May Overview: Crypto Market Dynamics

Latest News and Developments in the Crypto Market - May 2024

The cryptocurrency market witnessed significant developments in May 2024, driven by major institutional movements, regulatory discussions, and evolving political landscapes. Here's a comprehensive overview of the most important updates and trends:

1. NYSE's Potential Crypto Trading Expansion

At Consensus 2024 in Austin, Texas, NYSE President Lynn Martin expressed interest in offering cryptocurrency trading if there was clear regulatory guidance. Martin highlighted that the success of U.S.-listed spot bitcoin (BTC) exchange-traded funds (ETFs), which have amassed $58 billion in assets, indicates strong market demand for regulated crypto products. Tom Farley, CEO of Bullish and Martin's predecessor at NYSE, predicted that the U.S. regulatory environment would improve in the coming years, irrespective of the election outcome. This shift could pave the way for traditional financial markets to integrate more with digital assets, providing new opportunities for innovation and growth.

2. Political Shifts and Regulatory Changes

U.S. politics saw a rapid shift towards a more favourable stance on cryptocurrency. The ousting of the anti-crypto chair of the Federal Deposit Insurance Corp. (FDIC) and the passage of the Financial Innovation and Technology for the 21st Century Act (FIT21) bill in the House marked significant milestones. Additionally, Republican presidential frontrunner Donald Trump has expressed strong support for crypto. These changes are expected to foster a more supportive regulatory framework for the digital asset industry, encouraging further integration of blockchain technology into traditional financial systems.

3. Consensys Sues SEC for Regulatory Clarity

Ethereum co-founder Joseph Lubin announced that his firm, Consensys, has filed a lawsuit against the U.S. Securities and Exchange Commission (SEC) in Texas. This preemptive move aims to achieve regulatory clarity, preserve free markets in crypto, and ensure that open-source developers are not targeted by regulatory actions. Lubin emphasised the importance of allowing innovation within the crypto space without excessive regulatory interference, highlighting the existential threat Ethereum poses to traditional financial systems. This lawsuit represents a significant push for clearer and more supportive regulations for the crypto industry.

4. Goldman Sachs and Tokenization

Goldman Sachs continues to deepen its involvement in the crypto space, with a focus on tokenization. Mathew McDermott, the bank's global head of digital assets, discussed the benefits of digitising the lifecycle of asset issuance. Tokenization can improve operational efficiency and increase liquidity by attracting a broader group of investors. Goldman has been using private, permissioned blockchains due to the uncertain regulatory environment but remains open to exploring other options as the market evolves. The firm sees significant potential in tokenizing various asset classes, including real estate and green debt issuance, which could transform parts of the financial system.

5. Trump Campaign Embraces Crypto Donations

In a notable development, former U.S. President Donald Trump's campaign has begun accepting cryptocurrency donations via Coinbase Commerce. This move reflects Trump's aim to reduce government control over financial decisions and promote individual freedom. The campaign accepts various cryptocurrencies, including Bitcoin, Ethereum, Solana, and Dogecoin. This decision contrasts sharply with the current administration's tougher stance on digital assets and suggests a more favourable outlook for the crypto industry if Trump were to be re-elected.

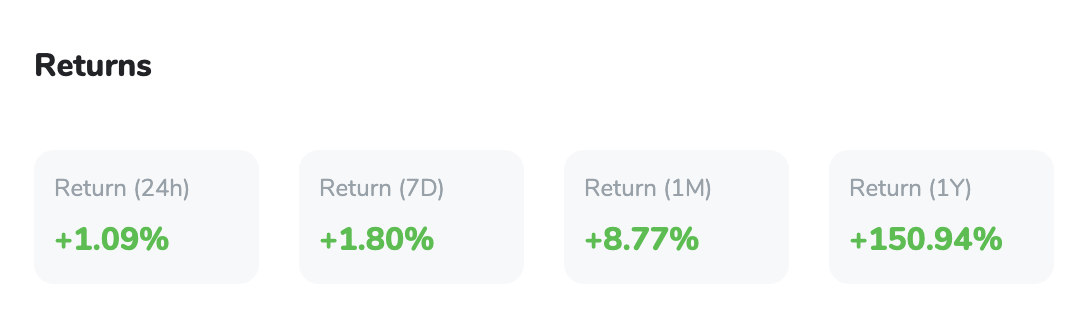

6. Market in May

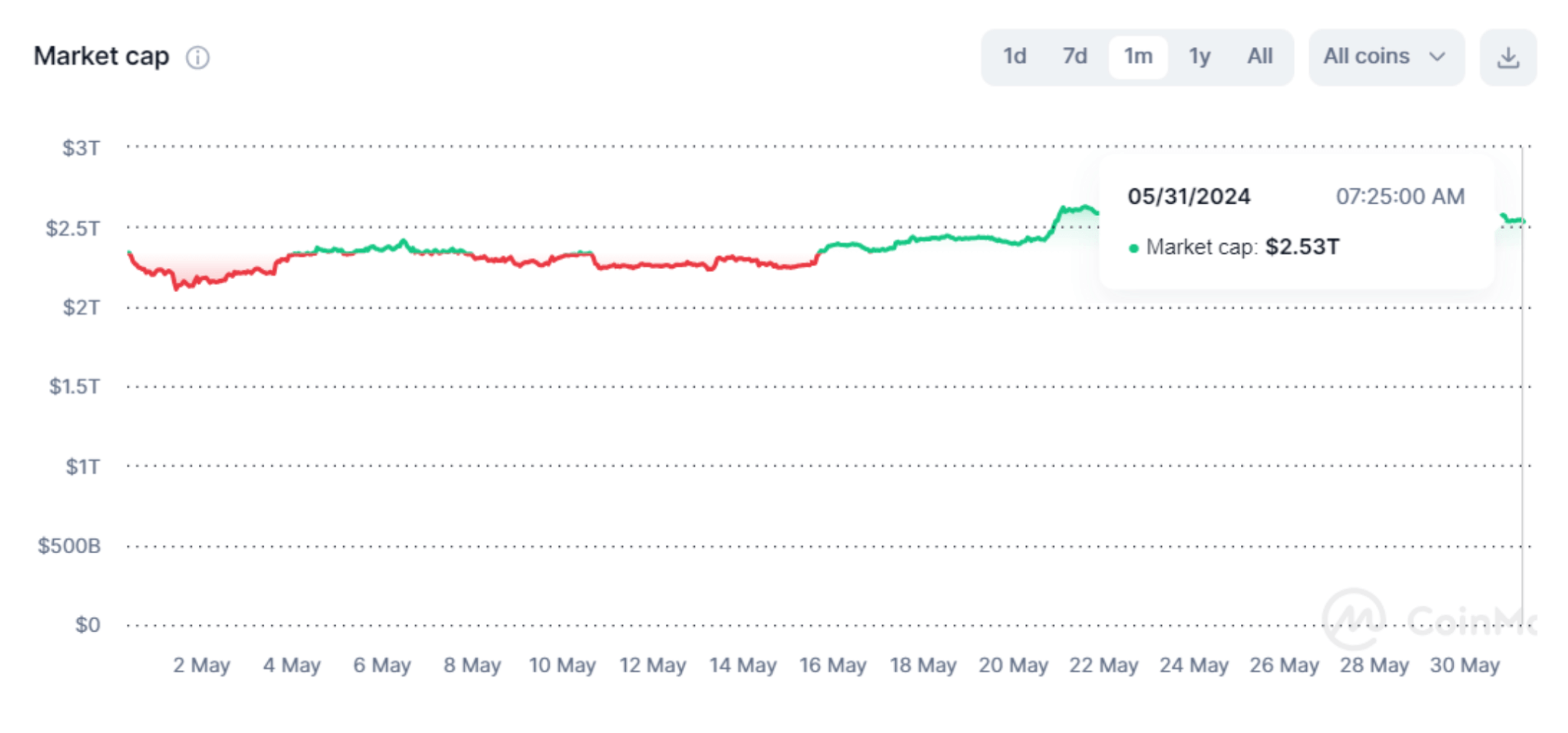

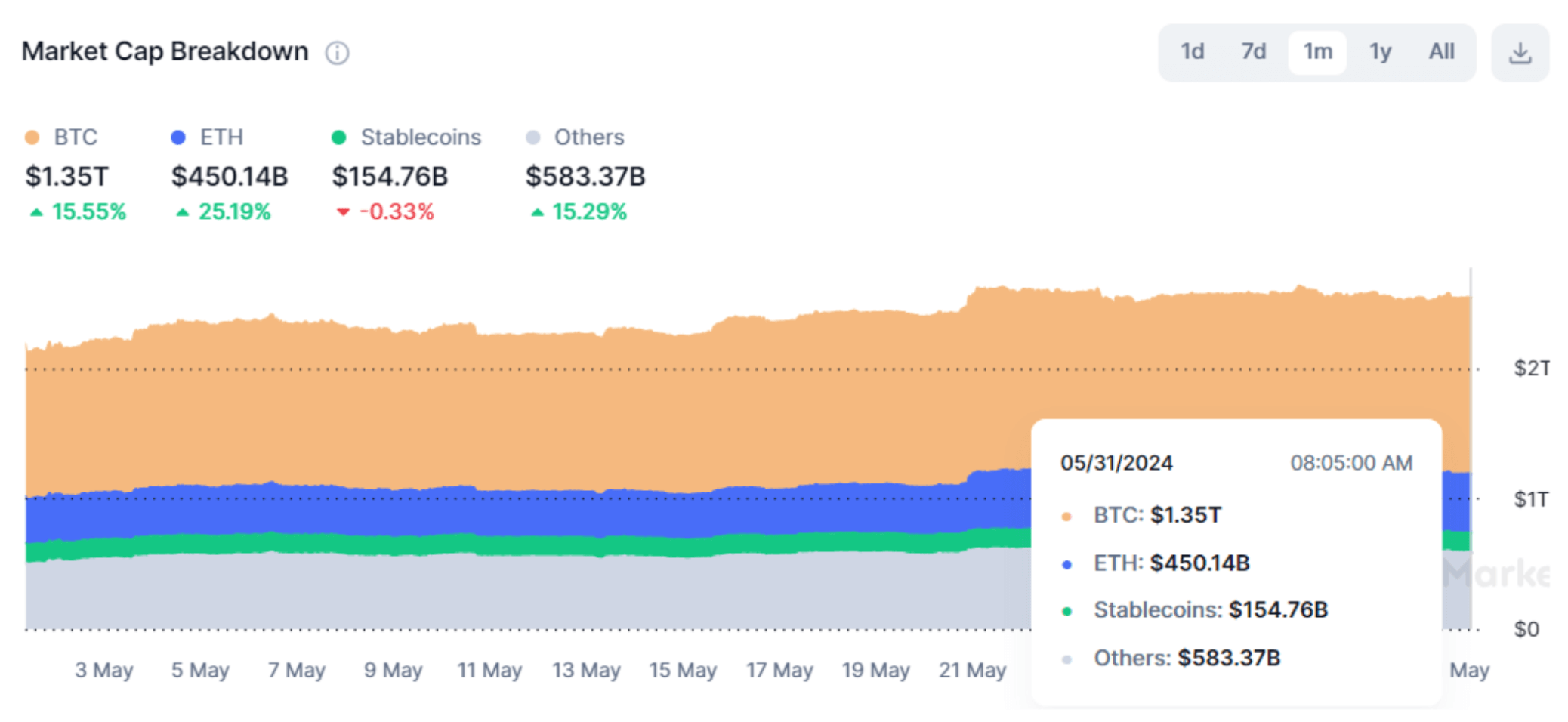

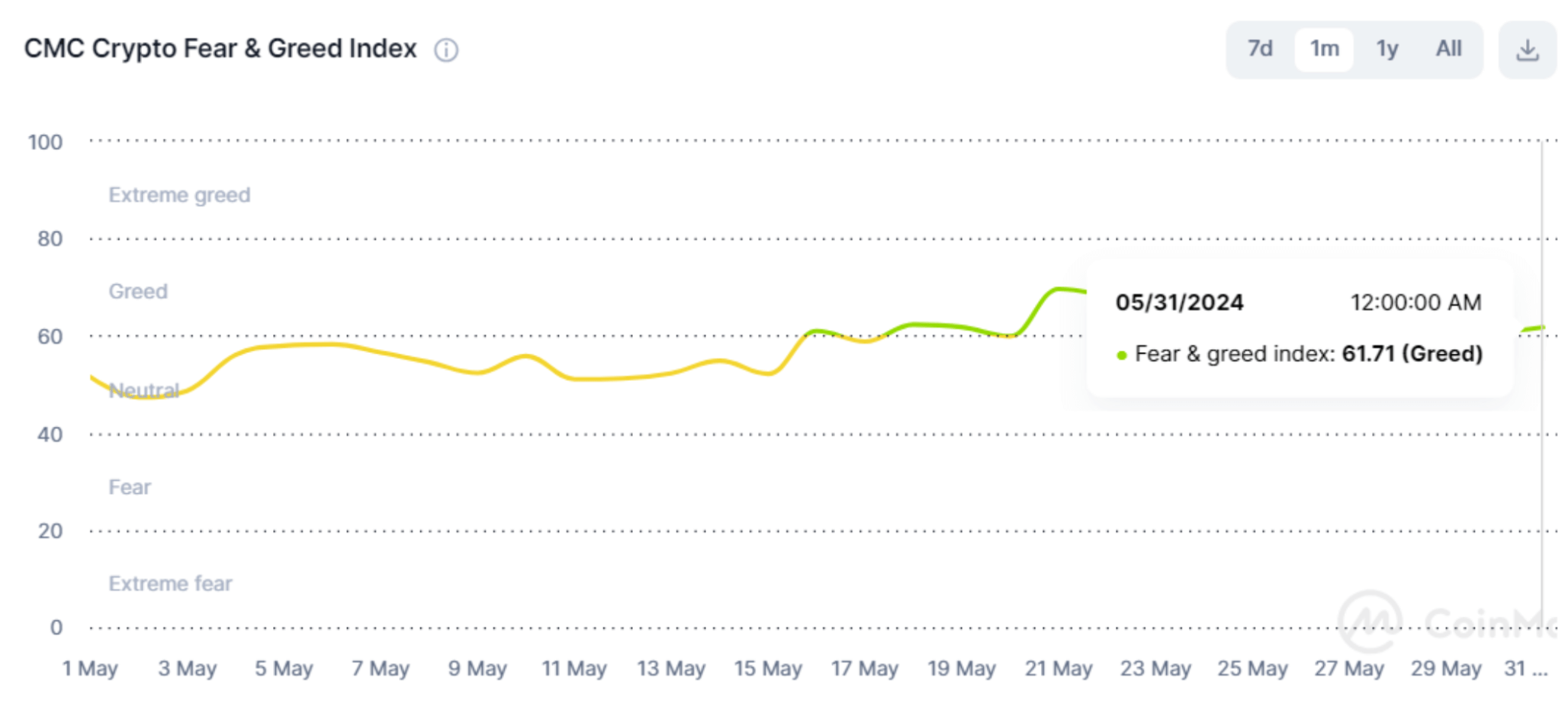

The cryptocurrency market on May 31, 2024, exhibited a mixed performance, reflecting its characteristic volatility. Bitcoin (BTC) stood out by topping the $68.5K mark, trading primarily in the green with a 0.71% increase over the past 24 hours. This surge pushed Bitcoin's price to $68,306, highlighting its resilience and dominance, which grew by 0.41% to 53.07%. The positive sentiment is also noticeable for Ethereum (ETH), whose price revolves around $3,800, experiencing a 0.80% decline in 24h to $3,759.93. This divergence underscores the different dynamics at play within the crypto market, where Bitcoin's growth is buoyed by increasing institutional interest and regulatory clarity, while Ethereum faces consolidation pressures despite the long-term optimism around Ethereum 2.0 and its technological advancements.

Source: Coinmarketcap

Altcoins, including Solana (SOL), Ripple (XRP), Dogecoin (DOGE), and Shiba Inu (SHIB), predominantly traded in the green. Solana rose to $166.34, and Ripple rose for 3.23% to $0.5177, reflecting broader trends. Meme coins like DOGE and SHIB saw notable rises, with DOGE elevating 30.03% to $0.1598 and SHIB elevating 23.51% to $0.000026, indicative of their inherent volatility driven by social media trends and speculative trading. The global crypto market cap saw a slight increase to $2.54 trillion, with total market volume rising by 0.58% to $83.07 billion, underscoring the market's nuanced and varied performance across different cryptocurrencies.

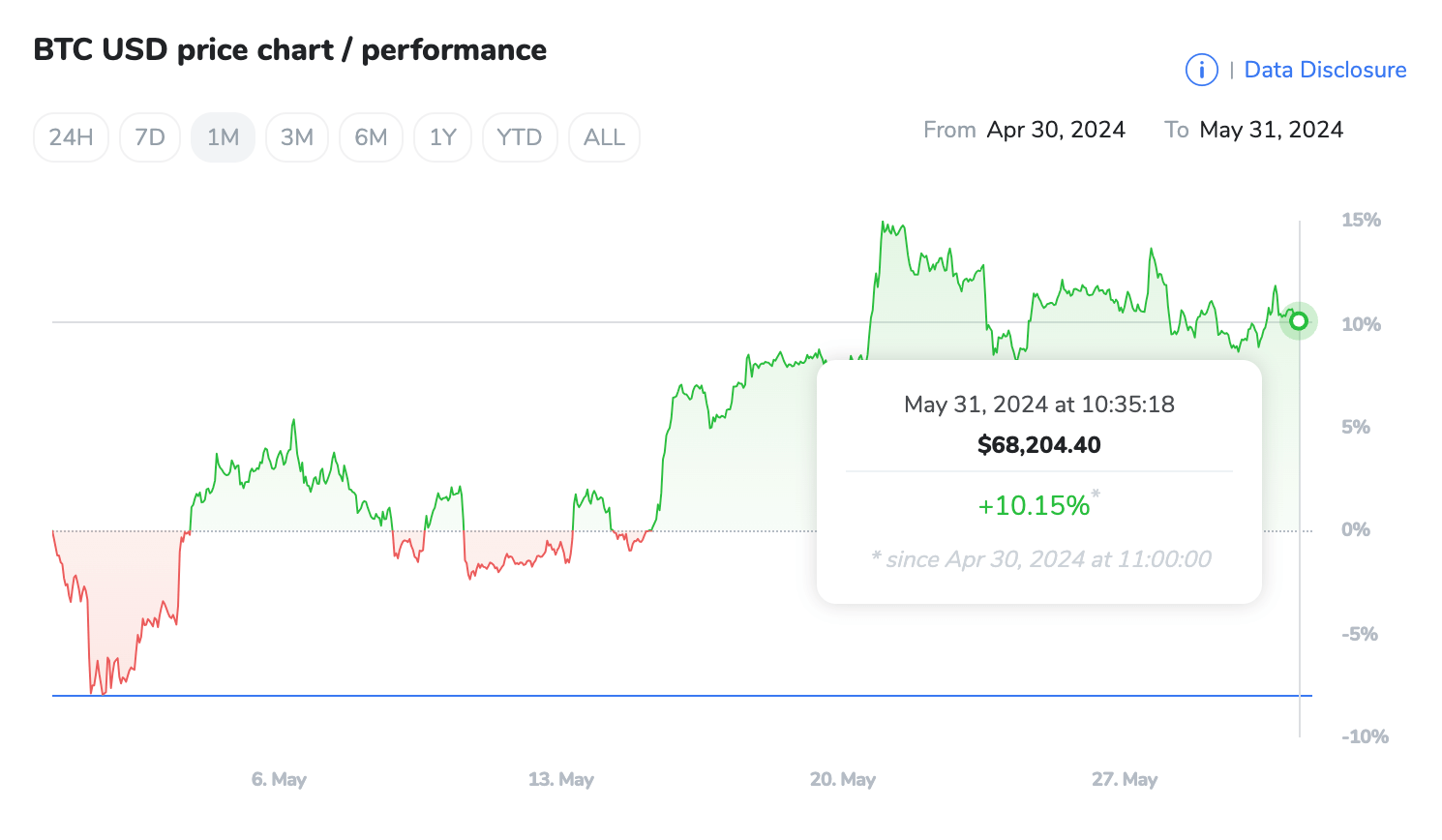

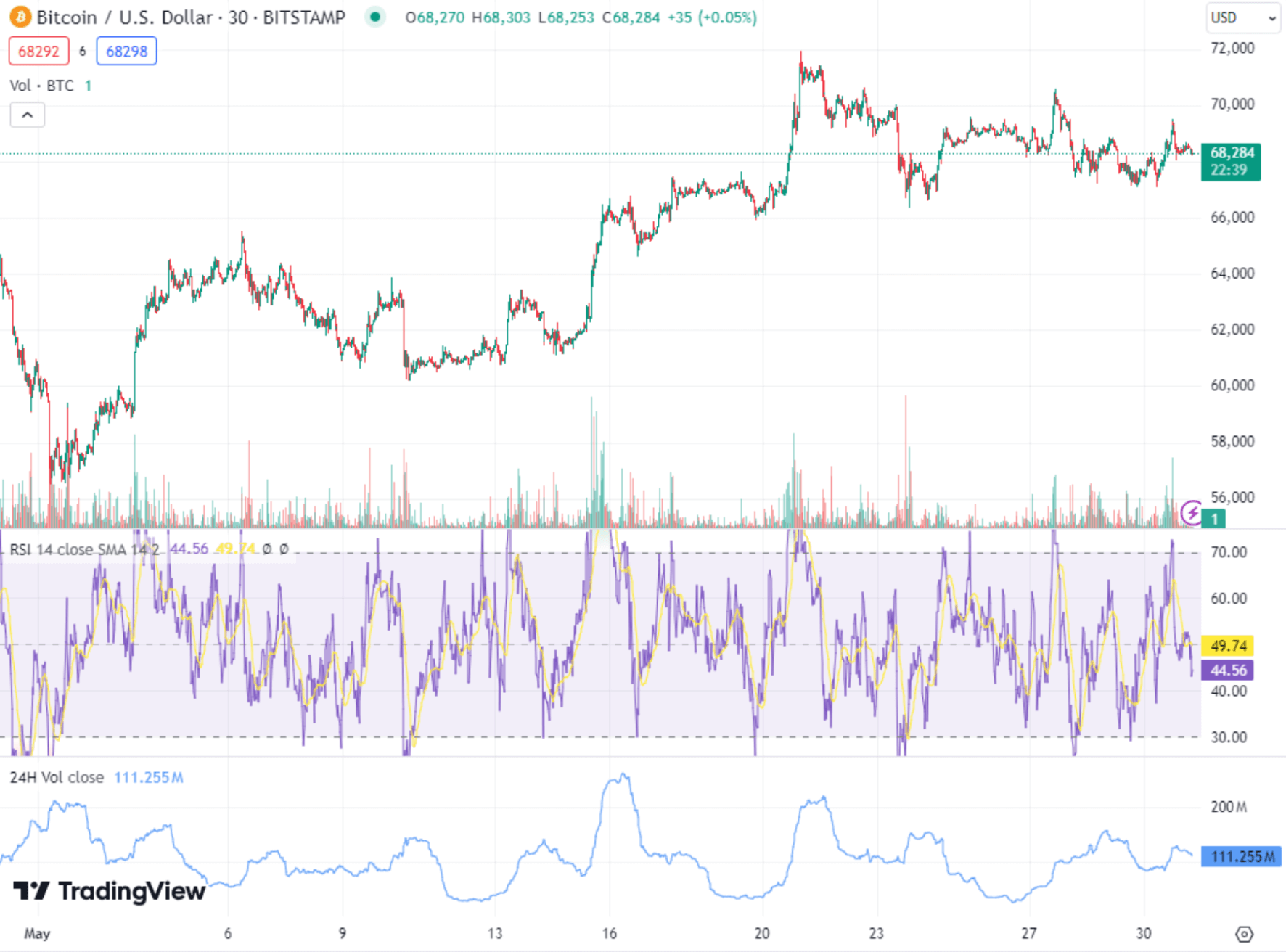

Bitcoin Technical Analysis

As of late May 2024, Bitcoin (BTC) is trading around $68,305, showing a slight increase of 0.71%. The market's sentiment remains bullish, with the 50-day Exponential Moving Average (EMA) at $68,211 indicating a positive trend as long as the price stays above this level. Immediate resistance levels are $68,880 and $69,770,, which are crucial for potential upward movements. On the downside, immediate support is found at $67,170, with further support at $66,590. The Relative Strength Index (RSI) is at 50, suggesting a neutral market sentiment.

Bitcoin's price has been influenced by several factors, including the success of Bitcoin ETFs and increasing institutional interest. BlackRock's iShares Bitcoin Trust, which has become the largest fund for BTC with $20 billion in assets, has boosted investor confidence. This institutional backing is expected to drive BTC prices higher, despite short-term fluctuations.

Source: TradingView

Overall, the outlook for Bitcoin remains bullish above the $68,000 mark, with key resistance and support levels providing a framework for traders to monitor. As regulatory clarity improves and more traditional financial institutions embrace crypto, Bitcoin's potential for growth continues to strengthen.

Conclusion

The crypto market in May 2024 has been marked by significant regulatory and political developments, increased institutional involvement, and ongoing technical analysis indicating a bullish trend for Bitcoin. These factors collectively point towards a promising future for the digital asset industry, with potential for further integration into traditional financial systems and increased adoption by both retail and institutional investors.