Hedera Hashgraph (HBAR): Latest Developments, Market Trends, and Technical Analysis

Hedera Hashgraph (HBAR) has been making waves in the crypto space with its advanced technology, increasing adoption, and potential price recovery. Despite a recent downturn, the cryptocurrency is showing signs of stabilisation and potential for future growth. Below, we explore the latest news, Hedera’s role in blockchain innovation, its price history, predictions, and a detailed technical analysis of its current market situation.

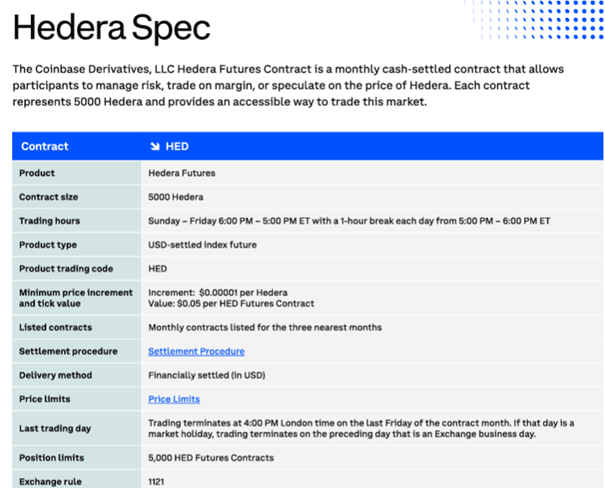

Coinbase Introduces Solana and Hedera Futures Contracts

In a significant development, Coinbase has expanded its derivatives offerings by launching CFTC-regulated futures contracts for Solana (SOL) and Hedera (HBAR). This marks an important step in bringing regulated trading products to institutions and retail investors in the United States.

Coinbase Derivatives LLC now offers 19 different futures contracts, including Bitcoin, Ethereum, Dogecoin, Litecoin, and gold. These newly introduced Solana and Hedera contracts allow traders to gain exposure to these assets with leverage, improving capital efficiency and risk management.

The launch of HBAR futures also comes at a time when the SEC is reconsidering its approach to crypto regulation, particularly after the resignation of former SEC Chair Gary Gensler. With regulatory clarity increasing under the Trump administration, the introduction of these futures contracts could strengthen HBAR’s legitimacy as an institutional-grade digital asset.

Source: Coinbase

Could a Hedera Spot ETF Be Next?

Following the approval of Bitcoin and Ethereum spot ETFs, asset managers are now shifting their focus to other cryptocurrencies, including Hedera, Solana, Dogecoin, and XRP.

More altcoins may soon have spot ETF offerings. With the approval timeline extending up to 240 days, there is growing speculation that Hedera (HBAR) could be among the next candidates for a spot ETF.

For years, the SEC has evaluated the presence of regulated futures markets before approving spot ETFs. The availability of regulated HBAR futures via Coinbase could influence the agency’s decision on whether to approve an HBAR ETF in the near future.

Source: X

Hedera’s Expanding Use Cases and Adoption

Hedera Hashgraph sets itself apart from traditional blockchains by offering a fast, secure, and energy-efficient ledger. Unlike Bitcoin or Ethereum, which rely on Proof-of-Work (PoW) or Proof-of-Stake (PoS) mechanisms, Hedera uses a Directed Acyclic Graph (DAG) structure, which enables thousands of transactions per second at minimal energy cost.

Industries are beginning to explore the use of HBAR for a variety of applications, including:

Finance: Instant settlement of cross-border payments.

Supply Chain Management: Transparent tracking of goods.

Healthcare: Secure data sharing and identity verification.

Government: Speculation suggests that Hedera could be used in US government projects, including timestamping federal spending and modernising financial tracking.

Although there is no confirmed partnership between Hedera and US agencies, ongoing discussions around blockchain adoption in governance could lead to future collaboration.

Source: Hedera

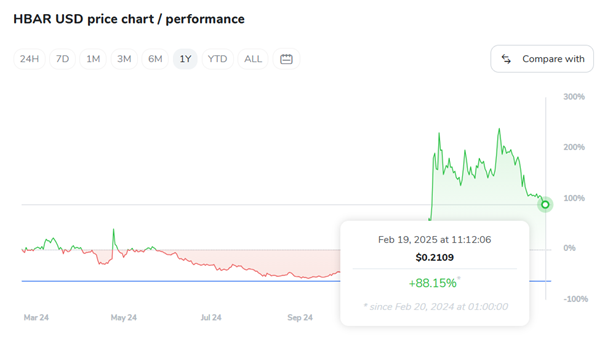

Price History and Recent Market Trends

Hedera (HBAR) has experienced significant price movements over the past few months:

November 2024: HBAR surged, reaching a high of $0.39.

December 2024: The price entered a correction phase, consolidating between $0.30 and $0.35.

January 2025: HBAR dropped significantly, losing 40% of its value and falling below $0.25.

February 2025: The token is now attempting a recovery, trading near $0.23, but still facing strong resistance.

While the price decline has been concerning for investors, technical indicators suggest a potential reversal, which we’ll explore in the next section.

HBAR Technical Analysis: A Potential Breakout or More Consolidation?

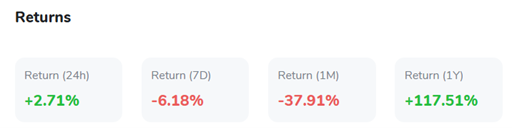

Hedera (HBAR) is currently showing signs of recovery but remains in a consolidation phase. The price is hovering around $0.21128, with immediate resistance at $0.248 and support at $0.21. The recent price action suggests a gradual shift in momentum, but a decisive breakout is needed to confirm a trend reversal.

Key Support and Resistance Levels

Immediate Resistance: $0.22 (short-term level to watch)

Major Resistance: $0.248 (a breakout above could signal a rally)

Immediate Support: $0.21 (a break below could trigger further downside)

Critical Support: $0.179 (the last defense before a deeper correction)

Momentum Indicators & Moving Averages

RSI (Relative Strength Index): At 63.60, indicating moderate bullish momentum but approaching overbought territory.

MACD (Moving Average Convergence Divergence): A bullish crossover is forming, suggesting that selling pressure is weakening and buying momentum is increasing.

Exponential Moving Averages (EMA): The 50-day EMA is acting as resistance, meaning HBAR must break above this level to confirm a bullish reversal.

Volume Trends: 24-hour volume is at 38.14M, showing a steady increase, which is a positive sign for momentum.

Directional Movement Index (DMI) Shift

+DI (buying pressure) has increased from 10.9 to 13.9.

-DI (selling pressure) has dropped from 22.3 to 19.4.This indicates that buyers are gradually regaining control, but a stronger confirmation is needed.

Prediction: Where Is HBAR Headed Next?

Bullish Case: If HBAR breaks and holds above $0.22, we could see a push toward $0.248. A rally past $0.32 would confirm a strong uptrend.

Bearish Case: If HBAR fails to break resistance, it could retest support at $0.21, and a break below this level might lead to further downside toward $0.179.

HBAR is showing early signs of recovery, with improving momentum and increasing buying pressure. However, a decisive breakout above resistance is needed before a full bullish trend is confirmed. Until then, traders should watch for key support and resistance levels for potential trading opportunities.

Source: TradingView

Future Outlook: Can HBAR Shape Web 3.0?

With its scalable and efficient consensus mechanism, Hedera is well-positioned to play a major role in Web 3.0 and the future of decentralised technology. Some of the key areas where HBAR could make a difference include:

Secure Digital Identity Management

Decentralised Finance (DeFi)

Tokenisation of Real-World Assets

Enterprise Blockchain Solutions

As institutions and developers continue exploring alternative blockchain networks, Hedera stands out as a sustainable and high-performance platform.

Source: X

Hedera and Dogecoin: Speculation or Strategic Integration?

While no official confirmation exists regarding Hedera’s integration with Dogecoin or U.S. government systems, speculation continues to drive discussions in the crypto community. Given Hedera’s reputation for efficiency, security, and enterprise-grade solutions, it would not be surprising if government agencies explored its potential applications in financial tracking, identity verification, or voting systems. However, until formal partnerships or contracts are disclosed, these remain speculative narratives rather than concrete developments. That said, Hedera’s growing presence in regulatory discussions, its potential ETF approval, and its connections to major industry players could boost HBAR’s long-term adoption and market position.

Source: X

Conclusion: Is Hedera Ready for a Breakout?

Hedera Hashgraph (HBAR) has been through a volatile period, but with new developments such as regulated futures, potential ETF discussions, and growing industry adoption, it is proving to be a long-term player in the blockchain space.

While short-term price movements remain uncertain, key technical indicators suggest a potential recovery is underway. Whether it’s institutional interest, regulatory clarity, or increasing adoption, all eyes are on HBAR to see if it can reclaim higher price levels in the coming months.

For now, investors should monitor key resistance levels and watch for institutional interest as a signal for HBAR’s next big move.