Crypto Weekly Wrap: 11th October 2024

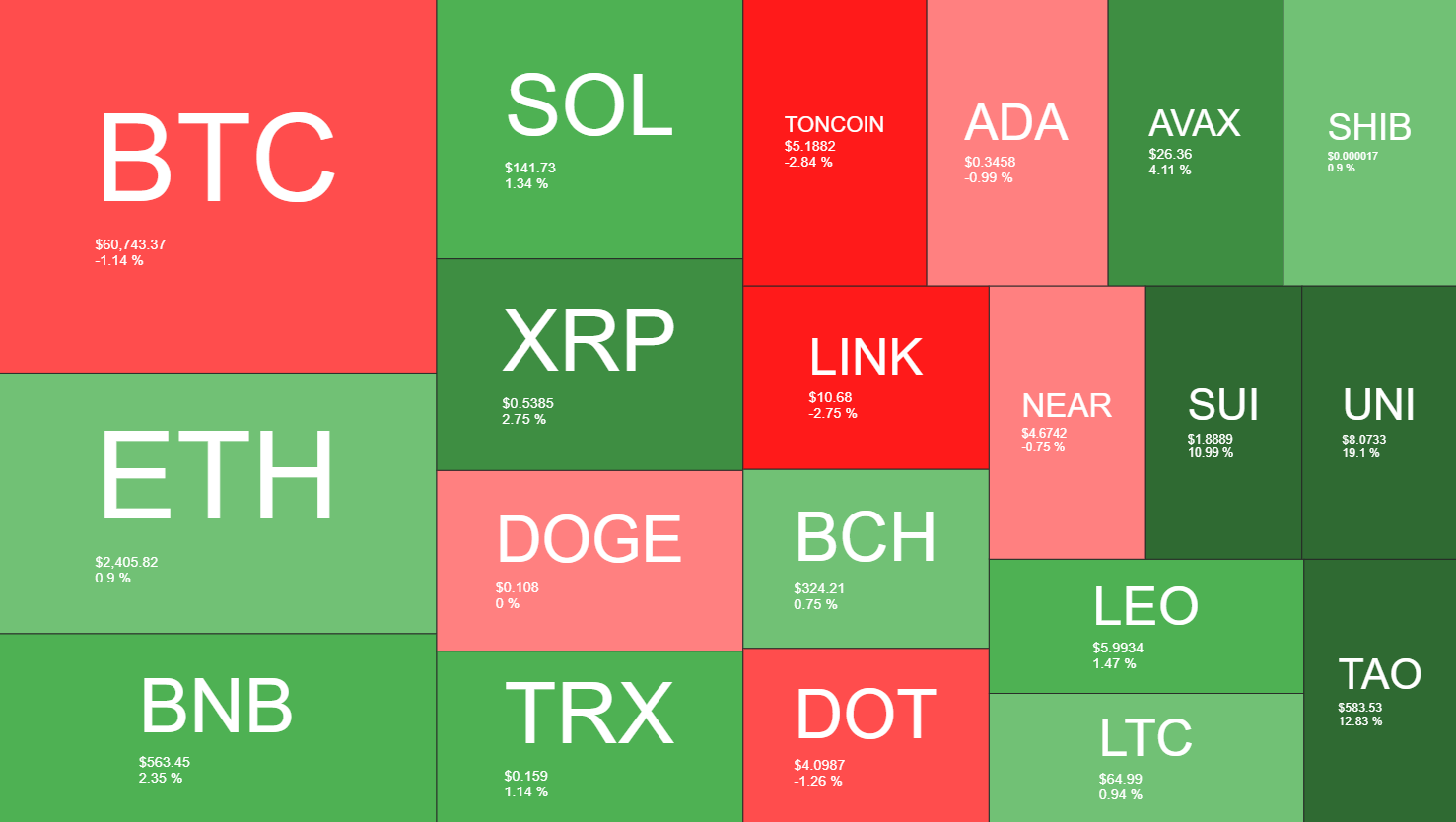

Bitcoin (BTC) dipped below $61,000 on Wednesday, largely due to the movement of crypto assets linked to the infamous PlusToken Ponzi scheme. Reports indicated that 7,000 ETH, valued at $16 million, was transferred to exchanges, sparking concerns of increased selling pressure that could further weigh on the market. Chinese authorities had seized $4 billion worth of crypto from the scheme’s operators back in 2020, including Bitcoin, Ethereum, Dogecoin, and XRP, and the latest movements reignited fears of potential liquidations. BTC began yesterday at around $62,000 but gradually declined to $60,400 by the U.S. trading session, representing a 2.4% drop over 24 hours. Ether (ETH) followed a similar trend, falling 3.2%, as concerns over the movement of these seized assets unsettled investors.

Bitcoin remains heavily influenced by the U.S. Federal Reserve’s monetary policy, with the latest inflation data further impacting market sentiment. The September CPI report showed a stronger-than-expected 0.2% rise, while core CPI, which excludes food and energy, increased by 0.3%, both figures exceeding forecasts. As a result, the likelihood of the Fed pausing rate cuts in November grew, with traders reassessing their expectations for future monetary easing. Bitcoin, which had rallied following the Fed's 50 basis point rate cut in September, fell again on the back of these inflation concerns, exacerbating the decline that began ten days earlier. BTC dropped further to around $60,800 after the CPI release, reflecting the broader market’s sensitivity to economic indicators.

Donald Trump’s crypto venture, World Liberty Financial, is making waves in the DeFi space with a proposal to integrate its platform with Aave, a major decentralised finance protocol. The partnership would use Aave's infrastructure to enhance liquidity for top digital assets such as Ether (ETH) and Wrapped Bitcoin (WBTC), expanding World Liberty Financial’s DeFi capabilities. The proposal includes a revenue-sharing model, offering AaveDAO 20% of platform fees, with 7% of the governance token WLFI also allocated to Aave stakeholders. This move is seen as a significant step for both projects, potentially broadening Aave’s user base and cementing World Liberty Financial’s position in the DeFi ecosystem. Trump’s pro-crypto stance, particularly his promise to dismantle regulatory barriers, continues to attract attention and could position his platform as a leader in the space if the partnership moves forward.

Source: X

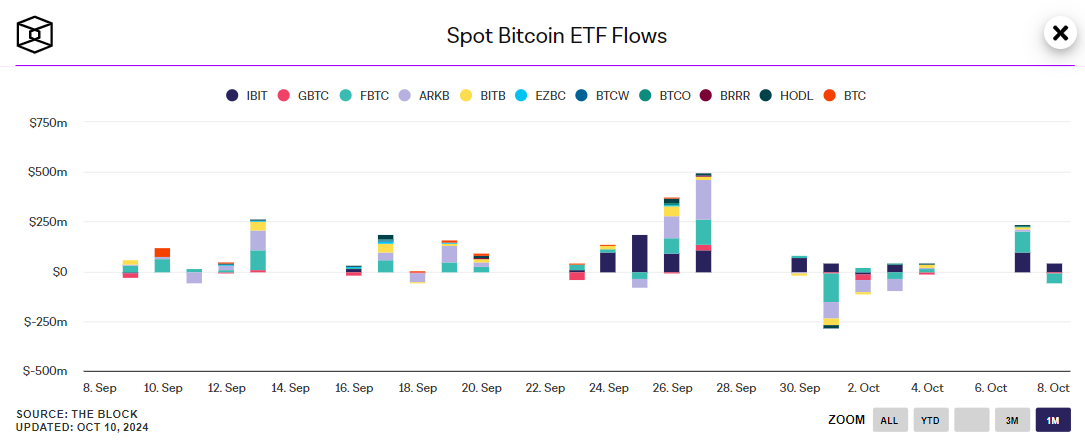

Bitcoin ETF options are anticipated to become available in the U.S. by 2025, according to Bloomberg analyst James Seyffart. The introduction of these options is expected to boost institutional adoption of Bitcoin, offering financial advisors a new avenue for managing portfolio risk and potentially driving increased demand for the cryptocurrency. Advisors, who currently use options in over 10% of client portfolios, could play a pivotal role in integrating Bitcoin into mainstream investment strategies through these new products. While the SEC has approved Bitcoin ETF options from BlackRock, final regulatory approvals from the CFTC and OCC are still pending. Nonetheless, the launch of these ETF options is widely seen as a major catalyst that could enhance Bitcoin's liquidity and market stability, potentially pushing prices higher in the long term.

Source: TheBlock

Bitcoin's technical outlook has turned cautious after the cryptocurrency slipped below its key support level of $62,500, currently trading around $60,800. The break below this level signals potential further downside, though technical indicators suggest a bullish reversal may be on the horizon. A hammer candle on the 2-hour chart points to the possibility of an upward move, with immediate support at $60,500 and deeper support levels at $59,890 and $59,120. A Bitcoin RSI around 62.5 indicates that the asset is showing moderate upward momentum but is not yet in overbought territory, suggesting potential room for further price gains. Meanwhile, Bitcoin faces resistance at $61,760 and $62,540, with the 50-day Exponential Moving Average (EMA) at $62,400 acting as a key barrier. A confirmed move above these resistance levels could reinvigorate bullish sentiment and potentially push BTC higher in the near term.

Source: TradingView

While Bitcoin and Ethereum continue to drive the bulk of market activity, several altcoins have experienced contrasting fortunes. Major altcoins like TONCOIN, LINK and DOT saw declines, mirroring Bitcoin’s downward trend. However, other altcoins like AVAX, UNI and SUI posted gains of 4-19%, with investors showing renewed interest in these assets amid market uncertainty. Additionally, the rise of Real-World Asset (RWA) protocols within the decentralised finance (DeFi) ecosystem has garnered attention, with these protocols now accounting for 3.69% of the total value locked (TVL) in DeFi. The integration of traditional assets into blockchain-based platforms signals a growing trend, as tokenization of real estate, commodities, and other assets opens new opportunities for investors and institutions alike.

In summary, Bitcoin’s short-term outlook remains cautious, with potential for both downside and bullish reversal depending on market conditions and key resistance levels.

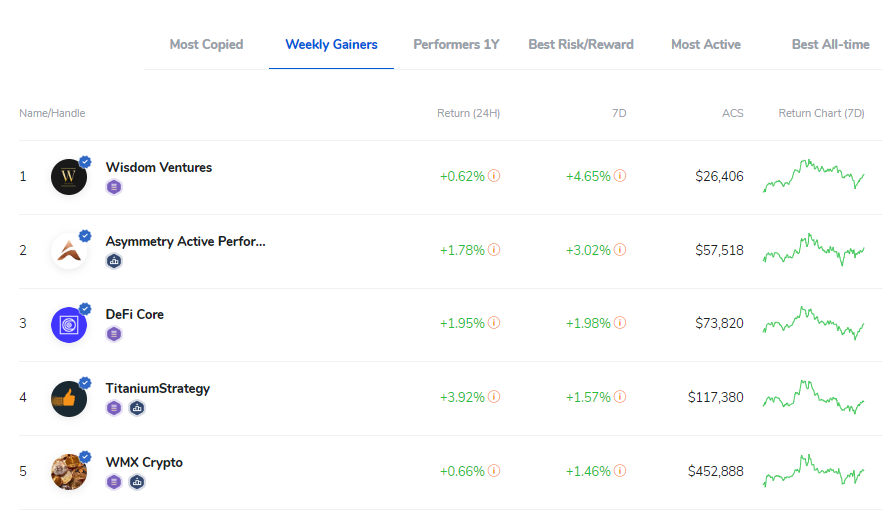

Source: QuantifyCrypto