Crypto Weekly Wrap: 9th August 2024

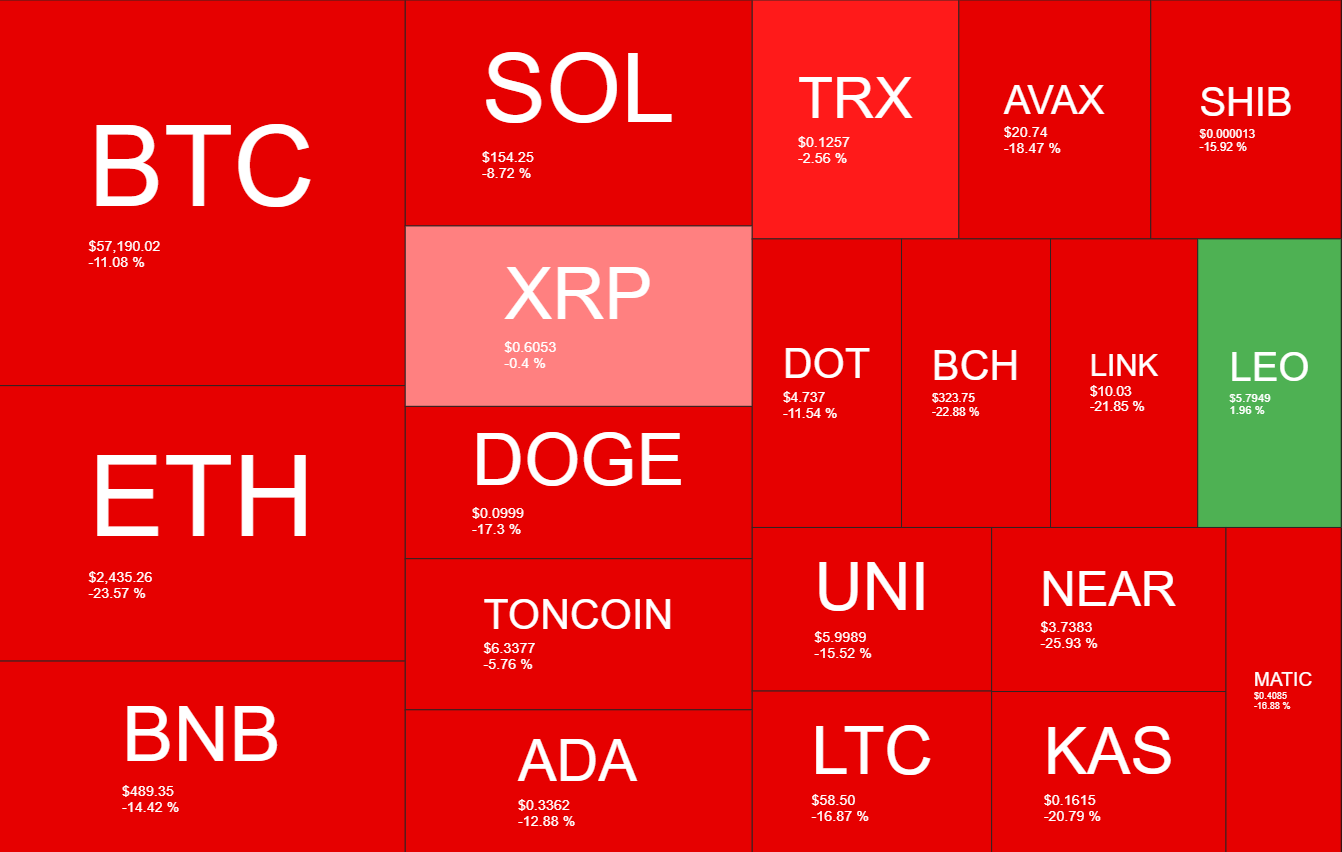

Black Monday Shakes Crypto Stock Exchanges

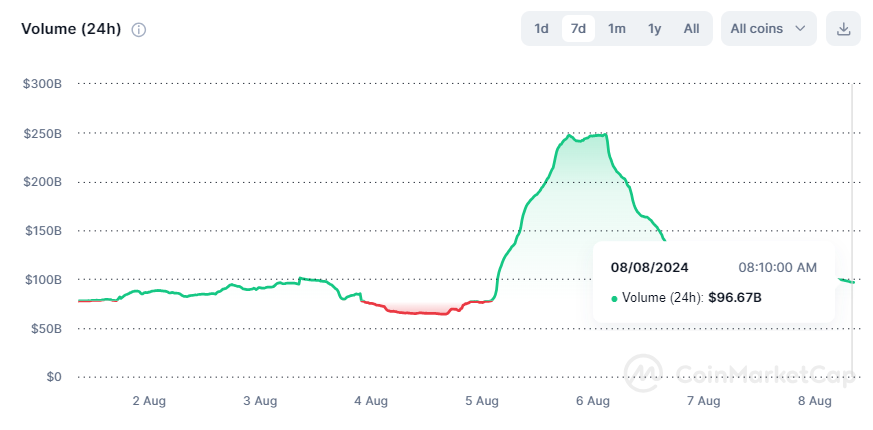

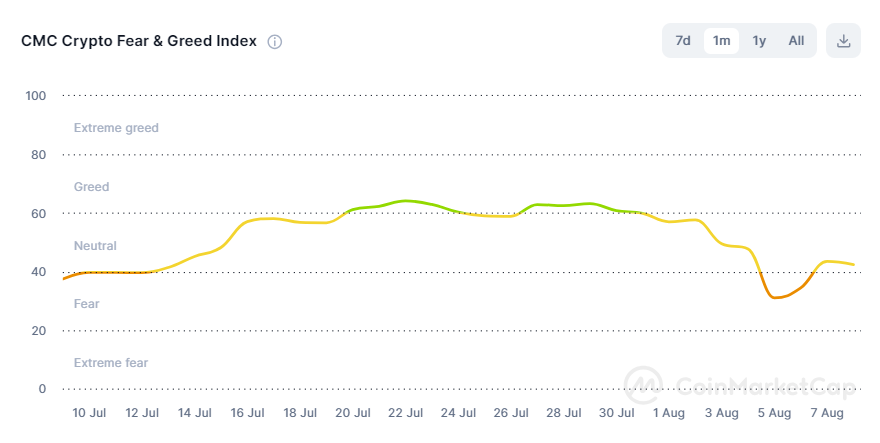

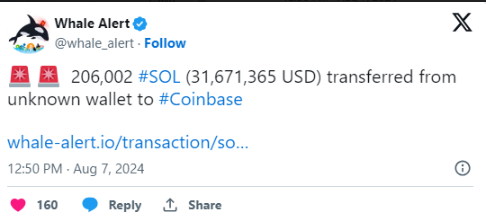

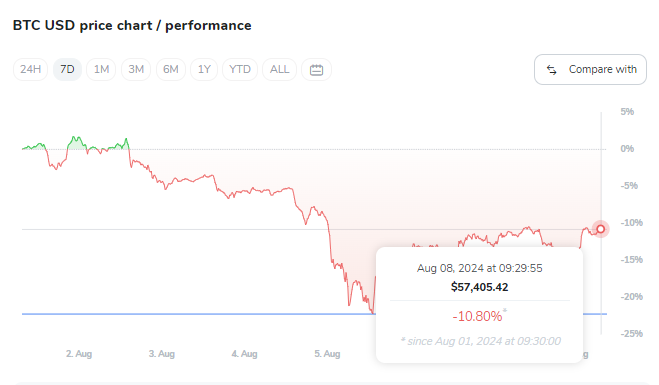

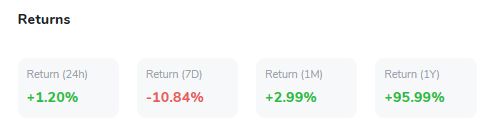

On August 5, 2024, dubbed "Black Monday," global stock exchanges, including crypto stock exchanges, faced a severe downturn, triggering widespread panic and massive sell-offs. This financial turmoil was marked by dramatic declines in major indices, reflecting fears over economic instability and geopolitical tensions. The cryptocurrency market was not spared; leading cryptocurrencies experienced sharp declines, with Bitcoin plummeting to $57,000 from previous highs. The market chaos was exacerbated by significant liquidations and the unwinding of leveraged positions. Crypto exchanges saw a surge in trading volumes as investors rushed to liquidate assets, highlighting the market's vulnerability to broader financial market disruptions.

Cryptocurrency Market Rebound: Solana, Dogecoin, and Toncoin Lead the Surge

The cryptocurrency market saw a significant rebound on Wednesday, with the top ten cryptocurrencies by market capitalization experiencing notable gains. Solana (SOL) spearheaded this surge with a remarkable 10.58% increase, followed by Dogecoin (DOGE) and Toncoin (TON), which saw gains of 5.16% and 5.61% respectively. This recovery follows recent market turmoil.

Mox Bank Introduces Bitcoin ETFs

Hong Kong's virtual bank Mox has launched crypto ETF trading for its customers, becoming the first virtual bank to offer direct trading of spot Bitcoin and Ether ETFs. Mox, a subsidiary of Standard Chartered, charges 0.12% of the transaction volume for Hong Kong-listed ETFs, with a minimum fee of $3.85. For US-listed derivatives ETFs, the fee is 0.01% per share, with a minimum of $5. This initiative aims to attract both novice and experienced investors seeking efficient and economical ways to trade crypto ETFs.

Dogecoin Gains Momentum Amidst Payment Integration Rumors

Over the past 2 days, Dogecoin's price has increased by 2.45%, contributing to overall market growth as meme coins recorded an average gain of 5.30%. Speculation about integrating Dogecoin as a payment method on Elon Musk’s social media platform, X, has sparked renewed interest in the coin. Musk’s vision of transforming X into an “everything app,” with a payment service being a key component, has fueled this anticipation. Despite no direct mention of Dogecoin in the development code, Musk’s ongoing public support for the cryptocurrency has led to speculation about its potential integration. This development has traders hopeful for a new meme coin season, which could rejuvenate Dogecoin and similar tokens.

Bitcoin Technical Analysis and Market Outlook: Post-Crash Recovery and Future Projections

After experiencing a significant downturn that saw Bitcoin break below the critical support level of $50K, the market has shown signs of a potential recovery. This price movement indicates a possible shift towards a bearish market structure, but there are also indications of a rebound and consolidation phase.

Technical Analysis

A detailed examination of Bitcoin’s daily chart reveals that the sharp decline was driven by widespread fears of economic turmoil. Since the crash on Black Monday, increased selling pressure led to Bitcoin's price plummeting, breaking below the 200-day moving average at $61.1K and the crucial $53K level. This breakout below $53K is a strong bearish signal, suggesting a shift in market structure towards bearishness and triggering a long-squeeze event.

Sell-side liquidity, previously resting below $53K, was activated, leading to a significant drop in price. However, with the perpetual markets cooling down and deleveraging, a mid-term consolidation phase is now more likely. In the coming days, Bitcoin's price is expected to fluctuate between $50K and $60K, indicating a sideways movement until a significant market shift occurs.

Bitcoin's recent price decline has been influenced by selling activity in perpetual markets and a long-squeeze event. Recently, funding rates have dropped sharply, indicating that the decline was driven by aggressive short selling and the liquidation of many long positions. With funding rates turning negative, this reflects an overall bearish sentiment and the dominance of short sellers. However, this could also be seen as a positive sign, suggesting that the futures market is no longer overheated and could create conditions for a more sustainable bullish trend in the coming months, provided there are no drastic changes.

Market Outlook

Despite the recent downturn, there is significant dip-buying activity, particularly among retail investors and institutions. On August 8, Binance experienced a net inflow of $2.4 billion, primarily in stablecoins, indicating that retail investors are buying the dip. Trading volumes on major exchanges like Binance and Coinbase spiked significantly following the crash, indicating heightened market activity and interest in accumulating Bitcoin at lower prices.

Since the market bottomed on August 5, the total cryptocurrency market capitalization has recovered around 13%, reaching $2.1 trillion. This recovery suggests a renewed confidence among investors, with institutions also participating in dip buying. Bitcoin's recent price movements indicate a complex interplay of bearish signals and potential recovery phases. The market is currently in a consolidation phase, with prices expected to fluctuate between $50K and $62K in the short term. On-chain metrics suggest that the futures market sentiment is bearish but stabilising, which could pave the way for a more sustainable bullish trend. Dip-buying activity among retail and institutional investors further supports the possibility of a market recovery in the coming months.

In conclusion, the cryptocurrency market is witnessing significant developments, with institutional investors capitalising on lower prices, new financial products being introduced, and continued interest in specific cryptocurrencies like Dogecoin and Bitcoin. The market remains dynamic and volatile, with potential for both short-term corrections and long-term gains as key indicators and institutional activities shape its future trajectory.