Crypto Weekly Wrap: 23rd August 2024

Crypto Market Update: Bitcoin Eyes $62K Amid Market Resurgence

The cryptocurrency market is buzzing with activity as Bitcoin (BTC) makes significant strides toward the $62,000 mark. In the last 7 days, BTC has experienced a sharp recovery, reclaiming a position of strength after recent setbacks. This resurgence has also influenced several altcoins, which have posted impressive gains. Here’s a detailed look at the latest developments in the crypto market and an in-depth technical analysis of Bitcoin.

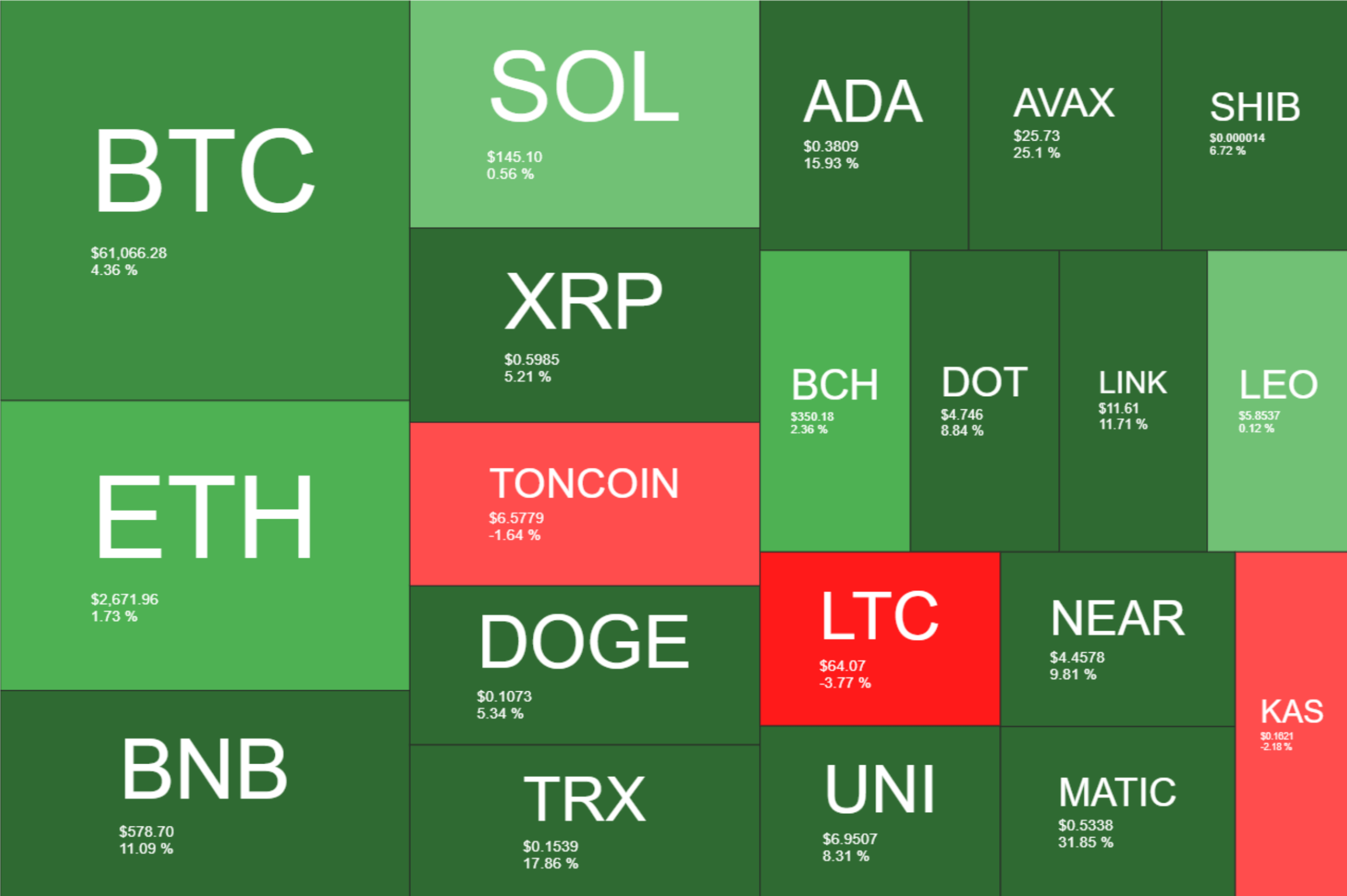

Altcoin Market Shows Strength

The positive sentiment in the Bitcoin market has spilled over to the altcoin sector, with most major cryptocurrencies turning green. Ethereum (ETH) has inched closer to $2,680, posting a modest 2% gain. Other notable gainers include XRP, SOL, AVAX, DOGE, and DOT, each recording slight increases.

However, some altcoins have outperformed the market, with Polygon (MATIC) leading the charge. MATIC has soared by 11%, crossing the $0.50 mark. Chainlink (LINK) and Uniswap (UNI) have also posted significant gains, rising by 10% and 7.5%, respectively.

Among the top 100 altcoins, Fantom (FTM), and Render Token (RNDR) have emerged as the biggest gainers, with daily increases ranging between 12% and 15%. The total cryptocurrency market cap has recovered over $50 billion since yesterday, reaching approximately $2.25 trillion.

Weekly Heatmap

Source: QuantifyCrypto

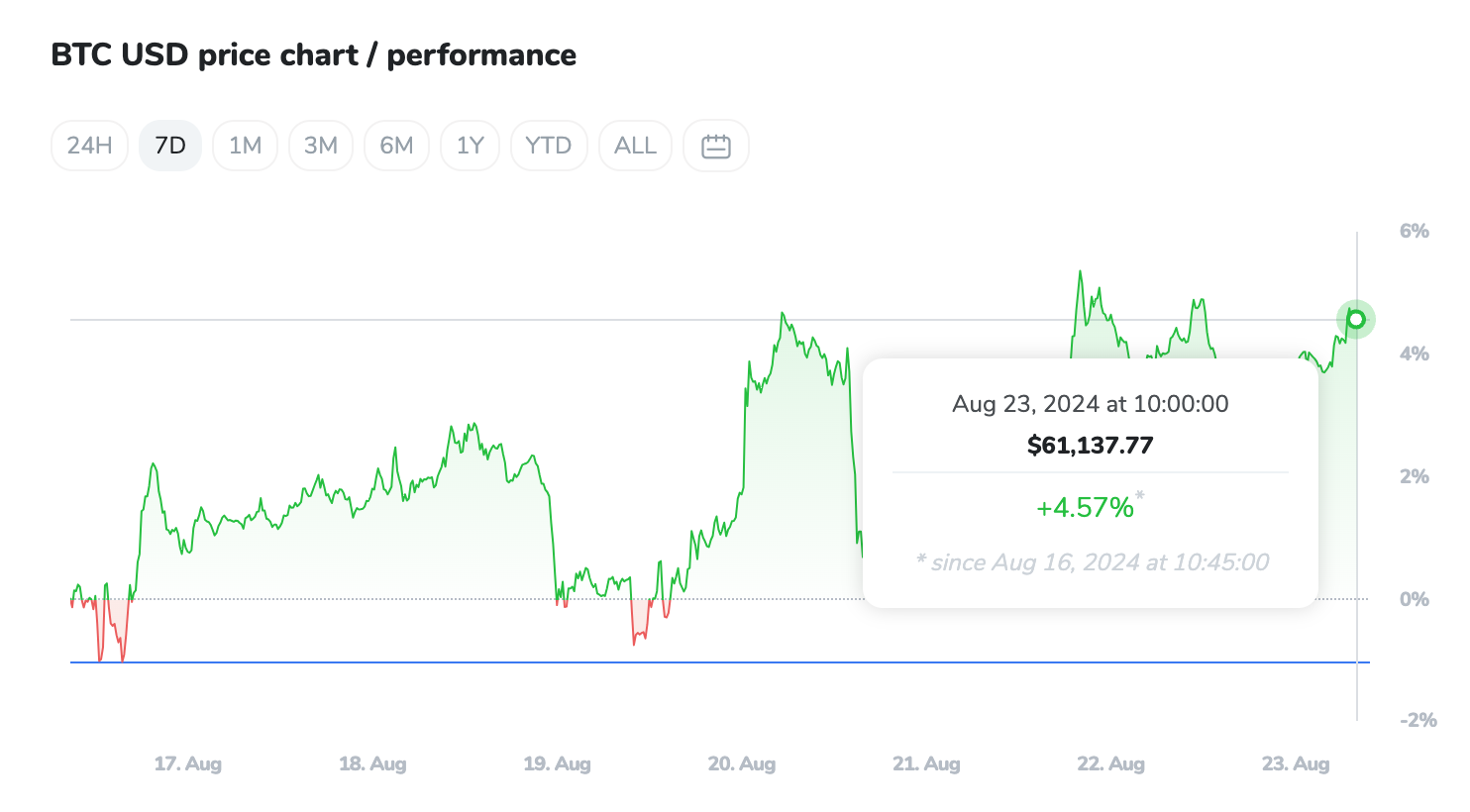

Bitcoin Approaches $62K: A Renewed Bullish Momentum

After experiencing a significant drop last week, where Bitcoin tumbled from $59,600 to $56,300, the primary cryptocurrency has made a strong comeback. The bulls have managed to fend off further declines, pushing BTC back up, where it spent most of the weekend trading just below $60,000.

As the new week began, BTC saw another retracement, dipping to $58,000. However, this downturn was short-lived. On 21 August, Bitcoin surged past the $61,000 mark, peaking at $61,800—its highest level in a week. This rally was partly fueled by rumours surrounding Robert F. Kennedy Jr.'s potential exit from the U.S. presidential race, which some market participants believe could favour pro-crypto candidate Donald Trump.

Despite this upward momentum, BTC has faced some resistance around the $61,800 level, leading to a minor retracement to around $61,000. As of now, Bitcoin’s market cap stands just above $1.2 trillion, with its dominance over altcoins slightly increasing to 53.6%.

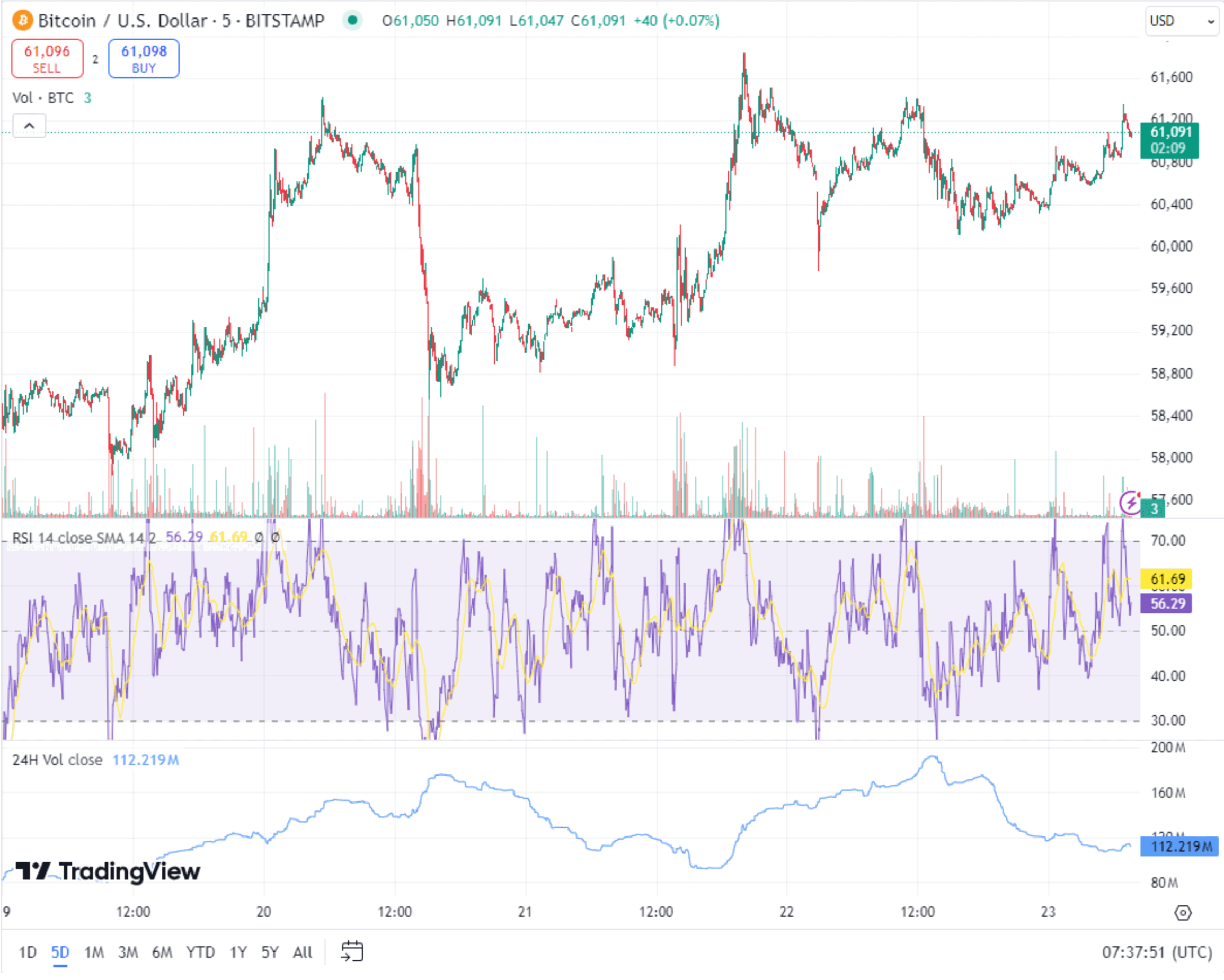

Bitcoin Technical Analysis: Is a Breakout Imminent?

Bitcoin’s price has been consolidating in a tight range around $60,000, leaving market participants anxious about its next move. The daily chart reveals that BTC has struggled to reclaim the critical 200-day moving average (MA), which is currently situated around $63,000. This level has proven to be a significant resistance point since Bitcoin’s drop from $68,000 a few weeks ago.

As long as BTC remains below the 200-day MA, the likelihood of continuing the long-term bullish trend remains low. However, there are some optimistic signs on the horizon. The Bitcoin funding rates, which measure futures market sentiment, have recently cooled down to near zero. This pattern has historically preceded significant price rallies, indicating that a sustainable upward movement could be on the verge of materialising.

Source: TradingView

For a breakout to occur, Bitcoin needs to convincingly breach the $63,000 resistance level and establish support above it. Failure to do so could result in further consolidation or even a potential decline. Traders should also watch the $58,000 support level closely, as a drop below this could signal a bearish reversal.

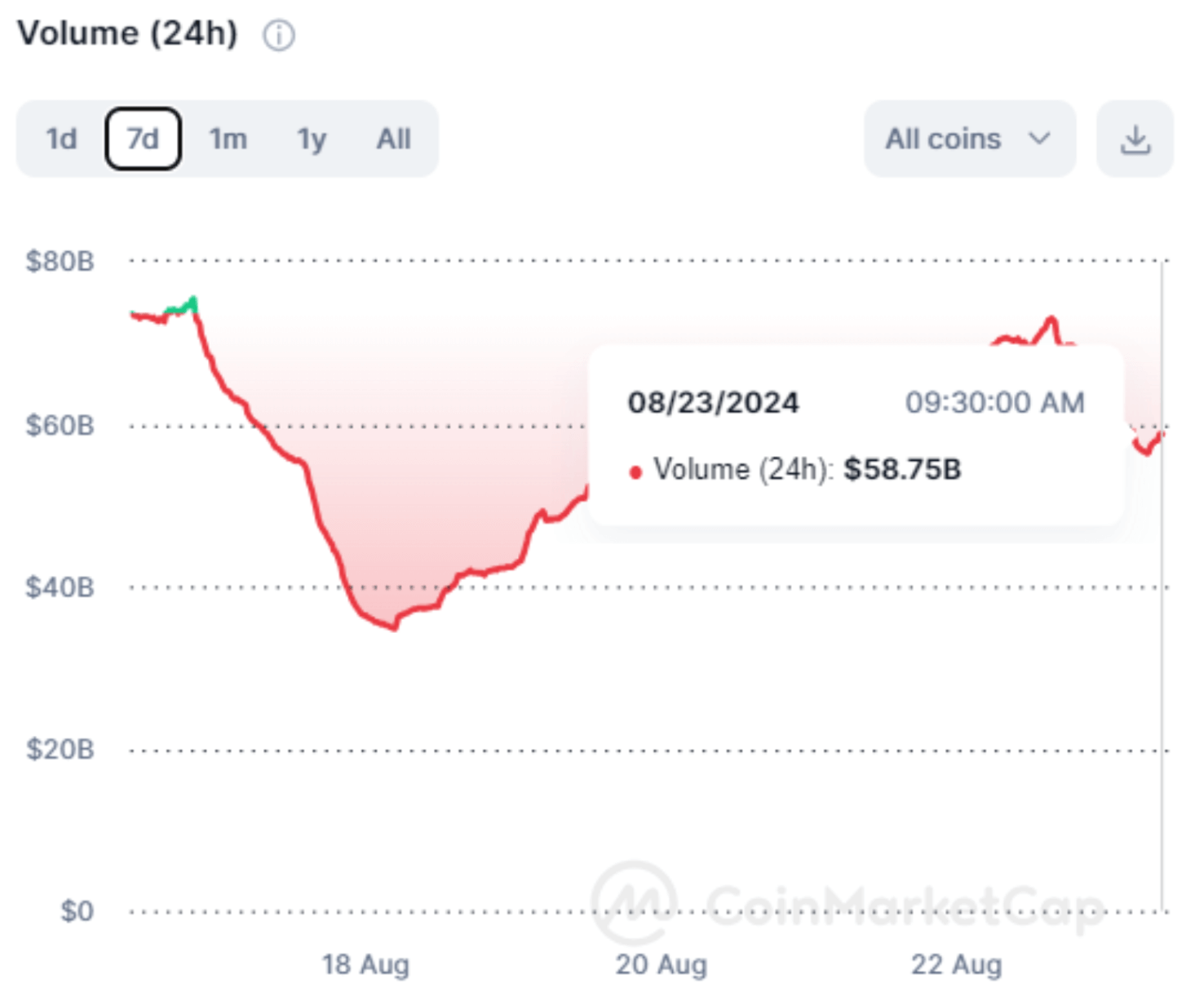

Source: Coinmarketcap

Institutional Interest in Bitcoin ETFs Reaches New Highs

In a related development, institutional investors have shown unprecedented interest in Bitcoin exchange-traded funds (ETFs). According to industry experts, Bitcoin ETFs are being adopted by institutions faster than any other ETF in history. Since their launch in January, these ETFs have amassed $17.5 billion in net flows, setting a new record.

Notably, Bitcoin ETFs have outpaced the growth of the Nasdaq-100 QQQs, which held the previous record. Despite some criticism that retail investors are the primary buyers of these ETFs, the data shows that institutional adoption is robust. Over 60% of the largest U.S. hedge funds now hold Bitcoin ETFs, with many continuing to accumulate.

The strong inflows into Bitcoin ETFs, despite the recent price downturn, underscore the growing institutional confidence in Bitcoin as a long-term investment. This trend could further support Bitcoin’s price in the coming months, especially if spot market demand also picks up.

In summary, Bitcoin's recent price action and the broader market trends suggest that the cryptocurrency is at a critical juncture. While the technical outlook remains mixed, with resistance at $63,000 posing a challenge, the growing institutional interest and the potential for a breakout offer a glimmer of hope for bullish traders. The next few days will be crucial in determining whether Bitcoin can sustain its upward momentum or if further consolidation is in store.

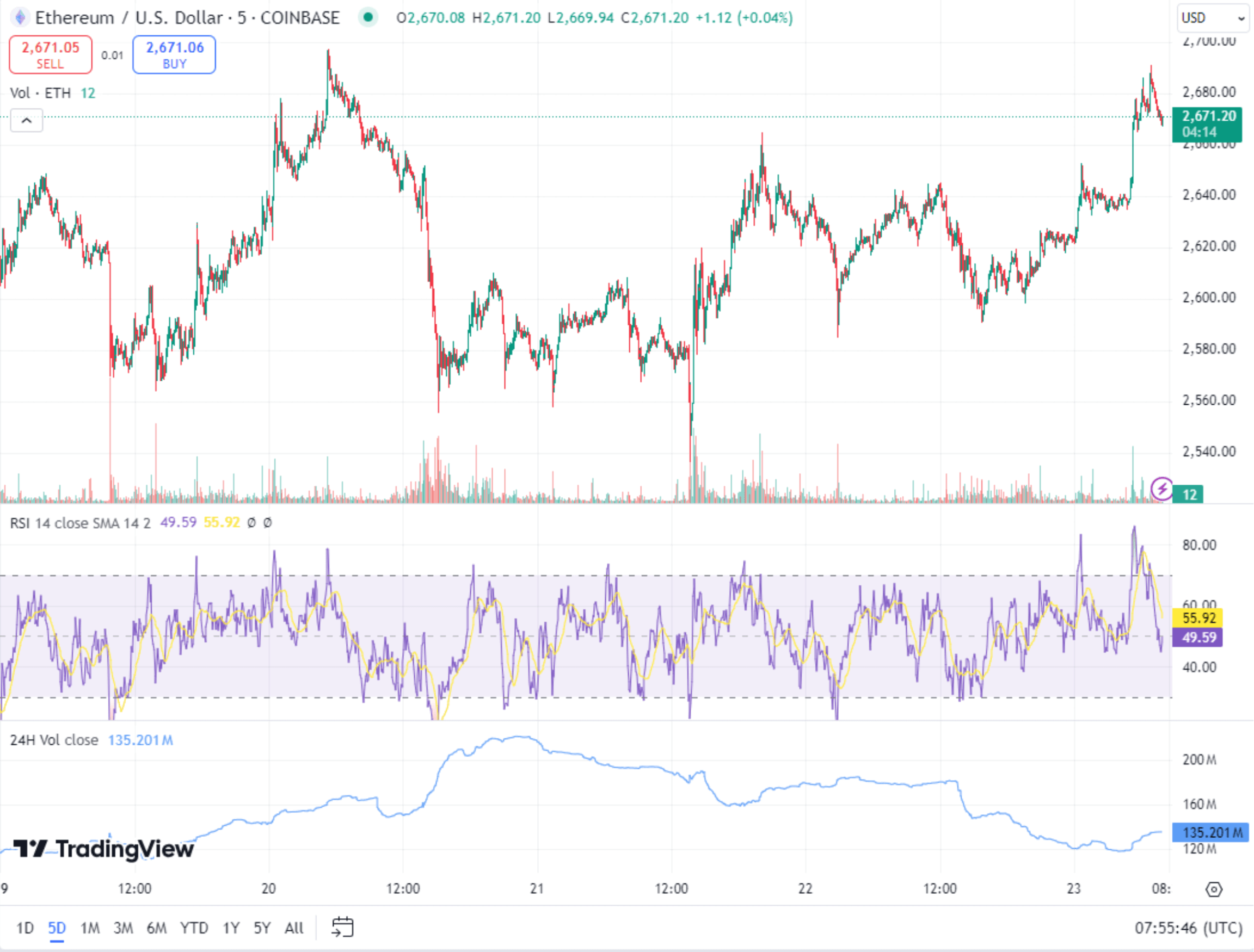

Ethereum Struggles Amid Market Uncertainty, But a Breakout Could Be on the Horizon

Ethereum's price has seen only a modest increase of 2% over the last week, lagging slightly behind Bitcoin's 4.61% rise. This is happening amid widespread market uncertainty, with investors gravitating toward safer assets like bonds and stocks due to recession fears in the U.S. Despite the current cautious sentiment, there are potential catalysts on the horizon that could spark a rally for Ethereum. The prospect of future Federal Reserve rate cuts and the significant liquidity held by large tech companies suggest that Ethereum might be poised for a breakout. However, the current price trend shows Ethereum struggling under the EMA 50, with significant bearish pressure keeping it in a tight range. If Ethereum manages to break through this range, it could surprise the market, potentially reversing its underperformance against Bitcoin over the last two years. As the market navigates through this phase, Ethereum could emerge as a key player, ready to catch up and possibly outperform once the macroeconomic conditions shift in its favour.

Source: TradingView

U.S. Elections and Their Impact on Crypto

As the 2024 U.S. presidential election approaches, the cryptocurrency industry's influence on the political landscape has become increasingly evident. Kamala Harris, the Democratic nominee following Joe Biden's withdrawal, has signalled a more supportive stance toward the crypto sector. Her campaign advisor, Brian Nelson, stated that Harris would back policies encouraging the growth of emerging technologies, a shift from the Biden administration's stricter regulatory approach. Meanwhile, Donald Trump, the leading Republican candidate, has promised to dismantle regulatory barriers, including the controversial vow to fire SEC Chair Gary Gensler. However, experts caution that some of Trump's promises may be difficult to fulfil, highlighting the complexities of regulatory processes. With both major candidates addressing crypto issues, the election could significantly impact the future regulatory environment for digital assets in the U.S.