Crypto Weekly Wrap: 25th April 2025

BlackRock’s IBIT Dominates ETF Awards with Record Inflows

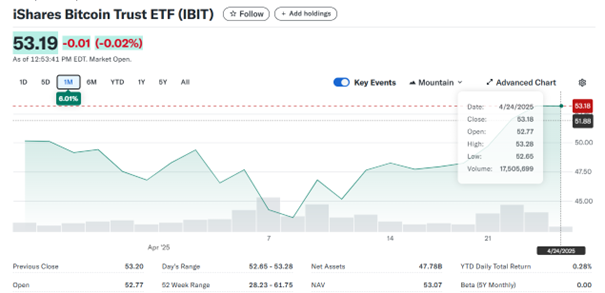

BlackRock’s iShares Bitcoin ETF (IBIT) just clinched a major victory at the annual etf.com awards, earning the title of “Best New ETF” after logging its biggest inflow day since January. On April 23, IBIT brought in $643.2 million—its highest since the day after Trump’s presidential inauguration—bringing the fund’s total assets to around $53.77 billion.

The ETF, launched alongside other spot Bitcoin funds in January 2024, has quickly become a market leader, averaging over 45 million shares traded per day. Bloomberg analyst Eric Balchunas supported the recognition, calling it well-deserved and noting that such inflows are monumental in showcasing institutional confidence in Bitcoin.

Source: finance.yahoo

The award comes at a time when institutional interest in digital assets appears to be resurging after a brief pause. With the ETF now trading at $53.20 per share, IBIT continues to attract capital faster than any other newcomer on the market. As ETF flows are often considered a proxy for long-term conviction, this milestone indicates that Bitcoin’s narrative as a mainstream financial asset is only growing stronger.

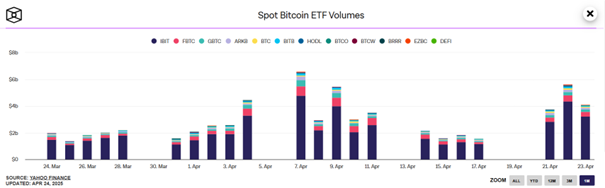

According to Yahoo Finance data updated on April 24, 2025, IBIT led the pack in trading volume among all spot Bitcoin ETFs throughout the past month. Notably, on April 23, volumes across all 11 ETFs surged to levels not seen since early April, with IBIT commanding the largest share by far—visibly dominating the $6 billion+ spike in total volume. From March 24 to April 23, IBIT consistently outpaced competitors like FBTC, GBTC, ARKB, and HODL, reinforcing its status as the preferred vehicle for institutional exposure to Bitcoin.

Source: The Block

TRUMP Memecoin Spikes on Exclusive Dinner News, But Risks Loom

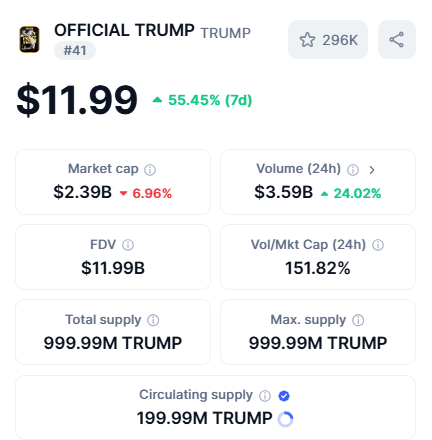

The TRUMP memecoin rocketed 52% on April 23 following news that top holders will be invited to an exclusive dinner with President Trump. This unexpected pump has reignited debates over the sustainability of hype-driven rallies, particularly for tokens lacking tangible utility. While TRUMP has a current market cap of $2.6 billion and ranks high in futures activity, critics point to its heavy founder token allocation and lack of DeFi use cases. Compared to other projects like Arbitrum or Maker, which justify their valuations through staking rewards and ecosystem depth, TRUMP’s longevity remains questionable despite its top-10 trading volume status.

Source: Coinmarketcap

Even with endorsements from high-profile figures and listings on some major exchanges, TRUMP remains highly speculative. Futures open interest is unusually high, sitting above that of more established tokens like Chainlink and Litecoin, which adds further volatility. Unless the token evolves to offer real-world value or governance features, it risks becoming a short-lived hype cycle rather than a sustained trend.

Source: Coinmarketcap

SEC Charges PGI Global for $200M Crypto Ponzi Scheme

In a sweeping enforcement move, the U.S. Securities and Exchange Commission (SEC) has charged Ramil Palafox and PGI Global with running a massive crypto-based Ponzi scheme. The firm allegedly scammed investors out of $198 million through fake AI trading platforms and multi-level marketing promises, even using $57 million for luxury purchases like a Lamborghini. The SEC's complaint, filed in the Eastern District of Virginia, accuses Palafox of violating federal securities laws and outlines how he used later investor funds to pay earlier participants—a hallmark of Ponzi tactics. With assistance from the FBI and IRS, the SEC is working to recover assets and ensure accountability in this case.

This action is part of the SEC’s broader crackdown on crypto fraud under its Cyber and Emerging Technologies Unit. Regulators have ramped up enforcement in 2025, particularly targeting firms that prey on retail investors with unrealistic promises. As investigations continue, this case serves as a cautionary tale highlighting the importance of transparency, due diligence, and compliance in the digital asset space.

Source: SEC.gov

Aptos Drives Mass Adoption with Expo 2025 Digital Wallet

Aptos made a bold entrance into mainstream blockchain by becoming the official digital wallet provider for Expo 2025 Osaka. In just its first week, Aptos registered 133,000 new users and processed over 558,000 transactions, driven by its seamless wallet integration and unique use of soulbound NFTs. These digital stamps serve as personal keepsakes that tie users’ real-world experiences to blockchain in a non-transferable way. Aptos’ performance at such a large international venue showcases the potential of blockchain technology to engage mainstream audiences, especially when the complexities of Web3 are abstracted away.The project’s strategy of prioritising user experience appears to be paying off. Rather than forcing users to understand seed phrases or pay gas fees, Aptos handles everything in the background, allowing for smooth onboarding. This approach could be a model for future blockchain integrations at real-world events, bridging the gap between crypto natives and everyday users.

Source: X

From a technical standpoint, Aptos (APT) has been trading steadily over the last five days, currently priced at $5.45 with a minor daily dip of 0.37%. The Relative Strength Index (RSI) has been fluctuating, most recently dipping from a peak of 75 to a neutral 41.19, indicating some cooling off after recent bullish momentum. Trading volume has also remained consistent, with a 24-hour close at 4.46 million, suggesting steady investor interest without excessive volatility.

Source: TradingView

Bitcoin Hovers Near $93K Amid Regulatory Momentum

Bitcoin is currently trading around $92,996 after touching a high of $93,064 in the past 24 hours, showing resilience amid wider market indecision. The Relative Strength Index (RSI) has slipped to 40.74, indicating waning bullish momentum, while the 24-hour trading volume remains strong at 879.72 million, suggesting continued trader engagement. With prices stabilising just above $92,500, the technical setup appears poised for either a breakout or deeper consolidation depending on macroeconomic cues.

Source: TradingView

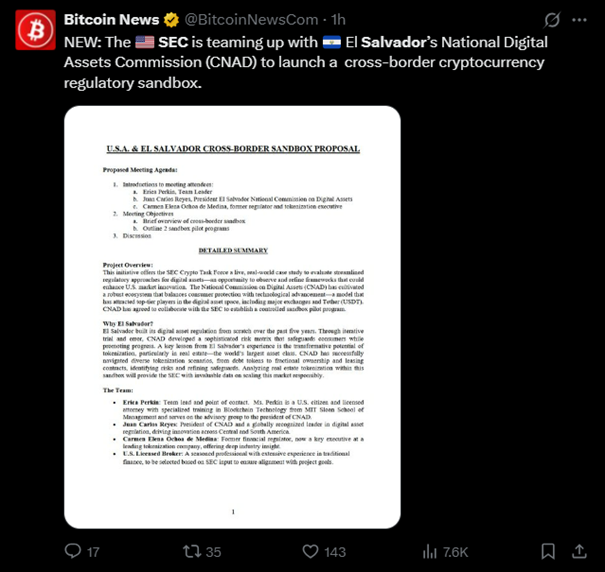

But the narrative surrounding Bitcoin extends well beyond charts—it’s becoming a geopolitical asset. The U.S. SEC is reportedly in early talks with El Salvador’s digital asset commission to explore a cross-border crypto sandbox, which would allow U.S. brokers to issue non-security tokens under El Salvador’s more accommodating framework. This development, backed by SEC Commissioner Hester Peirce, could signal a landmark shift in U.S. regulatory posture, potentially unlocking broader institutional adoption.

The significance of these moves is compounded by global developments. Russia is preparing a crypto exchange exclusively for “super-qualified” investors, while Twenty One Capital—a MicroStrategy-style fund led by Jack Mallers—aims to channel billions into Bitcoin. These initiatives reinforce the asset’s appeal as a tool of monetary sovereignty and institutional-grade hedging.

This growing institutional interest highlights how Bitcoin is evolving from a speculative vehicle into a foundational asset for modern finance. With regulatory sandboxes and global crypto infrastructure under development, Bitcoin’s utility is increasingly tied to its ability to facilitate cross-border capital flows and financial innovation. If regulatory support continues, Bitcoin may soon cement its role as a geopolitical and economic mainstay.

Source: X

Cardano Eyes a Major Breakout Amid Altcoin Resurgence

Cardano (ADA) has pushed through its 50-day moving average, now trading around $0.719 with a weekly gain exceeding 13%. Technical indicators suggest ADA is entering a bullish phase, supported by increasing volume, which has risen to over 30.41 million in the past 24 hours. The Relative Strength Index (RSI) sits at 40.11, leaving room for further upside before reaching overbought conditions.

Source: TradingView

Market sentiment is shifting cautiously towards optimism, with the Fear and Greed Index at a neutral 53. Despite ongoing uncertainty, Bitcoin’s firm position above $92,000 has sparked renewed interest in large-cap altcoins like ADA. Notably, the Altcoin Season Index remains low at 15, indicating it is still “Bitcoin Season,” though ADA’s price action could signal the early stages of a wider altcoin rally.

From a market structure perspective, capital continues to rotate back into altcoins as BTC dominance slows. As long as Bitcoin holds its gains and macro pressures don’t intensify, ADA could benefit from improved sentiment and renewed inflows.

Source: Coinmarketcap

In this context, seasoned investors may see ADA’s current price levels as a strategic accumulation zone. If the macro environment aligns—through liquidity injections or favourable policy shifts—Cardano may be among the key altcoins to lead the next wave of gains. For now, patience and strategic positioning remain essential amid mixed signals from both the charts and global markets.

Conclusion: Altcoins Catch Fire as Market Momentum Returns

The crypto market is ending the week on a high note, with bullish sentiment spreading across major tokens. Bitcoin continues to dominate the narrative, trading at $92,809 with a weekly gain of 9.18%, while Ethereum follows closely at $1,750.50, up 8.69%. However, the spotlight is shifting toward altcoins, many of which posted double-digit gains. Cardano (ADA) surged by 14.35%, Solana (SOL) jumped 10.73%, and Dogecoin (DOGE) rallied 12.74%. SUI led the pack with a staggering 51.61% weekly gain, further highlighting the potential for explosive altcoin moves during bullish cycles.

Even slower movers like Polkadot (DOT) and Stellar (XLM) posted impressive gains of 13.79% and 14.34% respectively, reinforcing the theme of broad-based market recovery. The only outlier among large caps was TRON (TRX), down 1.31%, suggesting selective corrections amid the altcoin rally. With the Altcoin Season Index still at just 15/100, the data suggests this could only be the beginning. If momentum holds, and macro conditions remain stable, the coming weeks could usher in the full onset of altcoin season.

Source: QuantifyCrypto