Reef Token Surges Following Binance Delisting

Reef (REEF), the native token of Reef Finance, has experienced an impressive price rebound despite being delisted by Binance, one of the largest cryptocurrency exchanges. The token rose by 106% to reach a high of $0.0012 on September 3, 2024, marking its highest point in a month and recovering significantly from its lowest point in the prior month. This recent surge increased its market capitalization to over $25 million, signalling renewed investor interest in Reef.

Interestingly, this rally came after Binance removed some REEF trading pairs (REEF/TRY and REEF/USDT) from its platform in late August. Typically, cryptocurrencies face a sharp decline following such delistings by major exchanges. However, Reef bucked this trend, with most of the trading volume shifting to other exchanges like Gate.io, HTX, KuCoin, and Bitget. The futures market also saw increased activity, with open interest in REEF futures skyrocketing to $60 million—its highest level in two years.

Community Fund and Strategic Developments Fueling Interest

The rebound in REEF’s price also coincides with a series of strategic developments by the Reef Finance team. A key catalyst was the launch of a new community developer fund aimed at fostering growth in the ecosystem by supporting projects related to decentralised finance (DeFi) protocols, hardware wallets, DAO (Decentralised Autonomous Organization) infrastructure, and cross-chain bridge integrations. This initiative has increased optimism about Reef's future prospects and boosted demand for the token.

Source: X

Moreover, the introduction of new services like ReefSwap, a decentralised exchange (DEX) that allows users to trade various tokens with ease, and the release of the Reef Chain Wallet on Android, have reinforced Reef’s commitment to expanding its DeFi ecosystem. These developments highlight the platform's ability to adapt and evolve, contributing to its recent price surge.

Technical Analysis: REEF's Current Market Position

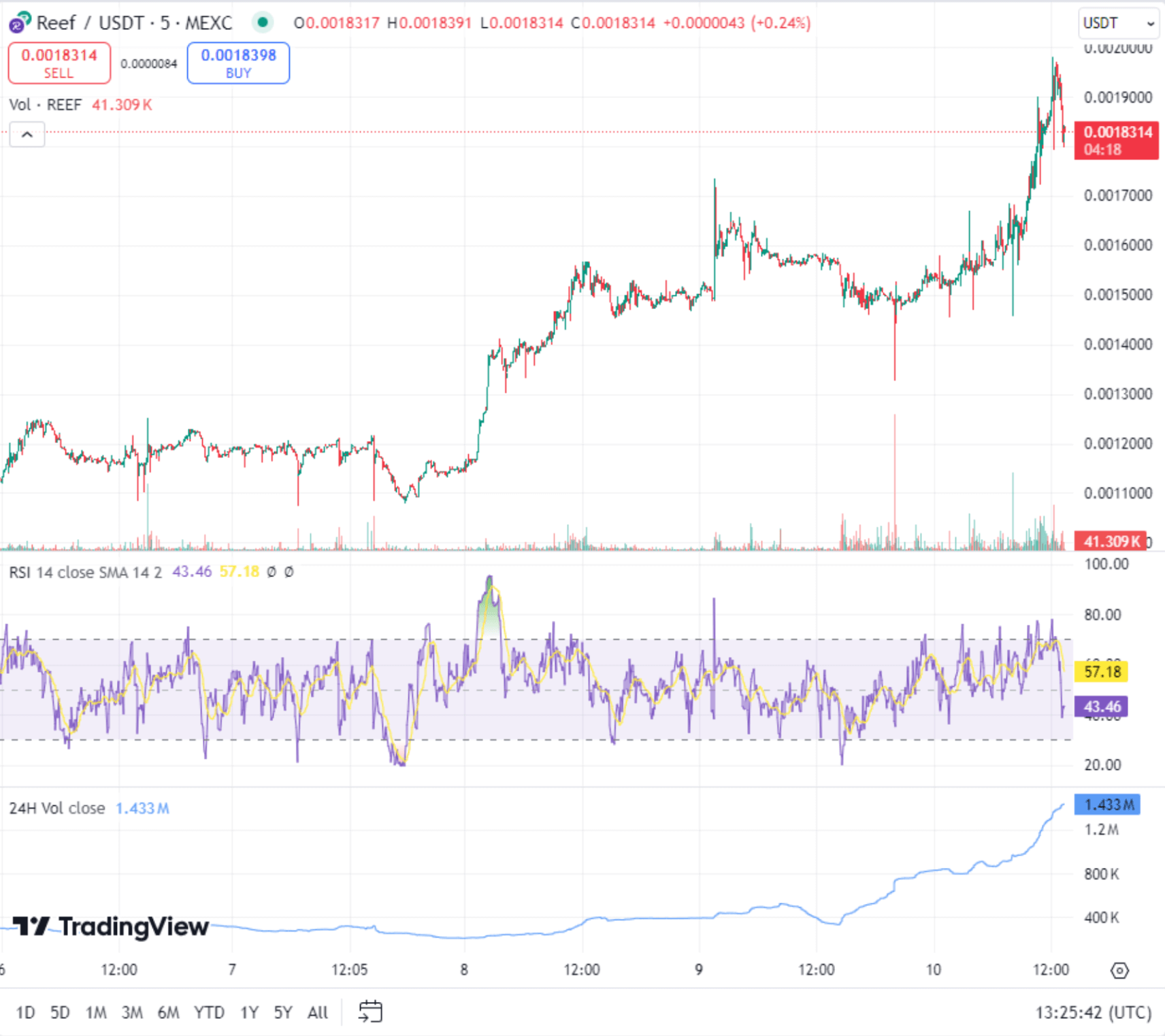

From a technical perspective, REEF is exhibiting signs of strength, despite the challenges posed by its recent delisting from Binance. Prior to its rally, the token had formed a falling wedge pattern, which is generally viewed as a bullish reversal indicator. Since then, REEF has climbed above its 50-day moving average, signalling a potential shift in trend. An RSI of 43.46 indicates that the market is in a neutral state, neither overbought nor oversold. Since the RSI is below 50 but above 30, it suggests that the market might have recently experienced some selling pressure, but not enough to reach oversold conditions.

The Average Directional Index (ADX), which measures the strength of a trend, is currently at 50 but pointing downward, indicating that while the uptrend is strong, there could be some consolidation before another potential upward move. The token remains around 34% below its 200-day simple moving average, suggesting room for further growth if positive momentum continues. Volatility is relatively low, with a reading of 19%, implying that the price may stabilise in the short term.

Source: TradingView

Outlook for REEF: Opportunities and Challenges

Looking ahead, REEF's future will depend largely on its ability to maintain the current positive momentum. The platform's focus on DeFi, non-fungible tokens (NFTs), and gaming, coupled with its high scalability and low transaction fees, provides a solid foundation for long-term growth. Reef’s compatibility with the Polkadot ecosystem also positions it well for cross-chain interoperability, making it an attractive option for developers and users alike.

However, investors should remain cautious of potential market corrections. While the recent surge is encouraging, the broader cryptocurrency market remains highly volatile and sensitive to macroeconomic conditions. REEF is still down approximately 20% year-over-year, indicating that it has yet to fully recover from its past declines. The token’s ability to sustain its current gains will likely depend on continued innovation, strategic partnerships, and broader market trends.

Conclusion: A Resilient Recovery Amidst Challenges

In summary, REEF has demonstrated resilience in the face of significant challenges, including its delisting from Binance and a turbulent market environment. The token’s recent price surge, driven by strategic developments like the new community fund and increased futures market activity, shows its potential for growth. However, with technical indicators suggesting a possible short-term pullback, investors should approach with caution while acknowledging the longer-term opportunities that Reef Finance offers within the DeFi and blockchain space.