Crypto Weekly Wrap: 16th August 2024

Crypto Market Update: $80 Billion Wiped Out as Bitcoin Slips to $58K

The cryptocurrency market has recently faced a significant downturn, shedding around $80 billion in a single day. This decline has been largely driven by Bitcoin's (BTC) sharp drop to $58,000. After almost reaching $62,000, Bitcoin faced strong resistance, leading to a $4,000 drop. This volatility has not been limited to Bitcoin alone; the entire crypto market, including major altcoins like Ethereum (ETH), has been affected.

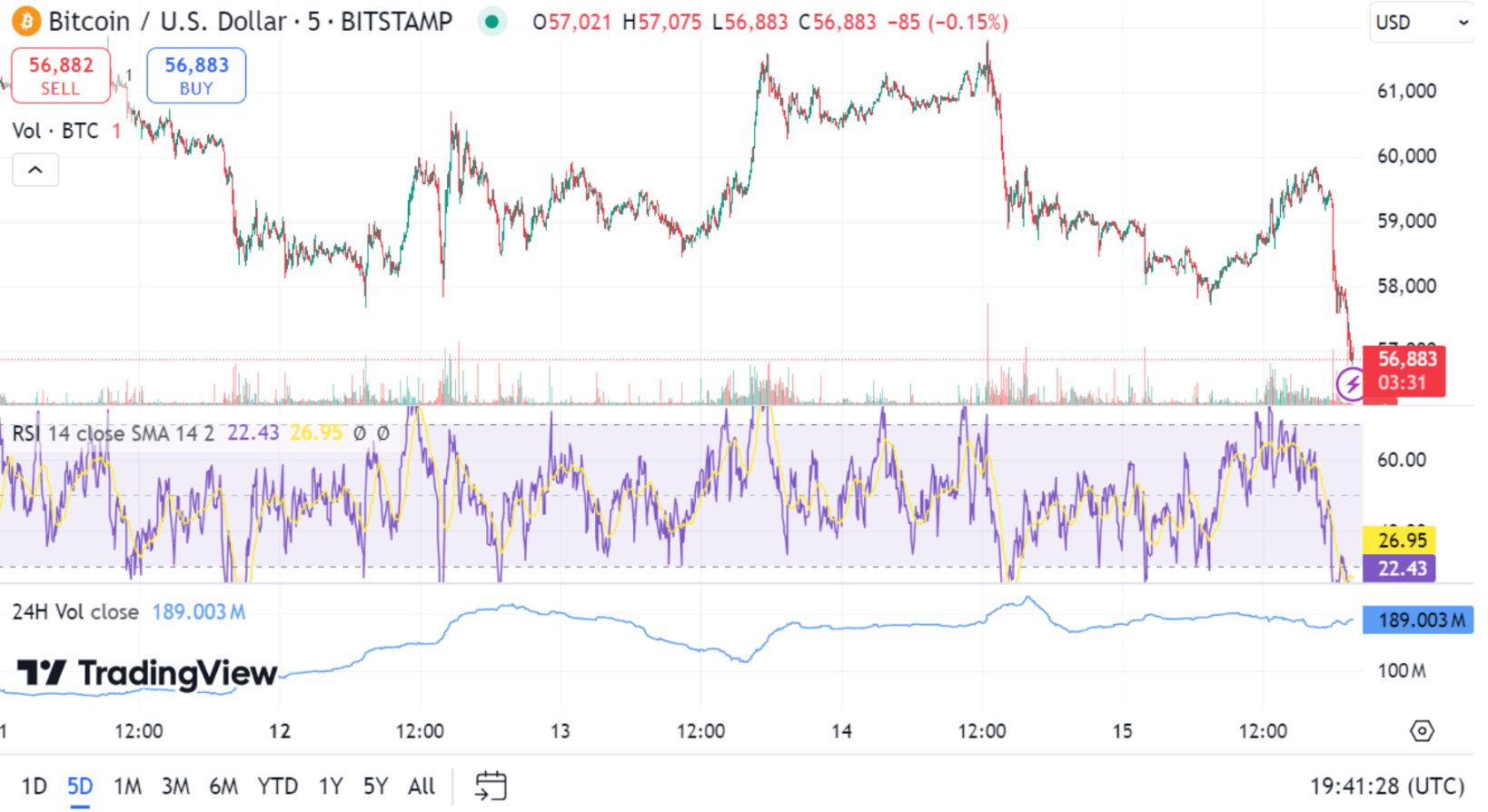

Bitcoin's Recent Performance: A Volatile Ride to $57K

Bitcoin has had a turbulent week, marked by fluctuations that saw its price drop from nearly $63,000 to $57,000. The weekend was particularly sluggish for BTC, as it oscillated between $60,000 and $61,000. Monday brought another dip, though less severe, with Bitcoin falling just below $58,000. Despite briefly rebounding to nearly $62,000 after the U.S. released its Consumer Price Index (CPI) data for July, Bitcoin couldn't maintain its gains. Reports of the U.S. government sending $600 million to Coinbase Prime added to the downward pressure, pushing BTC to its local low of just under $58,000.

Bitcoin's market capitalization has since slipped to $1.150 trillion, and its dominance over altcoins has weakened, dropping to 53.3%.

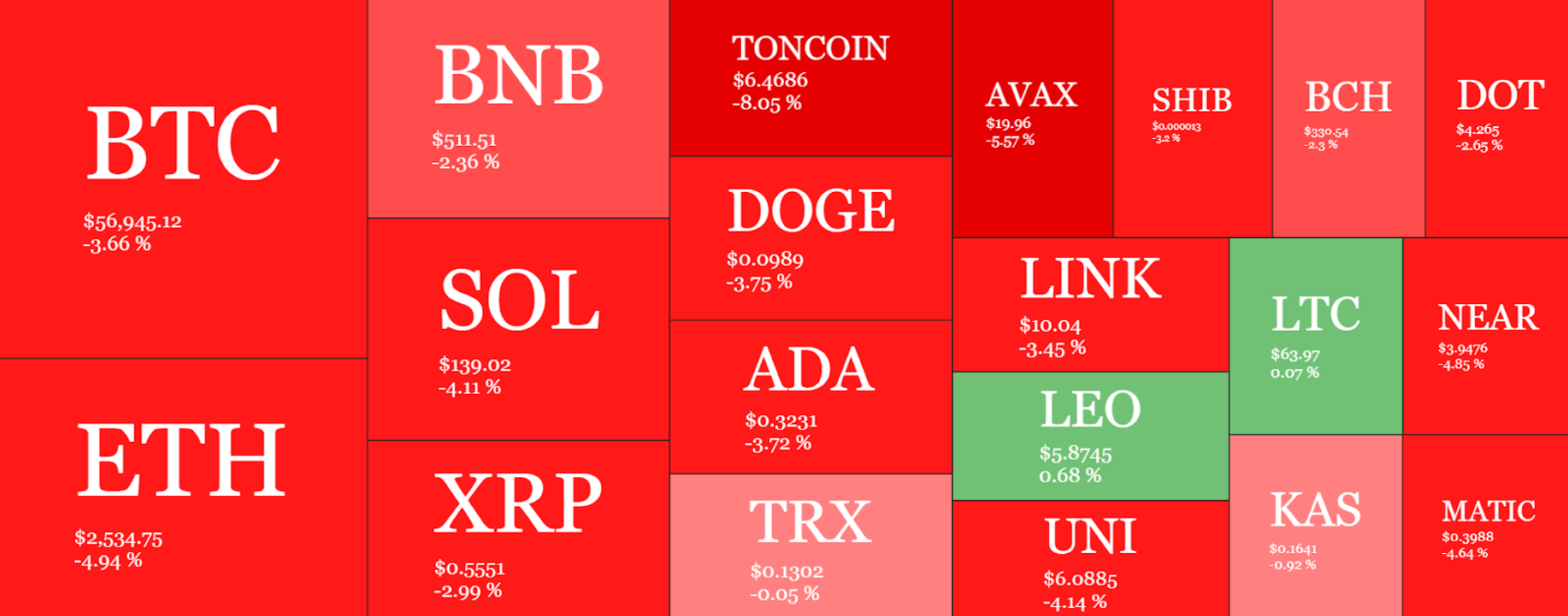

Altcoins in the Red: Ethereum and Others Take a Hit

The broader altcoin market has mirrored Bitcoin's downturn, with Ethereum (ETH) seeing a 2% drop to just over $2,600. This decline has been partly attributed to Jump Crypto's recent ETH sale, which fueled speculation of further price drops. Other major altcoins, including Binance Coin (BNB), Solana (SOL), Ripple (XRP), and Dogecoin (DOGE), have also recorded losses. Among mid-cap altcoins, TIA and WIF have been the biggest losers, each dropping by 2-3%. The total cryptocurrency market capitalization now stands at $2.160 trillion, down from its previous levels.

Investor Sentiment: HODLing Trends and Market Uncertainty

Despite the market's downturn, Bitcoin investors seem to be holding onto their assets, a behaviour often referred to as "HODLing." According to Glassnode, a prominent blockchain analytics firm, there's been a noticeable resurgence in HODLing and accumulation among investors. This trend suggests that long-term holders (LTH) are once again accumulating BTC, even as the market experiences volatility.

Glassnode's data indicates that over the past few weeks, a significant amount of Bitcoin has moved into LTH status, with +374k BTC being held by long-term investors. This shift in investor behaviour hints at a growing preference for holding onto Bitcoin rather than selling it during market downturns.

Bitcoin Technical Analysis

Bitcoin's price action has been challenging to predict, with technical indicators providing mixed signals. On the daily chart, Bitcoin recently broke below its 200-day moving average, which was located around the $63,000 mark. This break could signal a further decline toward the $56,000 level, a critical support zone. If Bitcoin can hold this level, there may be a chance for a rally back toward the 200-day moving average, potentially sparking a new bull run.

Source: TradingView

On the 4-hour chart, Bitcoin has shown signs of a possible recovery after bouncing off the $52,000 support level last week. However, it faces strong resistance at the $61,000 level. The formation of a bullish flag pattern could indicate a potential upward move toward $64,000 if it breaks to the upside. Conversely, if the pattern fails, Bitcoin could retest the $52,000 level, potentially leading to further declines.

Fundamentally, the decline in Bitcoin's exchange reserves suggests a positive outlook. A steep drop in exchange-held BTC indicates that investors are moving their assets off exchanges, likely into cold storage, which reduces the available supply for trading. This could lead to a supply shock in the near future, potentially driving prices higher.

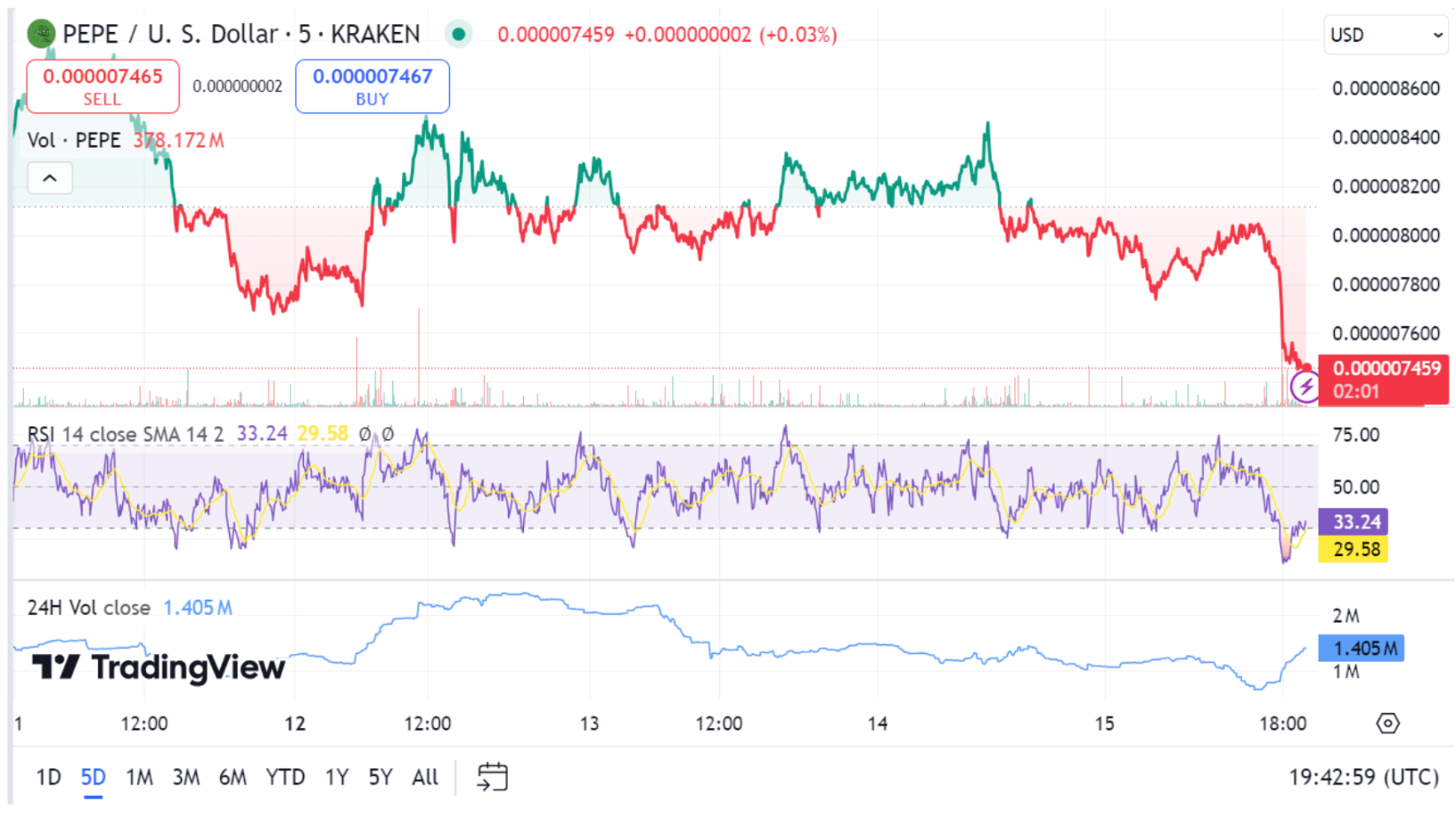

PEPE and Meme Coins: Whales and Market Sentiment

The meme coin market has also faced challenges, with PEPE, one of the most popular meme tokens, experiencing a 4% drop to $0.0.000008. Despite this decline, PEPE's trading volume remains strong at $700 million, suggesting that the coin still has significant market interest. However, recent data indicates that whales are more likely to sell than buy PEPE, which could lead to further price drops in the short term.

As the market awaits a potential Federal Reserve rate cut in September, which could boost investor sentiment, meme coins like PEPE may struggle to recover until broader market conditions improve.

Source: TradingView

Source: Quantifycrypto

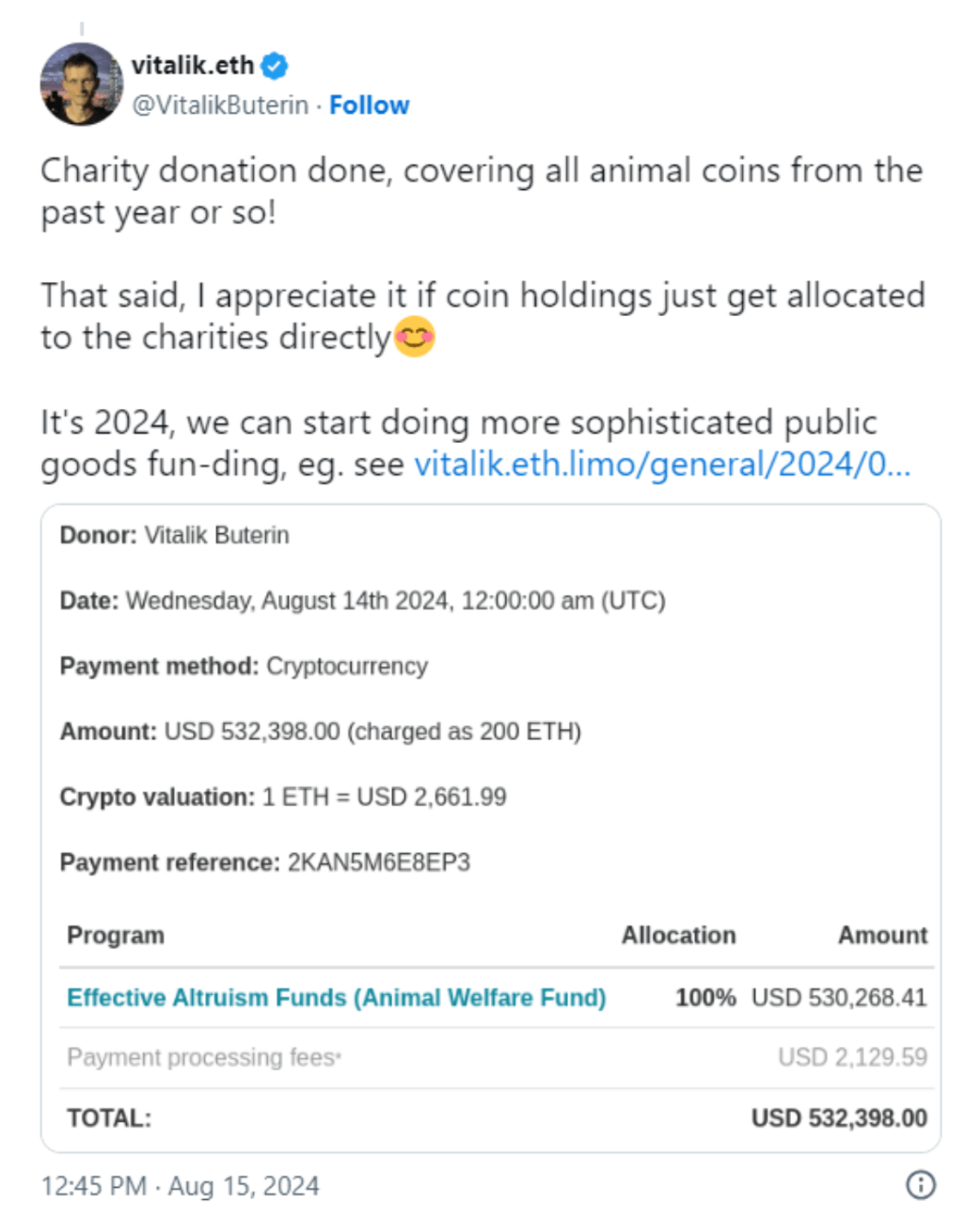

Vitalik Buterin's Commitment to Charity: Utilising Meme Coins for Good

Amid the recent market turmoil, Ethereum co-founder Vitalik Buterin has once again demonstrated his commitment to using cryptocurrency for philanthropic purposes. In a recent act of generosity, Buterin donated over $500,000 worth of an animal-themed meme coin called Neirodog to charity. This donation follows a history of similar contributions, including his significant $5 million Ethereum donation to support Ukraine during its conflict with Russia in October 2023. Buterin's actions highlight the potential for even niche digital assets to be leveraged for the greater good. He has consistently advocated for more sophisticated methods of using crypto for funding public goods, as reflected in his writings and actions. By directing proceeds from meme coins towards charitable causes, Buterin continues to set an example of how wealth in the crypto space can be harnessed to positively impact global issues.

Source: X

Conclusion: Navigating the Crypto Market's Uncertain Waters

The cryptocurrency market's recent volatility highlights the challenges investors face in navigating these turbulent times. While Bitcoin and major altcoins have experienced significant declines, the behaviour of long-term holders and on-chain metrics suggest that there may be a silver lining on the horizon. However, with the market's direction still uncertain, traders and investors will need to stay vigilant and monitor key support and resistance levels closely.