SUI's Meteoric Rise: What’s Driving the Momentum?

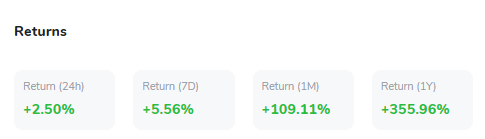

SUI, the native token of the Sui blockchain, has seen an impressive surge in recent weeks, capturing the attention of investors and market analysts alike. Over the past month, SUI has gained an astounding 140%, positioning itself as one of the top-performing cryptocurrencies in the market. Several factors have contributed to this rapid growth, including key partnerships, new integrations, and developments within the Sui ecosystem. Notably, the recent listing of SUI on Bybit's Launchpool, along with the introduction of staking options and expanded DeFi liquidity, has been a crucial driver for its price rally.

A major catalyst behind SUI's impressive rally was the announcement that Circle’s USDC stablecoin would be integrated into the Sui network. As one of the most widely used stablecoins, USDC plays a significant role in decentralised finance (DeFi) applications, and its integration into Sui has opened up new possibilities for developers and investors. This move is expected to enhance the overall utility of the Sui blockchain, making it more attractive for DeFi projects and other applications that require stablecoin transactions. Following the announcement in mid-September, SUI’s price surged by 100%, signalling strong investor confidence in the project’s future potential.

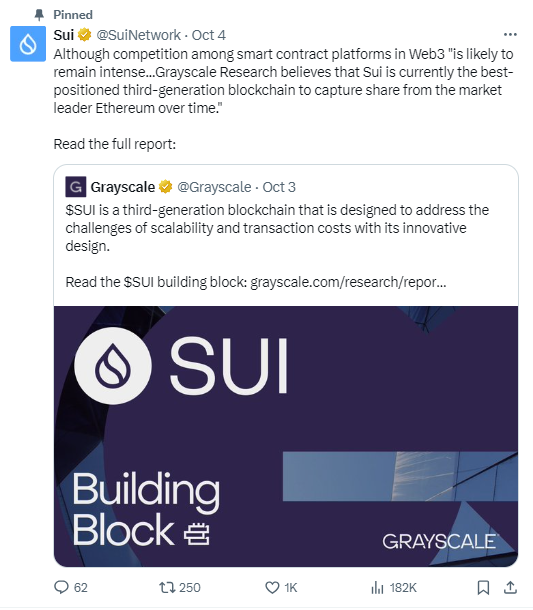

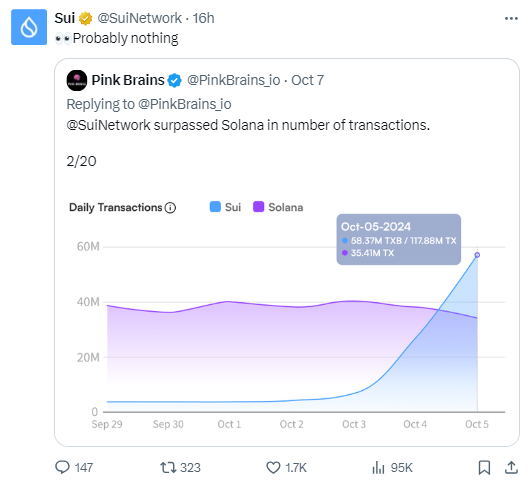

Sui’s continued growth has been fueled by a series of high-profile partnerships and integrations. The platform has recently introduced SCION technology, designed to address security issues in internet routing and improve overall network reliability. Additionally, the launch of the Grayscale SUI Trust in August has provided institutional investors with easier access to the token, further increasing interest in the project. The rise of memecoins within the Sui ecosystem has also contributed to the token's growth, with new projects like Sudeng and Fud The Pug attracting attention and driving up transaction volumes.

Source: X

Bybit’s decision to introduce SUI as the first native token in its Launchpool has had a substantial impact on the token’s price. This move not only expanded liquidity options but also allowed users to stake SUI and earn rewards, thereby enhancing the token's appeal to both retail and institutional investors. As a result, SUI saw a 20% surge in just 24 hours, hitting a six-month high of $2.09. This development follows the token's inclusion in Bybit’s ecosystem, where staking options for other tokens like NAVI and USDC were also introduced, providing additional earning opportunities for investors.

From a technical perspective, SUI has shown significant bullish momentum, especially since its breakout above $2. Despite the recent dip below $2, SUI might be approaching its all-time high of $2.17, which was last reached in March 2024. The token has seen strong buying pressure, with total value locked (TVL) on the Sui network surging to $1.58 billion, making it the 9th largest chain by TVL. Indicators such as the Relative Strength Index (RSI) and Stochastic Oscillator suggest that while SUI is currently in a slightly oversold region, the bullish trend may continue if the token maintains support above key levels like $1.80.

Source: TradingView

The Awesome Oscillator is showing signs of a potential slowdown in bullish momentum, with red bars forming above the neutral line. However, with open interest in SUI’s derivatives market growing by over 250% since September, there is still strong investor sentiment driving the rally. If SUI can sustain its current momentum, the token could break through its resistance and reach new all-time highs in the coming weeks.

Source: DefiLlama

Institutional interest in SUI has also been a driving factor in its recent success. The launch of the Grayscale SUI Trust has opened doors for accredited investors to gain exposure to the token, adding further legitimacy to the project. Sui’s commitment to improving its infrastructure through technological advancements like the Mysticeti consensus upgrade and SCION technology integration has also attracted attention from both retail and institutional investors. As Sui continues to expand its ecosystem and enhance its capabilities, the project is well-positioned to maintain its upward trajectory in the coming months.

With a strong foundation of technological innovation, key partnerships, and growing institutional support, SUI appears to be on track for continued growth. The token’s impressive performance in recent weeks, combined with its rising TVL and expanding ecosystem, suggests that Sui is poised to become a major player in the blockchain space. However, investors should remain cautious, as the token’s high inflation rate and overbought indicators could lead to short-term corrections. Nonetheless, with a solid roadmap and increasing market visibility, SUI remains a promising asset for both short-term traders and long-term investors.

Source: X