Solana's Price Boost Following SIMD-0096 Approval

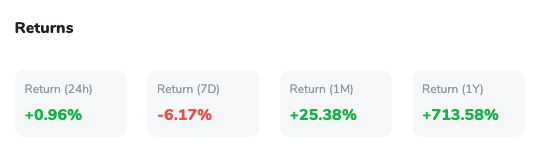

Solana (SOL) has seen a price increase of 3.04% in the past 24 hours, reaching $171.76. This uptick comes amid a challenging period for the broader crypto market. The positive price movement coincides with the recent approval of the SIMD-0096 proposal by Solana validators. This proposal, which allows validators to keep 100% of priority transaction fees instead of burning 50%, aims to enhance the network's efficiency. Despite the slight fall in the last week, the coin remains up by 26.79% over the past month and an impressive 727.9% over the year, indicating strong underlying momentum that could lead to further gains.

Impact of SIMD-0096 on Solana's Network Efficiency

The SIMD-0096 proposal is designed to make the Solana network more efficient by incentivizing validators to prioritise on-chain transactions over side deals. By allowing validators to retain the entirety of priority fees, the proposal reduces the economic motivation for processing transactions off the main network. This change is expected to streamline transaction processing and enhance the overall functionality of Solana. Although additional updates will be necessary to fully realise these benefits, the long-term impact is anticipated to be significant, potentially driving more substantial price increases as network efficiency improves.

Solana Price Prediction and Technical Analysis

Solana's price currently stands at $171.76, showing signs of breaking through its resistance level. With the approval of SIMD-0096, SOL has gained momentum, evidenced by its price moving towards the $175 mark. The relative strength index (RSI) has risen from 40 to 60, indicating increasing buying interest. Additionally, the 30-day moving average (MA) appears ready to cross above the 200-day MA, signalling a potential breakout.

Source: TradingView

Technical Analysis

As of now, SOL's trading volume is approximately $2.5 billion, slightly lower than in recent weeks. However, this reduced volume means that significant purchases could have a pronounced effect on the price. The technical indicators suggest a bullish outlook:

- Support and Resistance Levels: The immediate support levels are at $160 and $143, with resistance at $189, and $200. The $200 resistance is crucial; a breakout above this level would be a strong bullish signal.

- Relative Strength Index (RSI): The RSI is at 60, up from 40 earlier, suggesting that SOL is not yet overbought and has room for further gains.

- Moving Average Convergence Divergence (MACD): The MACD line is above the signal line, though the histogram bars are declining, indicating that momentum may be peaking.

Trading Strategy

Given the current trends, a potential trading strategy could involve buying SOL on a pullback near the $160 support level, with an eye towards the long-term uptrend line at $143. This setup offers a potential upside of up to 25%, targeting the $200 resistance level. A stop loss should be set at $140 to manage downside risk. This strategy leverages the current bullish trend and aims to capitalise on potential dips as buying opportunities.

Solana's Strong Uptrend and Market Sentiment

Solana continues to exhibit a strong uptrend across short, medium, and long-term timeframes. Investors remain optimistic, supported by positive technical signals such as the inverse head and shoulders formation breaking through the $153 resistance. This pattern suggests further gains towards $189 or more, provided that SOL can maintain its current trajectory.

The approval of SIMD-0096 has reinforced this bullish sentiment, with the proposal expected to drive efficiency improvements and long-term network benefits. As the market becomes increasingly bullish, SOL's price could reach new heights in the coming weeks, assuming it breaks through the current resistance levels and maintains its upward momentum.

Optimistic Outlook for Solana

Overall, Solana's recent price action and the approval of the SIMD-0096 proposal paint a positive picture for the cryptocurrency. With strong technical indicators, robust support levels, and the potential for further network efficiency improvements, SOL appears well-positioned for continued growth. Traders should monitor key levels and market developments closely, as the current trends suggest a bullish outlook with potential for significant gains. As always, managing risk through well-placed stop losses and strategic entry points will be crucial in navigating the dynamic crypto market.