Crypto Weekly Wrap: 28th June 2024

The cryptocurrency market has seen notable developments in recent months, marked by regulatory changes, new product filings, and significant technological advancements. Here are the key updates:

VanEck Files for Solana ETF

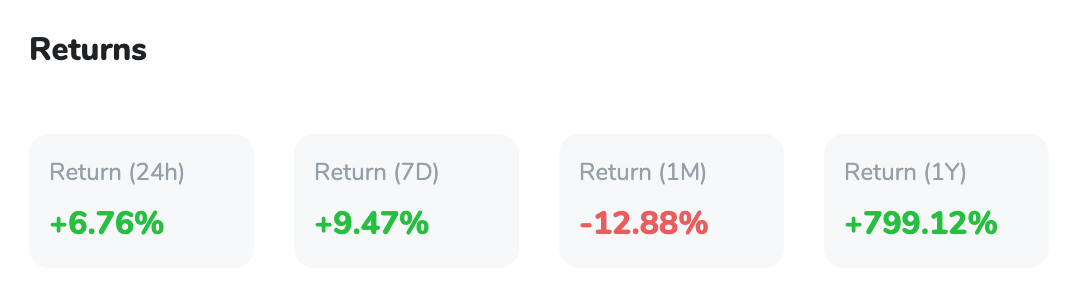

VanEck, a leading asset management firm, has made headlines by filing for a Solana (SOL) exchange-traded fund (ETF) in the United States. This move follows a similar filing in Canada by 3iQ just six days earlier. The registration of the Solana ETF with the Securities and Exchange Commission (SEC) significantly impacted SOL's price, which saw an 6.76% increase in just 24 hours. VanEck’s head of digital assets research, Matthew Sigel, emphasised Solana's similarities to Ethereum, citing its scalability, speed, and low costs as competitive advantages.

SEC's Legal Authority Weakened

In a landmark decision, the United States Supreme Court curtailed the SEC’s enforcement powers by ruling against the agency’s use of in-house judges for fraud proceedings. This ruling mandates that fraud defendants are entitled to a trial by jury in federal court, a significant shift from the SEC's previous practice of resolving cases internally. This decision is expected to impact the SEC's approach to securities law enforcement and could influence other federal agencies like the FTC and CFPB.

Layer 2 Networks Are Arriving on the Telegram-Associated TON Blockchain

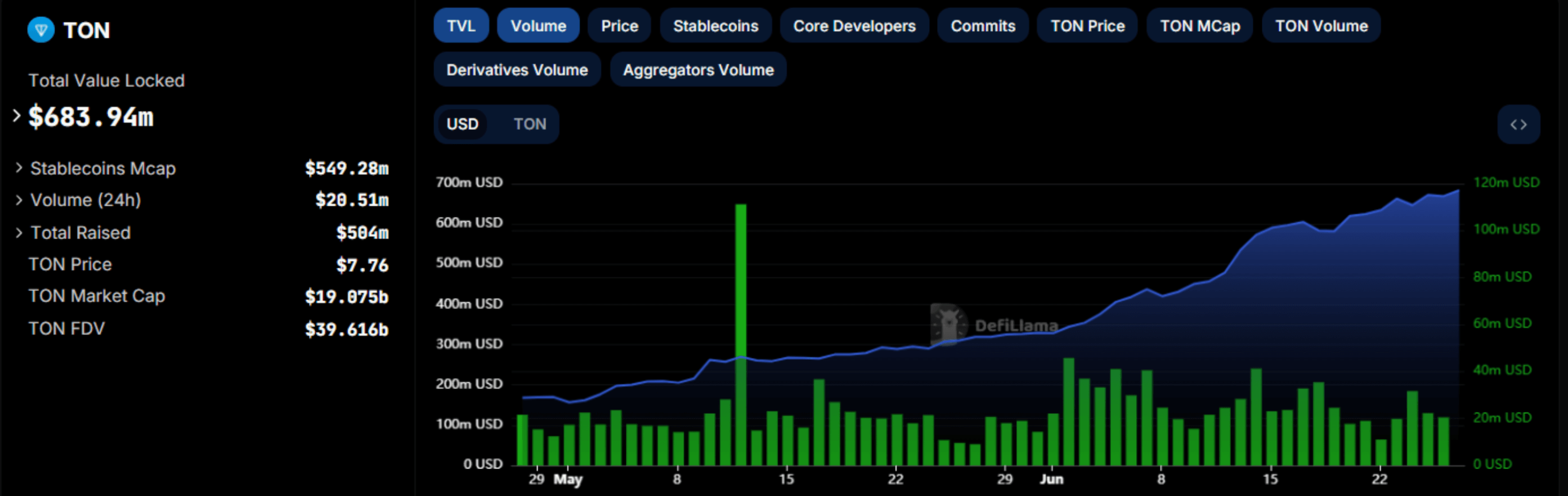

The TON blockchain, closely associated with the messaging app Telegram, has experienced a dramatic increase in its total value locked (TVL), rising to $671.43 million since January 1st, a surge of over 4,600%. Layer 2 networks, which enhance transaction speed and throughput, are now being integrated into The Open Network (TON). Originally developed for Ethereum, these networks have expanded to Bitcoin and now TON, with protocols like Atlas Protocol and TON App Chain (TAC) leading the way.

Source: DefiLlama

These networks are also compatible with the Ethereum virtual machine, enabling developers to leverage TON’s user base while growing DeFi applications and TVL. The adoption of L2 networks is expected to further enhance TON’s scalability and appeal to Ethereum-based DeFi apps.

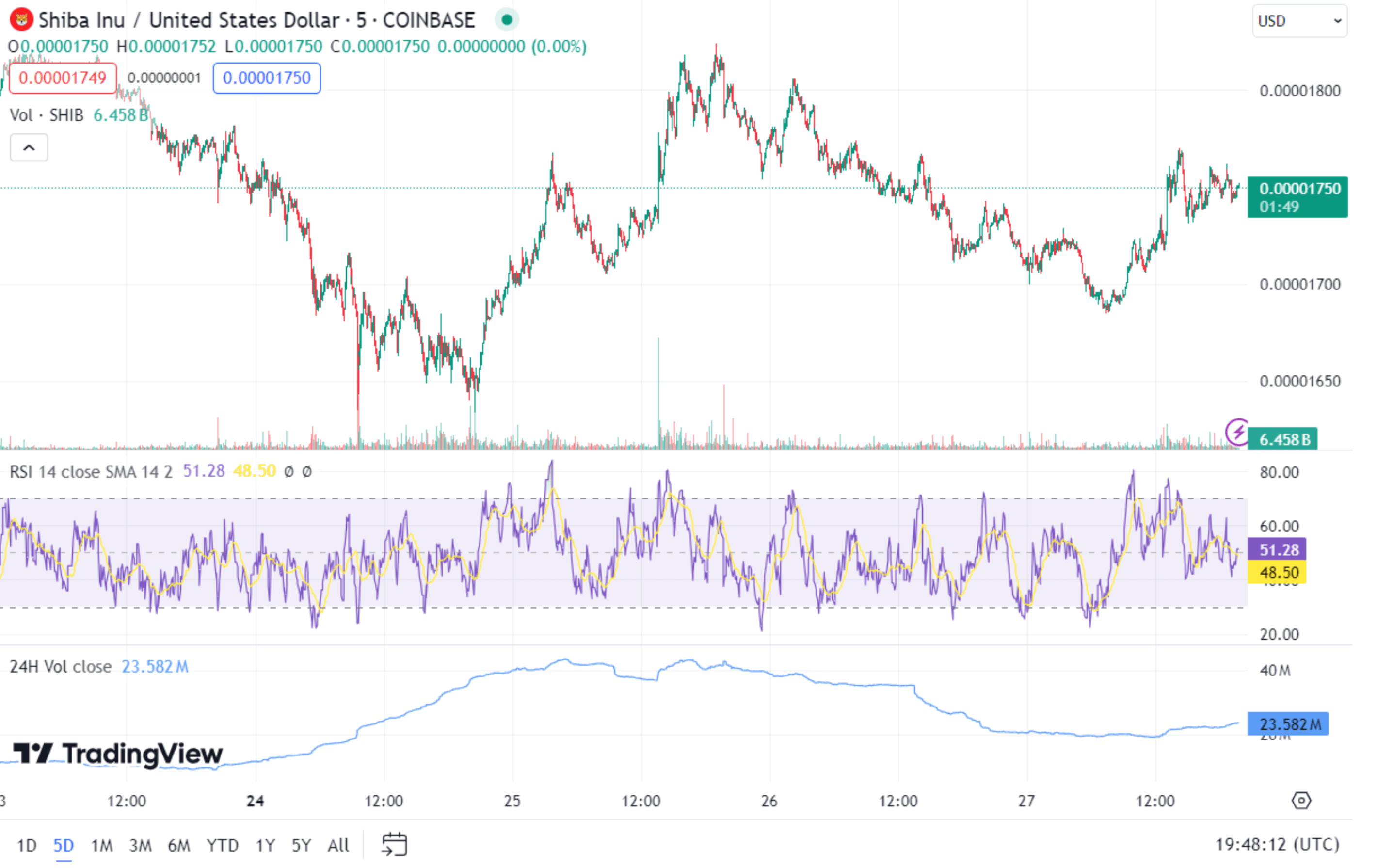

Shiba Inu's Market Position

Shiba Inu (SHIB) has been under pressure, experiencing a 0.23% increase in the past 24 hours and a 4% drop over the past week. Despite these recent setbacks, SHIB has seen a significant 130% increase over the last year. The token is currently in an oversold position, suggesting a potential rebound. Technical indicators, such as its rising relative strength index (RSI), support the possibility of an upcoming price surge. Additionally, the anticipated launch of Ethereum ETFs could positively impact SHIB and other Ethereum-based tokens.

Technical Analysis of Bitcoin

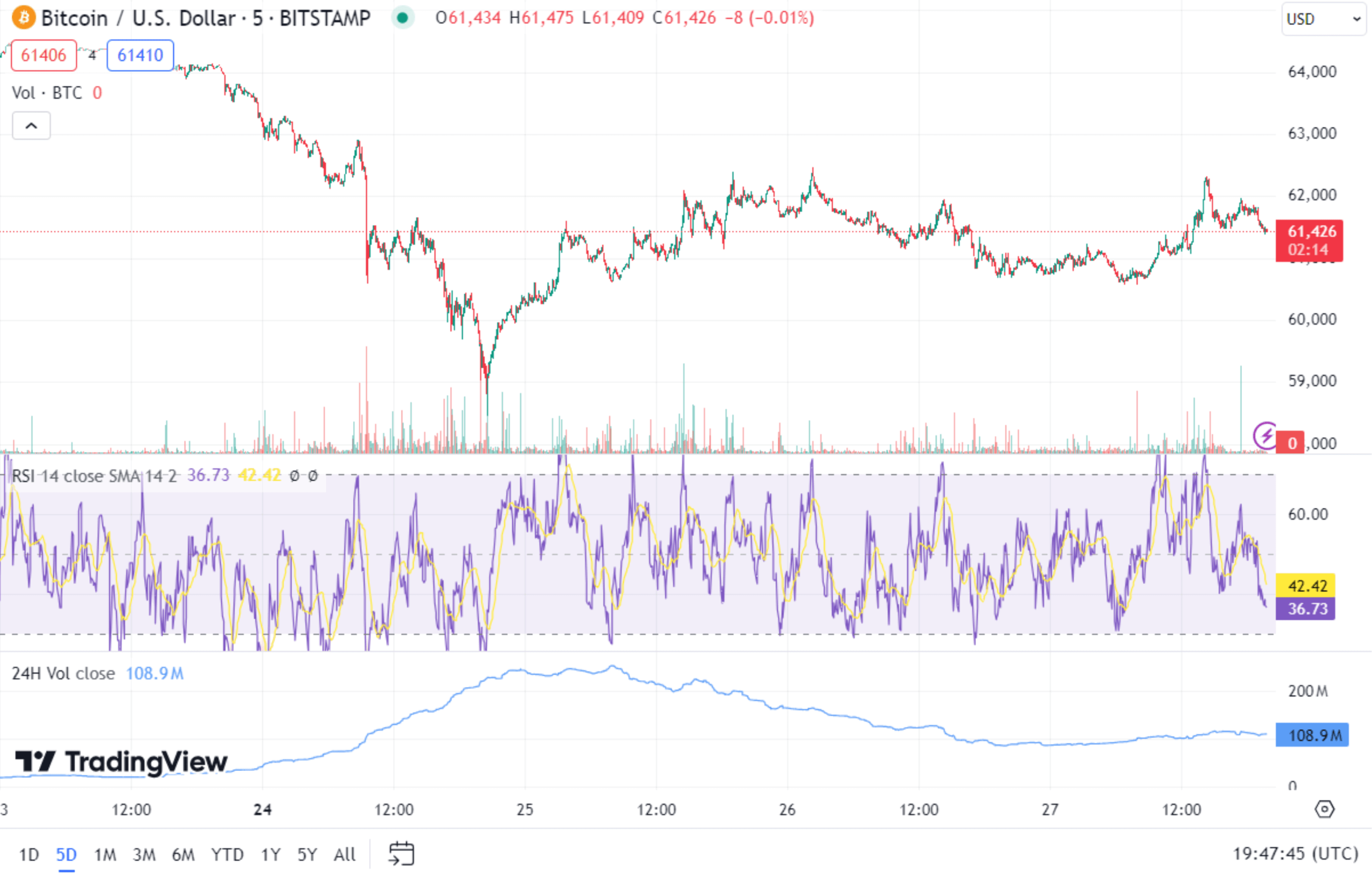

Bitcoin (BTC) is currently trading at around $61,426, showing a slight decline. The technical analysis of Bitcoin reveals several key insights:

Resistance and Support Levels: Immediate resistance is seen at $62,520, and $63,445, while support levels are at $60,600 and $59,370. The pivot point is set at $61,500, suggesting a bearish outlook if Bitcoin remains below this level.

Relative Strength Index (RSI): The RSI is currently at 37, indicating neutral to slightly bearish sentiment. This suggests that Bitcoin is neither overbought nor oversold, but there is potential for further downside.

Exponential Moving Average (EMA): The 50-day EMA is at $62,520, serving as a resistance level. If Bitcoin fails to break above this level, it may continue to face selling pressure.

Market Sentiment: Despite recent inflows into Bitcoin ETFs, regulatory challenges, and significant BTC transfers by the German government have contributed to the recent decline. The strengthening US dollar and the Federal Reserve’s hawkish stance also add to the bearish sentiment.

Overall, Bitcoin's technical indicators suggest a cautious outlook. While there is potential for a bullish reversal if Bitcoin breaks above the resistance levels, the current market conditions and external pressures point towards continued volatility and potential downside risks. Investors should closely monitor these factors when making trading decisions.