What is Celestia

Celestia is a cutting-edge modular data availability (DA) network designed to scale securely with user growth, simplifying the process of launching new blockchains. It serves as a network for rollups and layer 2 solutions (L2s), which publish and make transaction data accessible for public download. Celestia ensures high-throughp ut DA, easily verifiable with a light node, by separating the blockchain stack into modular components. This modular approach eliminates the need for each blockchain to maintain its own validator set, thereby enhancing scalability and accessibility.

Source: Celestia

Importance of Data Availability

Data availability is crucial for blockchain security, answering whether the blockchain's data has been published. It allows anyone to inspect and verify the transaction ledger. Traditional monolithic blockchains require users to download all data to verify availability, which becomes impractical as block sizes increase. Modular blockchains, like Celestia, solve this issue using data availability sampling, enabling users to verify very large blocks efficiently without downloading all the data.

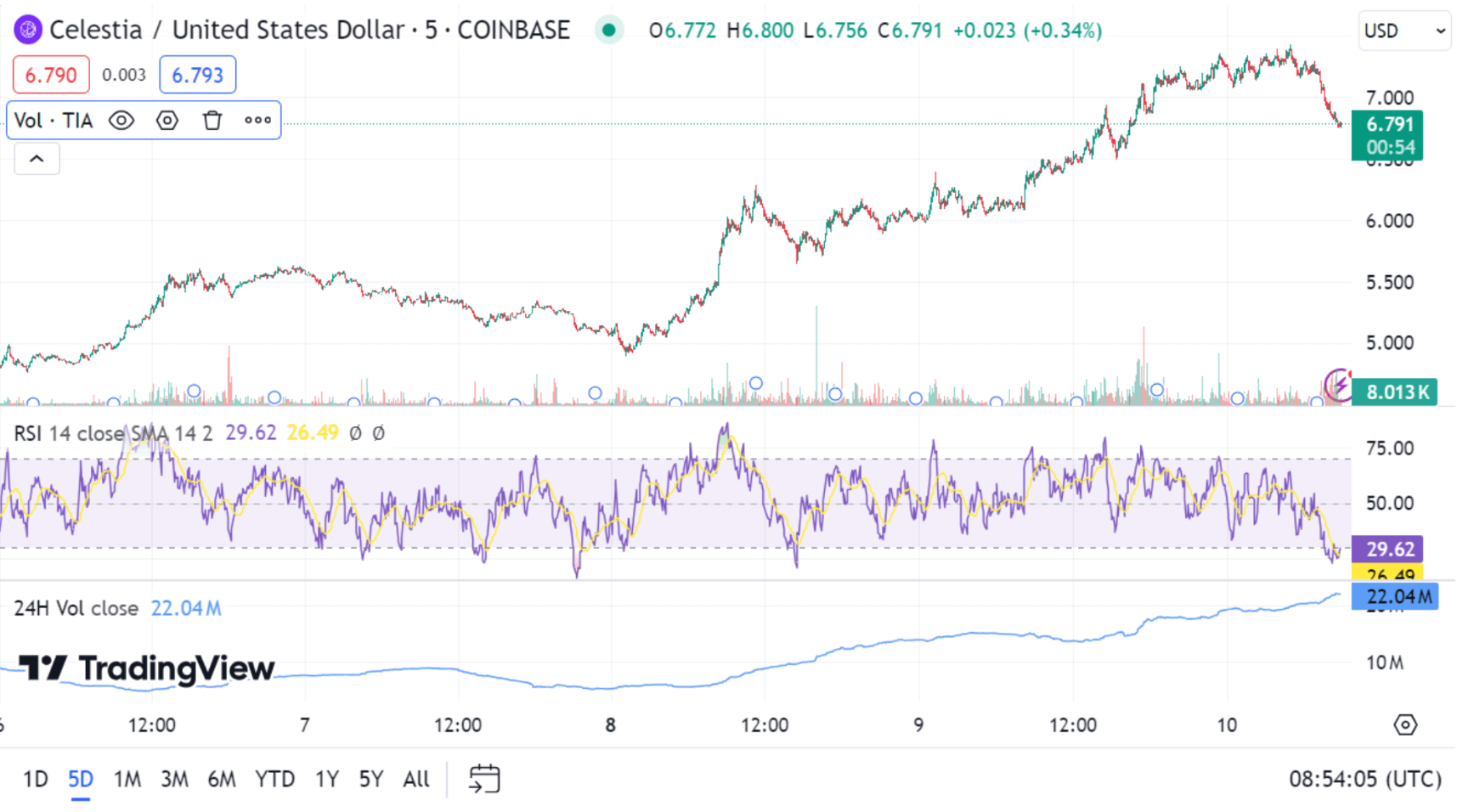

Recent Market Performance

Celestia's native cryptocurrency, TIA, recently surged 25% to $7.30, making it the best performer among the top 100 digital assets by market value. Despite this rally, traders remain sceptical, evidenced by the negative funding rates for TIA perpetual futures, indicating a high demand for short positions. This scepticism stems from TIA's five-month downtrend, where prices dropped from $21 to under $5. Nonetheless, the recent price increase suggests a potential market bottom, supported by Celestia's critical role as a data availability layer for booming layer 2 networks like Orderly Network.

Market Sentiment and Technical Analysis

Despite TIA's recent gains, negative funding rates highlight a prevalent bearish sentiment, as traders continue to short the asset. However, this negative bias could trigger a short squeeze, further driving up prices. The increase in funding fees for shorts, if prices remain resilient, may force traders to cover their positions, leading to a price surge.

Celestia's role in providing essential data availability for Orderly Network, which supports on-chain perpetual markets, underlines its importance. As the demand for secure, permissionless liquidity grows, Celestia's infrastructure becomes increasingly vital. The ongoing Modular Summit, featuring Celestia prominently, has also bolstered market sentiment, contributing to a 23% surge in trading volume recently.

Price History

Celestia debuted on October 31, 2023, with an initial airdrop to 580,000 users. The token reached an all-time high of $20.91 on February 10 but has since declined by 65%. Despite hitting an 8-month low of $4.16 on July 5, recent developments have reignited interest in TIA, pushing its price back up. Currently, TIA trades at $6.85, making it the 55th largest cryptocurrency by market cap.

According to recent forecasts, TIA's value is expected to rise by 8.82% to $7.28 by the end of July, 2024. The market sentiment is neutral-bullish, with 58% of technical indicators signalling positive outlooks, despite a Fear & Greed Index score of 27 (indicating fear). Over the past 30 days, TIA has had 12 green days with a price volatility of 17.45%.

Technical Analysis

From a technical perspective, TIA faces significant resistance at its 200-day exponential moving average (EMA) at $7.74. Overcoming this resistance is crucial for sustaining the bullish trend. Before reaching this level, TIA must break through another resistance at $7.26, a threshold that has held for eight months, posing a challenge for bearish investors.

The token's recent resurgence is attributed to its integral role in the Orderly Network, which handles substantial trading volumes and provides essential liquidity for on-chain perpetual markets. This real-world utility sets Celestia apart in a market often criticised for a lack of practical applications.

Source: TradingView

Additionally, the ongoing Modular Summit and the inability of insiders to sell their shares due to a vesting period contribute to the token's stability. Analysts predict that surpassing the $8.50 consolidation point could lead to substantial price increases, emphasising the importance of long consolidation periods for potent upward movements.

Overall, while market conditions and sentiment remain mixed, Celestia's unique position as a modular blockchain infrastructure with significant real-world utility supports a favourable outlook. Investors should monitor technical indicators and market developments closely to navigate potential opportunities and risks effectively.