2.80 resistance zone. A successful breakout could push the price toward $3.00+, while failure to hold momentum may lead to a retracement toward $2.40–$2.30 support levels.

Source: TradingView

Cardano (ADA) Eyes a 125% Rally

Cardano (ADA) is trading at $0.9220, holding strong above key support at $0.88-$0.90, with resistance near $0.95-$1.00. The RSI at 72.43 suggests ADA is entering overbought territory, indicating a possible short-term consolidation before another move higher. If ADA breaks above $1.00, it could target $1.14 and $1.30, with a bullish outlook toward $1.50 or even $2.20 if momentum continues. However, declining trading volume (166.91M) signals that buying pressure must increase for sustained gains. Holding above $0.90 keeps the bullish trend intact, but traders should watch for potential pullbacks.

Source: TradingView

Crypto Market Overview: Mixed Performance Across Major Assets

The cryptocurrency market is experiencing mixed sentiment, with Bitcoin (BTC) leading gains, currently trading at $89,485.80 (+6.73%). XRP saw an impressive surge of 19.38%, reaching $2.6065, while Cardano (ADA) posted the biggest rally among the top 10, soaring 43.68% to $0.9141. HBAR also surged 20.84%, showing strong bullish momentum.

On the downside, Ethereum (ETH) dipped 2.72% to $2,212.51, and Binance Coin (BNB) fell 1.1% to $596.86. Litecoin (LTC) recorded one of the largest losses, plunging 18.4%, while HYPE (-24.45%) and Toncoin (TON) (-9.65%) also struggled. Solana (SOL) remains bullish, climbing 4.95% to $144.22, while Chainlink (LINK) gained 12.63% to $16.91.

With market volatility persisting, investors are keeping a close eye on Bitcoin’s momentum and whether ADA can sustain its explosive rally.

Source: Quantifycrypto

DORA Compliance Package

Meanwhile, Fireblocks has introduced the DORA Compliance Package, aimed at helping financial institutions comply with the EU's Digital Operational Resilience Act (DORA), which took effect in January. This package is designed for firms relying on Third-Party ICT Providers and includes annual security audits, periodic compliance reports, and an advanced cybersecurity framework. A key feature is the Annual Security Pooled Audit, which allows clients to address compliance challenges in a structured manner. Fireblocks' Chief Security Officer, Oded Blatman, emphasized that the package aims to simplify regulatory requirements, enhance resilience, and allow institutions to focus on innovation while remaining compliant with evolving European regulations.

Source: X

Conclusion: What’s Next for the Crypto Market?

The crypto market is currently at a pivotal moment, with major price movements driven by macroeconomic factors, regulatory changes, and institutional activity.

Bitcoin remains the key driver, with price action above $92K signaling renewed bullish interest.

Solana and XRP are showing strong technical indicators, suggesting potential rallies.

Cardano is in a breakout zone, with a 125% price surge still possible if momentum continues.

Sui’s partnership with World Liberty Financial has added bullish sentiment to the altcoin market.

The upcoming White House Crypto Summit could provide further clarity on regulatory developments, influencing institutional investment strategies. Traders and investors should remain vigilant, watching key support and resistance levels across major assets.

As macroeconomic uncertainty continues to impact financial markets, crypto remains a volatile yet high-potential space for traders looking to capitalize on key price movements.