Crypto Investments for Tomorrow

Invest in crypto by copying portfolios. Manage your crypto portfolio with one-click.

Instant

Deposit & withdraw in seconds using FPS, Cards, Banks or Crypto.

Who is it for

User-friendly Start to Crypto

Buy Bitcoin and other cryptocurrencies easily

No subscription - open an account for FREE

No need to deal with the complexity of crypto

Copy portfolios of other investors and copy their trades

Use our smart features to make the most of your investment

Spend 80% less time on portfolio management every week

Automatically rebalance your portfolio in minutes, not hours

Have more control over your investment with stop-loss and profit-taking rules

Access vetted coins with the best liquidity

Enjoy top-tier security with cold storage

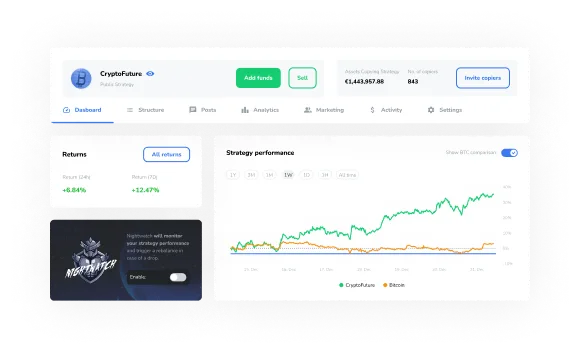

Put your crypto knowledge to your advantage

Access to a large base of potential copiers

Use automation and our advanced tools

Set your own fees

Use our marketing features to promote yourself

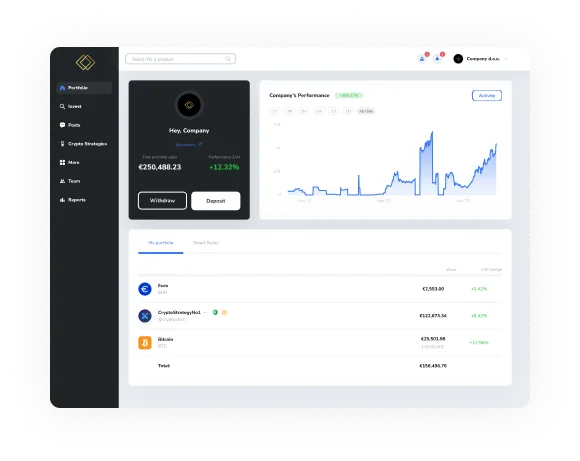

Check our full suite of business solutions

Crypto Business Account - manage all your company’s digital assets in one place

Advisors Portal - for financial advisors advising on crypto investments

Wealth Platform - whitelabel turn-key platform for asset managers & brokers

Focus your energy on generating returns, while we take care of the rest.

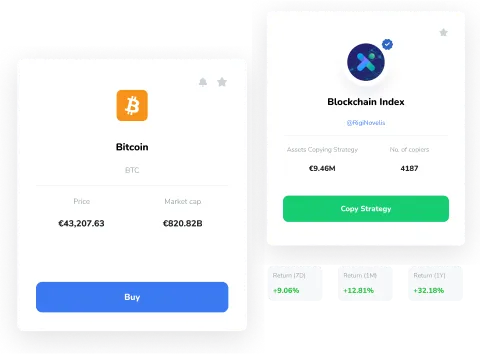

Start Investing by Copying Strategies

A Crypto Strategy is a collection of crypto assets chosen and led by a Strategist.

Past performance is not indicative of future results

Crypto Strategies - like portfolios, but better

At ICONOMI, we connect our users with Strategists, giving you the opportunity to copy their trades, learn from them, and build your investment confidence.

Crypto Strategies are collections of crypto assets designed to provide diversification with just one click. With out easy-to-use crypto investment app, Strategists can trade multiple cryptocurrencies at once and rebalance the assets in each Strategy without the hassle of managing several exchanges and ensuring optimal Crypto Strategy performance.

See all Crypto StrategiesPast performance is not indicative of future results

Crypto Strategies - like portfolios, but better

Past performance is not indicative of future results

At ICONOMI, we connect our users with Strategists, giving you the opportunity to copy their trades, learn from them, and build your investment confidence.

Crypto Strategies are collections of crypto assets designed to provide diversification with just one click. With out easy-to-use crypto investment app, Strategists can trade multiple cryptocurrencies at once and rebalance the assets in each Strategy without the hassle of managing several exchanges and ensuring optimal Crypto Strategy performance.

See all Crypto StrategiesPast performance is not indicative of future results

Buy Crypto

If you are looking for long-term or short-term crypto investments, our crypto investment app has you covered. Discover the best crypto to invest in, add it to your portfolio, or even better, put your know-how to the test and create your own Crypto Strategy.

Assets are stored with ICONOMI, so you don't need to worry about keys, wallets, or other technicalities. With beginners and traders in mind, ICONOMI is the right crypto investment app to buy and sell cryptocurrencies.

CryptocurrenciesBuy Crypto

Past performance is not indicative of future results

If you are looking for long-term or short-term crypto investments, our crypto investment app has you covered. Discover the best crypto to invest in, add it to your portfolio, or even better, put your know-how to the test and create your own Crypto Strategy.

Assets are stored with ICONOMI, so you don't need to worry about keys, wallets, or other technicalities. With beginners and traders in mind, ICONOMI is the right crypto investment app to buy and sell cryptocurrencies.

CryptocurrenciesEasy to use platform features

Dollar-cost averaging

Copy a selected Strategy and invest without lifting a finger. Perfect for the dollar-cost averaging investment Strategy. Set recurring payments to ICONOMI, and you will automatically invest in a Crypto Strategy of your choice.

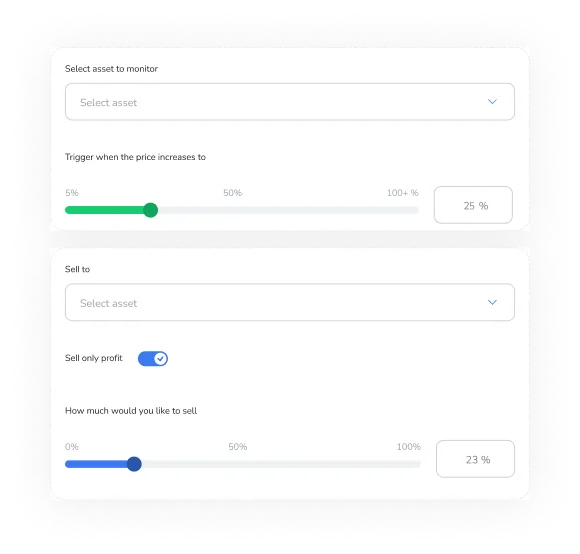

Automation

Rules are a staple of many investment portfolios. Be it for taking profits, stopping losses, or simply catching a big rise in an asset you’re looking at, rules are the best way to keep up with the market while you’re away.

Asset health

See how an asset is doing in the current market before adding it to your Crypto Strategy. ICONOMI also filters cryptoassets, bringing you only those with a solid adoption.

Asset custody

We wouldn’t be a great crypto app for beginners without putting a lot of focus on safety and security.

The safeguarding of assets combined with the protection of users is our top priority. We make maximum efforts in terms of security and transparency.

Read morePosts from the Community

Read what our Strategists are saying about the market and the crypto sphere

We are accepting