Investasi Kripto Menjadi Sederhana

Berinvestasi kripto dengan menyalin portofolio trader publik. Kelola portofolio kripto Anda dengan satu klik.

Instan

Setor & tarik dalam hitungan detik menggunakan iDEAL, FPS, Kartu, Bank, atau Kripto.

Kuat

Penyimpanan kripto tingkat lanjut & terpisah untuk perlindungan yang optimal

Untuk siapa ini

Awal yang Mudah dan Aman untuk Kripto

Beli Bitcoin dan mata uang kripto lainnya dengan mudah

Tanpa langganan - buka akun secara GRATIS

Tidak perlu berurusan dengan kompleksitas perdagangan kripto

Salin portofolio Ahli Strategi dan manfaatkan keahlian mereka

Gunakan fitur cerdas kami untuk memaksimalkan investasi Anda

Habiskan 80% lebih sedikit waktu untuk manajemen portofolio setiap minggu

Seimbangkan kembali secara otomatis portofolio Anda dalam hitungan menit, bukan jam

Amankan investasi dengan aturan stop loss dan take profit

Akses koin yang telah diperiksa dengan likuiditas terbaik

Nikmati keamanan tingkat atas dengan cold storage

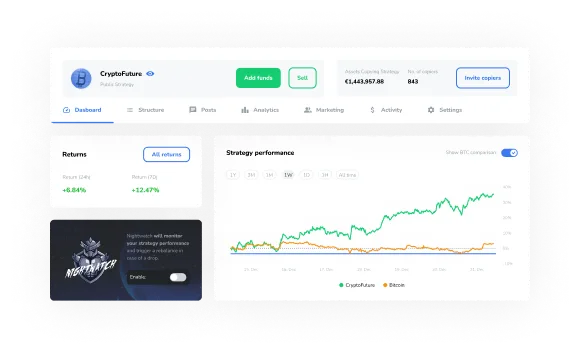

Manfaatkan pengetahuan kripto Anda untuk keuntungan Anda

Akses ke basis penyalin potensial yang besar

Gunakan otomatisasi dan alat tingkat lanjut kami

Tetapkan biaya Anda sendiri

Gunakan fitur pemasaran kami untuk mempromosikan diri Anda sendiri

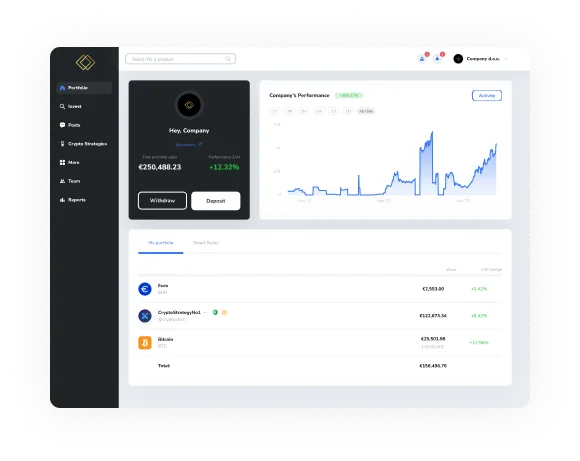

Lihat rangkaian lengkap solusi bisnis kami

Akun Bisnis Kripto - manage all your company’s digital assets in one place

Portal Penasihat - for financial advisors advising on crypto investments

Platform Kekayaan - whitelabel turn-key platform for asset managers & brokers

Fokuskan energi Anda untuk menghasilkan keuntungan, sementara kami mengurus sisanya.

Mulai Berinvestasi dengan Menyalin Strategi

Temukan Strategi Kripto berkinerja terbaik dari semua Ahli Strategi ICONOMI.

Kinerja masa lalu tidak menunjukkan hasil di masa depan

Strategi Kripto - seperti portofolio, tetapi lebih baik

Di ICONOMI, kami menghubungkan pengguna kami dengan Ahli Strategi, memberi Anda kesempatan untuk menyalin perdagangan mereka, belajar dari mereka, dan membangun keyakinan akan investasi Anda

Strategi Kripto adalah kumpulan aset kripto yang dirancang untuk memberikan diversifikasi hanya dengan satu klik. Dengan aplikasi copy trading kripto kami yang mudah digunakan, Ahli Strategi dapat memperdagangkan beberapa mata uang kripto sekaligus dan menyeimbangkan kembali aset di setiap Strategi tanpa perlu repot mengelola beberapa bursa dan memastikan kinerja Strategi Kripto yang optimal.

Lihat semua Strategi KriptoKinerja masa lalu tidak menunjukkan hasil di masa depan

Strategi Kripto - seperti portofolio, tetapi lebih baik

Kinerja masa lalu tidak menunjukkan hasil di masa depan

Di ICONOMI, kami menghubungkan pengguna kami dengan Ahli Strategi, memberi Anda kesempatan untuk menyalin perdagangan mereka, belajar dari mereka, dan membangun keyakinan akan investasi Anda

Strategi Kripto adalah kumpulan aset kripto yang dirancang untuk memberikan diversifikasi hanya dengan satu klik. Dengan aplikasi copy trading kripto kami yang mudah digunakan, Ahli Strategi dapat memperdagangkan beberapa mata uang kripto sekaligus dan menyeimbangkan kembali aset di setiap Strategi tanpa perlu repot mengelola beberapa bursa dan memastikan kinerja Strategi Kripto yang optimal.

Lihat semua Strategi KriptoKinerja masa lalu tidak menunjukkan hasil di masa depan

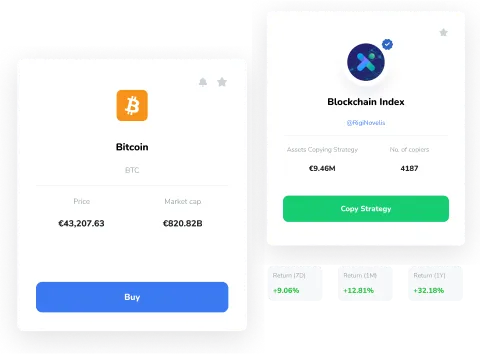

Beli Kripto

Jika Anda mencari investasi kripto jangka panjang atau jangka pendek, aplikasi investasi kripto kami siap membantu Anda. Temukan kripto terbaik untuk diinvestasikan, tambahkan ke portofolio Anda, atau lebih baik lagi, uji pengetahuan Anda dan buat Strategi Kripto Anda sendiri.

Aset disimpan di ICONOMI, jadi Anda tidak perlu khawatir tentang kunci, wallet, atau hal teknis lainnya. Dengan mempertimbangkan para pemula dan pedagang, ICONOMI adalah aplikasi investasi kripto yang tepat untuk membeli dan menjual mata uang kripto.

Mata uang kriptoBeli Kripto

Kinerja masa lalu tidak menunjukkan hasil di masa depan

Jika Anda mencari investasi kripto jangka panjang atau jangka pendek, aplikasi investasi kripto kami siap membantu Anda. Temukan kripto terbaik untuk diinvestasikan, tambahkan ke portofolio Anda, atau lebih baik lagi, uji pengetahuan Anda dan buat Strategi Kripto Anda sendiri.

Aset disimpan di ICONOMI, jadi Anda tidak perlu khawatir tentang kunci, wallet, atau hal teknis lainnya. Dengan mempertimbangkan para pemula dan pedagang, ICONOMI adalah aplikasi investasi kripto yang tepat untuk membeli dan menjual mata uang kripto.

Mata uang kriptoFitur platform yang mudah digunakan

Dollar-cost averaging

Salin Strategi yang dipilih dan investasikan tanpa perlu mengangkat jari. Sempurna untuk Strategi investasi dollar-cost averaging. Tetapkan pembayaran berulang ke ICONOMI, dan Anda akan secara otomatis berinvestasi dalam Strategi Kripto pilihan Anda.

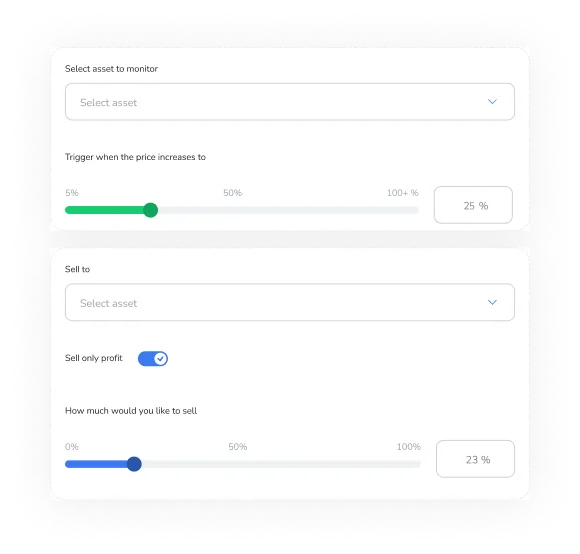

Otomatisasi

Aturan adalah hal penting dalam banyak portofolio perdagangan. Baik itu untuk mengambil profit, menghentikan kerugian, atau sekadar mendapatkan kenaikan besar dalam aset yang Anda amati, aturan adalah cara terbaik untuk mengikuti pasar saat Anda pergi.

Kesehatan aset

Lihat bagaimana kinerja aset di pasar saat ini sebelum menambahkannya ke Strategi Kripto Anda. ICONOMI juga memfilter aset kripto, sehingga hanya memberikan Anda aset yang memiliki adopsi yang kuat.

Penitipan aset

Kami tidak akan menjadi aplikasi kripto yang bagus untuk para pemula tanpa menaruh banyak perhatian pada keselamatan dan keamanan.

Pengamanan aset yang dikombinasikan dengan perlindungan pengguna adalah prioritas utama kami. Kami melakukan upaya maksimal dalam hal keamanan dan transparansi.

Baca lebih lanjut tentang Mengamankan Aset AndaPostingan dari Ahli Strategi

Baca apa yang dikatakan Ahli Strategi kami tentang pasar dan dunia kripto

Kami menerima