Kryptoinvesteringer På En Enkel Måde

Invester i krypto ved at kopiere offentlige forhandleres porteføljer. Administrer din kryptoportefølje med et enkelt klik.

Øjeblikkelig

Indbetal og udbetal på få sekunder med iDEAL, FPS, Kort, Banker eller Krypto.

Robust

Avanceret og adskilt kryptoforvaring for optimal beskyttelse

Hvem er det til

Nem og Sikker Start på Krypto

Køb nemt Bitcoin og andre kryptovalutaer

Intet abonnement - åbn en konto GRATIS

Ingen grund til at beskæftige sig med kompleksiteten af kryptohandel

Kopier porteføljer af Strateger og få gavn af deres færdigheder

Brug vores smarte funktioner til at få mest muligt ud af din investering

Brug 80% mindre tid på porteføljestyring hver uge

Rebalancer automatisk din portefølje på få minutter, ikke timer

Sikre investeringer med stop-loss og profit-taking regler

Få adgang til kontrollerede mønter med den bedste likviditet

Nyd sikkerhed i topklasse med køleopbevaring

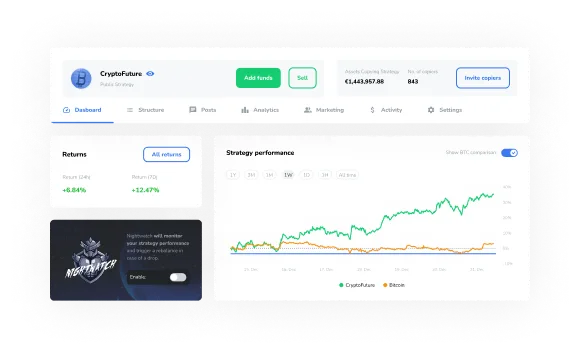

Brug din kryptoviden til din fordel

Adgang til en stor base af potentielle kopierende

Brug automatisering og vores avancerede værktøjer

Indstil dine egne gebyrer

Brug vores marketingfunktioner til at promovere dig selv

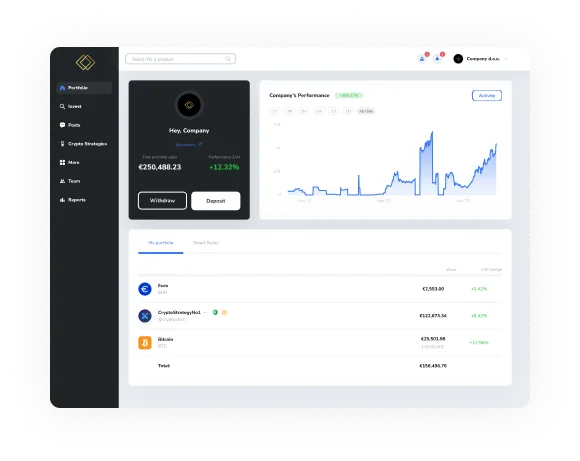

Se vores komplette udvalg af forretningsløsninger

Krypto forretningskonto - manage all your company’s digital assets in one place

Rådgivernes Portal - for financial advisors advising on crypto investments

Wealth Platform - whitelabel turn-key platform for asset managers & brokers

Fokuser din energi på at generere afkast, mens vi tager os af resten.

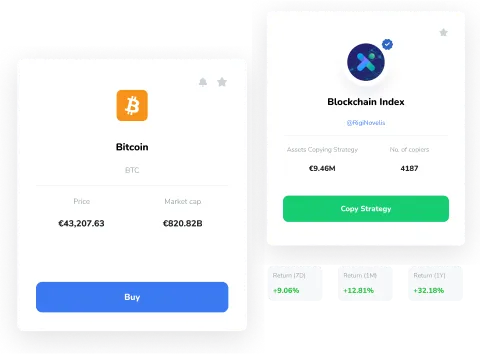

Begynd at Investere ved at Kopiere Strategier

Oplev de bedst præsterende Kryptostrategier fra alle ICONOMI-strateger.

Tidligere resultater er ikke vejledende for fremtidige resultater

Kryptostrategier - som porteføljer, men bedre

Hos ICONOMI forbinder vi vores brugere med Strateger, hvilket giver dig mulighed for at kopiere deres handler, lære af dem og opbygge din investeringssikkerhed

Kryptostrategier er samlinger af kryptoaktiver, der er designet til at give diversificering med blot ét klik. Med vores brugervenlige app til handel med kryptokopier kan Strateger handle med flere kryptovalutaer på én gang og rebalancere aktiverne i hver Strategi uden besværet med at administrere flere børser og sikre optimal Kryptostrategi-ydelse.

Se alle KryptostrategierTidligere resultater er ikke vejledende for fremtidige resultater

Kryptostrategier - som porteføljer, men bedre

Tidligere resultater er ikke vejledende for fremtidige resultater

Hos ICONOMI forbinder vi vores brugere med Strateger, hvilket giver dig mulighed for at kopiere deres handler, lære af dem og opbygge din investeringssikkerhed

Kryptostrategier er samlinger af kryptoaktiver, der er designet til at give diversificering med blot ét klik. Med vores brugervenlige app til handel med kryptokopier kan Strateger handle med flere kryptovalutaer på én gang og rebalancere aktiverne i hver Strategi uden besværet med at administrere flere børser og sikre optimal Kryptostrategi-ydelse.

Se alle KryptostrategierTidligere resultater er ikke vejledende for fremtidige resultater

Køb krypto

Hvis du er på udkig efter langsigtede eller kortsigtede kryptoinvesteringer, er du dækket ind med vores app til kryptoinvesteringer. Opdag den bedste krypto at investere i, tilføj den til din portefølje, eller endnu bedre, sæt din knowhow på prøve og lav din egen Kryptostrategi.

Aktiver opbevares hos ICONOMI, så du behøver ikke at bekymre dig om nøgler, wallets eller andre tekniske detaljer. Med begyndere og tradere i tankerne er ICONOMI den rigtige kryptoinvesterings-app til at købe og sælge kryptovalutaer.

KryptovalutaerKøb krypto

Tidligere resultater er ikke vejledende for fremtidige resultater

Hvis du er på udkig efter langsigtede eller kortsigtede kryptoinvesteringer, er du dækket ind med vores app til kryptoinvesteringer. Opdag den bedste krypto at investere i, tilføj den til din portefølje, eller endnu bedre, sæt din knowhow på prøve og lav din egen Kryptostrategi.

Aktiver opbevares hos ICONOMI, så du behøver ikke at bekymre dig om nøgler, wallets eller andre tekniske detaljer. Med begyndere og tradere i tankerne er ICONOMI den rigtige kryptoinvesterings-app til at købe og sælge kryptovalutaer.

KryptovalutaerLet at bruge platformens funktioner

Dollar-cost averaging

Kopier en valgt Strategi, og invester uden at røre en finger. Perfekt til den gennemsnitlige investeringsstrategi med dollaromkostninger. Indstil tilbagevendende betalinger til ICONOMI, og du vil automatisk investere i en Kryptostrategi efter eget valg.

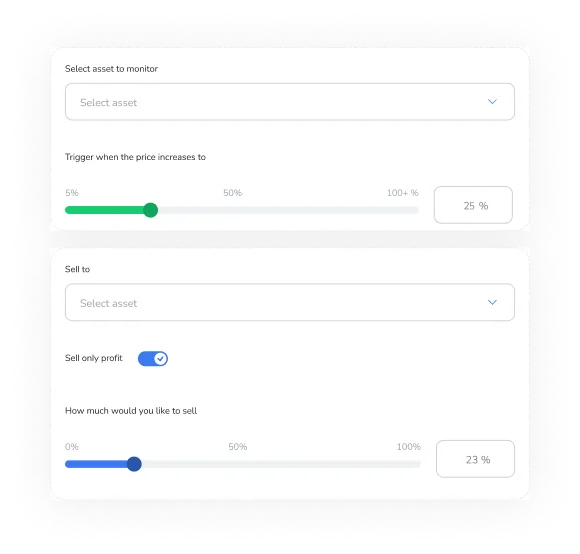

Automatisering

Regler er en fast bestanddel i mange handelsporteføljer. Uanset om det er for at tage overskud, stoppe tab eller bare fange en stor stigning i et aktiv, du kigger på, er regler den bedste måde at holde trit med markedet på, mens du er offline.

Aktivets sundhed

Se, hvordan et aktiv klarer sig på det nuværende marked, før du tilføjer det til din Kryptostrategi. ICONOMI filtrerer også kryptoaktiver og giver dig kun dem med en solid adoption.

Forvaring af aktiver

Vi ville ikke være en god kryptoapp for begyndere uden at lægge stor vægt på sikkerhed og tryghed.

Sikring af aktiver kombineret med beskyttelse af brugerne er vores højeste prioritet. Vi gør en maksimal indsats, når det gælder sikkerhed og gennemsigtighed.

Læs mere om Sikring af dine AktiverIndlæg fra strateger

Læs, hvad vores Strateger siger om markedet og kryptosfæren

Vi tager imod