Introduction to COTI (COTI)

COTI, which stands for Currency Of The Internet, is a blockchain-based payments infrastructure project established in 2017 by Shahaf Bar-Geffen, Dr. Nir Haloani, and David Assaraf. It aims to create a scalable, user-friendly platform for digital payments by leveraging blockchain technology. By utilising this technology, COTI offers fast, reliable, and low-cost transactions, making it an innovative solution in the digital payment landscape.

How COTI (COTI) Works

COTI's functionality relies on two key technologies: the Proof of Trust (PoT) consensus mechanism and the Directed Acyclic Graph (DAG) structure. The PoT system assigns a trust score to each user based on their transaction history and behaviour, determining their fees and network participation capabilities. Merchants with higher trust scores benefit from lower costs and faster transaction processing. Unlike traditional blockchains that store transactions in linear blocks, COTI’s DAG structure directly connects transactions, forming a web-like configuration that allows for faster processing and enhanced scalability. A typical COTI transaction involves the buyer sending a payment request to the seller, trust scores being assessed, fees being determined based on these scores, and users with high trust scores validating the transaction, ultimately completing the payment.

Recent Developments: COTI's Transition and Partnerships

COTI is currently transitioning from its DAG protocol to a privacy-focused Layer-2 network on the Ethereum blockchain, known as COTI V2. This new iteration, still under development, is set to release an initial test network in 2024 with the mainnet launch anticipated in early 2025. In a significant development, COTI has been selected by the Bank of Israel for the Digital Shekel project, partnering with industry giants like PayPal and Fireblocks. This collaboration underscores COTI’s advanced blockchain capabilities, as it is the only blockchain chosen to secure Israel’s CBDC. This partnership is a major milestone, highlighting COTI’s potential to revolutionise the digital currency market and cement its role in the expanding CBDC space.

COTI (COTI) Token and Tokenomics

The native cryptocurrency of the COTI platform is the COTI token, which is used for paying transaction fees and staking. With a total supply of 2 billion COTI and a circulating supply of approximately 1.57 billion COTI, the token plays a crucial role in the platform's ecosystem. The token distribution is divided among private and public token sales (30%), incentives (45%), the COTI team (15%), and advisors (10%).

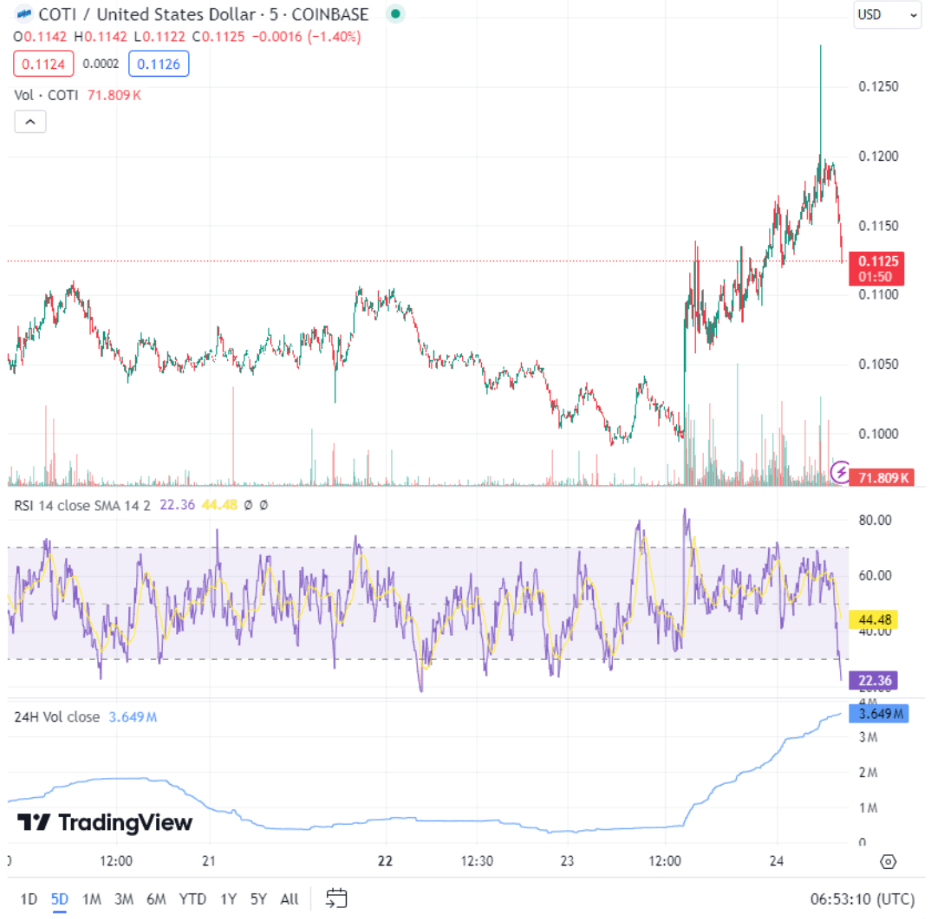

Technical Analysis of COTI

As of the latest technical analysis, COTI/USD presents an uncertain short-term outlook. The basic bullish trend appears to have slowed, with sellers generally having the upper hand. The current price remains above the critical support level of $0.102879 USD, suggesting caution for traders. While a minor correction at this support level is possible, it is not tradeable.

Long positions are favoured as long as the price stays above $0.102879 USD. The next bullish objective for buyers is $0.115027 USD, and breaking this resistance could enhance bullish momentum. Following this, the resistance levels at $0.119197 USD and $0.122952 USD are the subsequent targets. However, if the price falls below the support at $0.102303 USD, a new technical analysis is recommended as conditions will likely have changed, potentially indicating a more bearish short-term trend and a weakened overall bullish trend.

Source: TradingView