September in Review: Key Developments in the Crypto Market

Key News for the Crypto Market in September

One of the most significant developments in the crypto market during September was the Federal Reserve's decision to implement a 50 basis point interest rate cut, the largest since the COVID-19 pandemic. This move provided fresh liquidity to the markets and bolstered investor confidence in risk assets like Bitcoin and Ethereum.

Additionally, BlackRock’s Bitcoin ETF saw a record daily inflow of $184 million, signalling growing institutional interest in cryptocurrency as a legitimate asset class. These developments contributed to Bitcoin’s best September performance since 2013, with the cryptocurrency ending the month up 7%, positioning it for a potentially strong Q4. This, combined with ongoing market anticipation for further rate cuts and macroeconomic factors, has set a positive tone for the crypto market moving forward.

Bitcoin Resilience and Altcoin Struggles in September: Setting the Stage for "Uptober"

Despite a slight dip at the end of September, Bitcoin (BTC) posted a strong 7% monthly gain, marking its best September performance since 2013. Historically, September has been a challenging month for Bitcoin, but this year’s results defied expectations. BTC dropped 3.7% in the last 24 hours of the month, nearing the $63,000 level.

This positive performance sets the stage for a potentially strong October, historically known as "Uptober," a period when Bitcoin often delivers impressive returns. While Bitcoin and Ethereum held up relatively well, major altcoins like XRP, Cardano (ADA), Polkadot (DOT), and Chainlink (LINK) faced declines of over 5%, reflecting broader market volatility. Despite this, Bitcoin's resilience continues to attract investor confidence, especially as regulatory clarity improves and institutional interest, exemplified by BlackRock’s Bitcoin ETF inflows, strengthens, suggesting further price appreciation in the coming months.

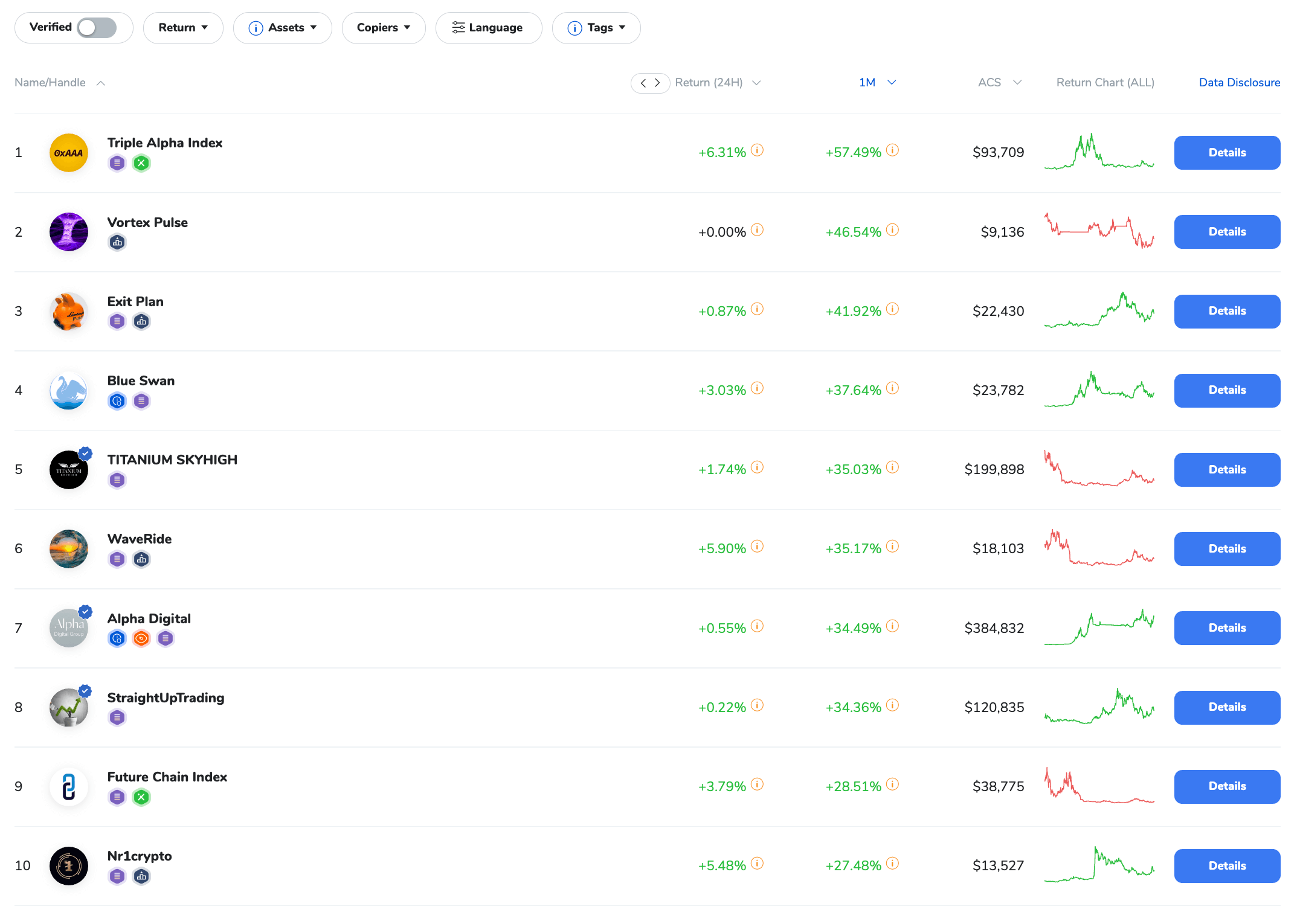

Monthly Heatmaps

Source: Quantifycrypto

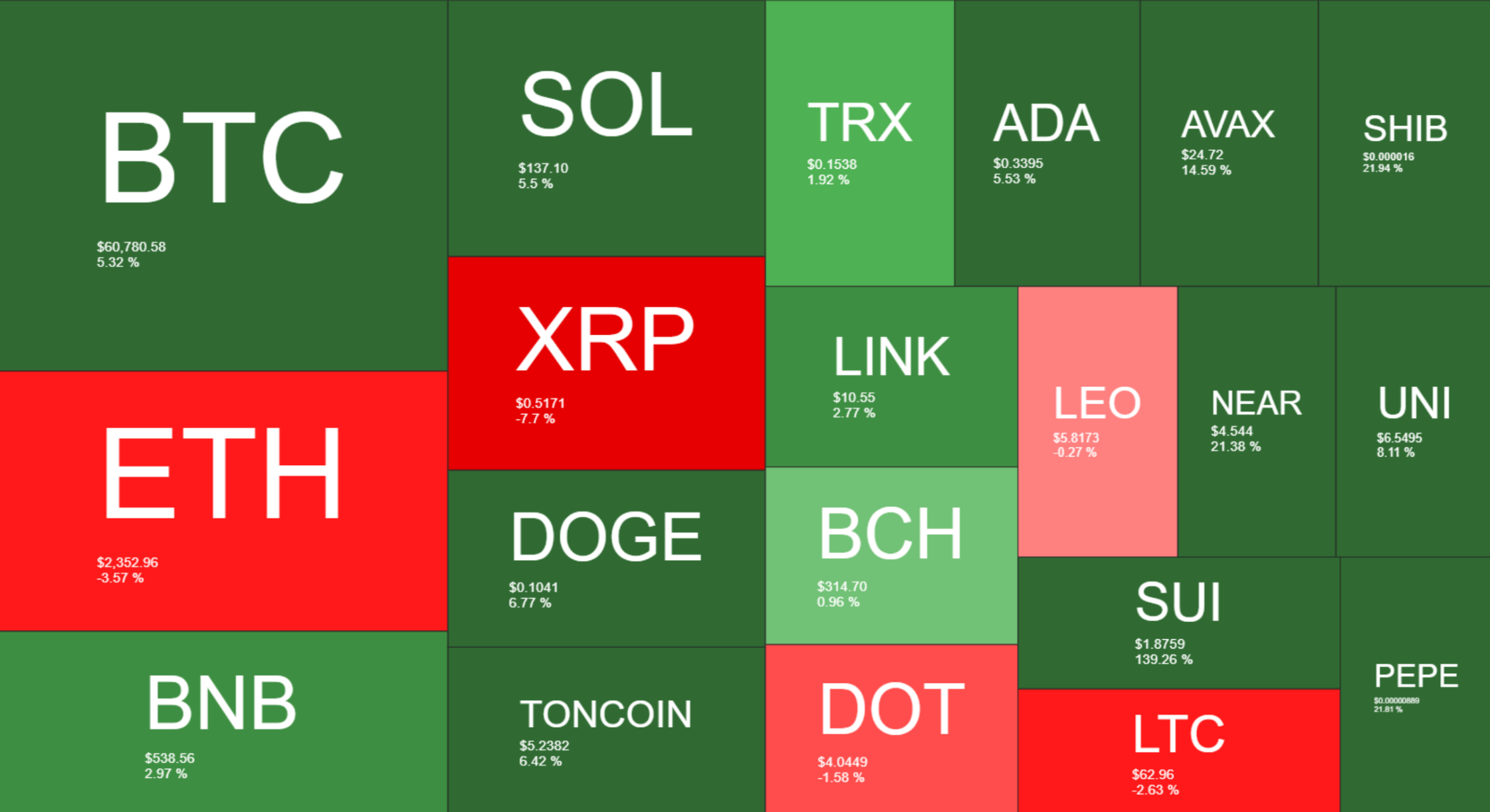

Ethereum’s Steady Performance and Dominance in DeFi

Ethereum (ETH) has also fared well, with a smaller decline of 2.8% in late September. Ethereum’s continued dominance in the decentralised finance (DeFi) ecosystem and its role as the leading platform for smart contracts give it a unique position in the market. Despite the dip, Ethereum remains the foundation for many emerging blockchain applications, including non-fungible tokens (NFTs) and DeFi projects. Ethereum’s upcoming technical upgrades, including the continued evolution of Ethereum 2.0, are expected to bolster its performance in the long term. Furthermore, with stablecoins heavily utilising Ethereum’s network, the blockchain continues to be a crucial part of the digital economy.

Source: DefiLlama

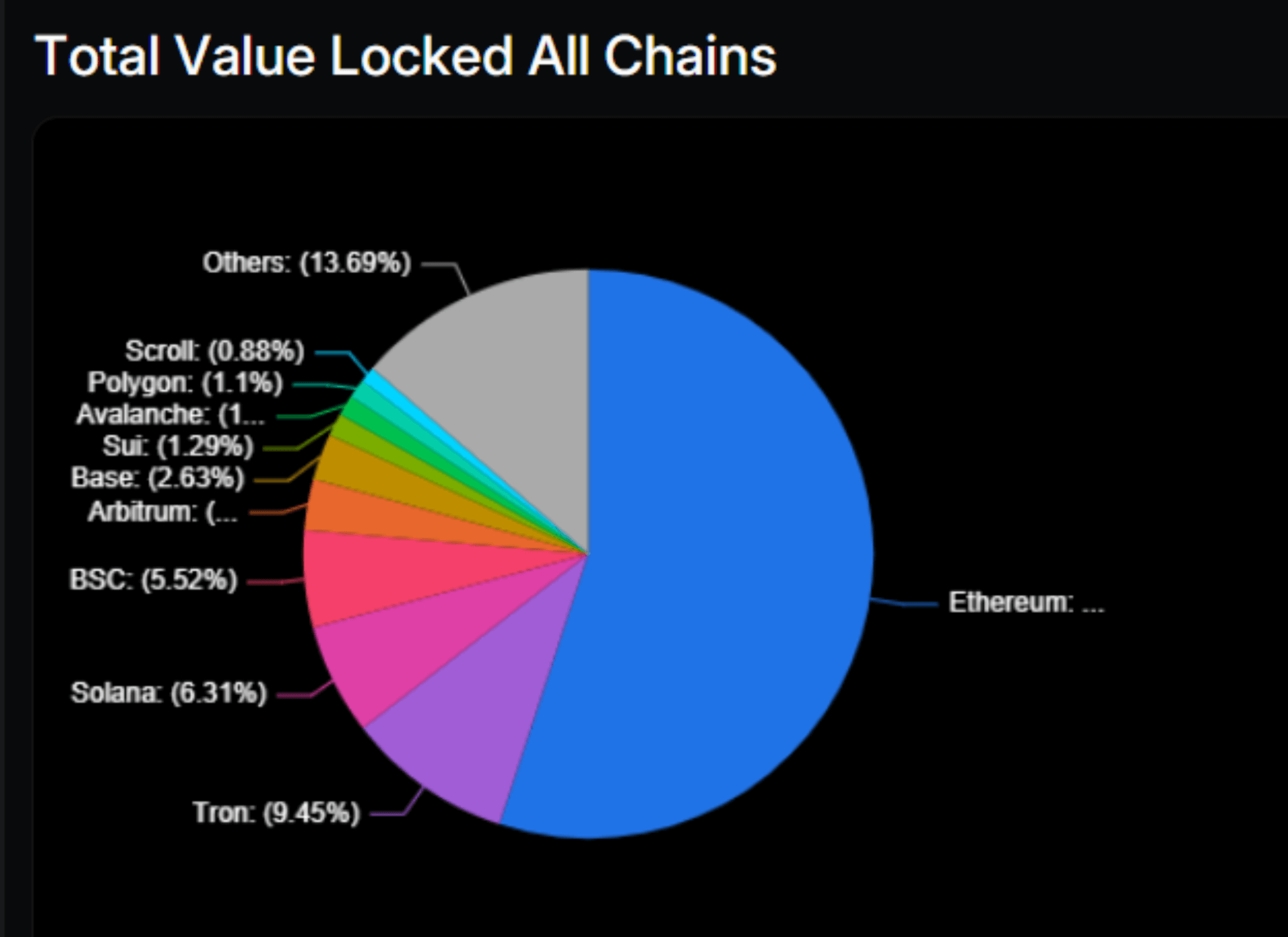

Bitcoin’s Technical Analysis: Consolidation Before a Potential Breakout

From a technical analysis perspective, Bitcoin is currently consolidating below the $62,245 resistance level at 60,800. The cryptocurrency is trading above its 50-day exponential moving average (EMA), which suggests a bullish momentum. However, Bitcoin’s price failed to break through key resistance levels during its most recent rally, signalling potential short-term consolidation.

The Relative Strength Index (RSI) is hovering around 47, indicating neutral momentum. If Bitcoin successfully breaks past the $62,245 resistance, it could test the next major level at $63,020, which would open the door for further gains. On the downside, if Bitcoin fails to maintain support around $59,227, it may face a deeper correction, potentially falling back toward $58,494.

Source: TradingView

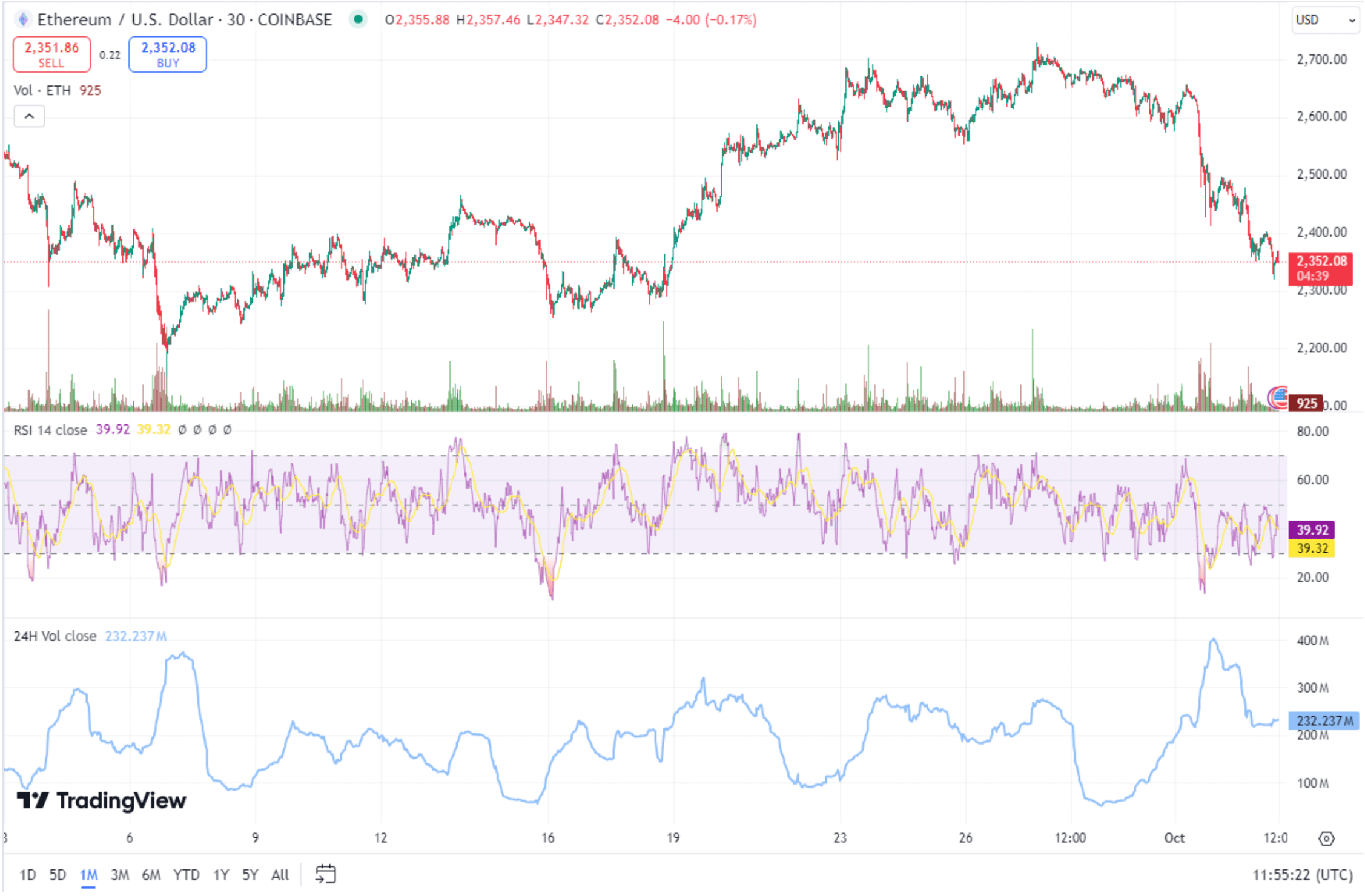

Ethereum’s Technical Analysis: Holding Strong Amid Volatility

Ethereum’s technical indicators point to ongoing strength, with the cryptocurrency holding above key support levels. ETH has been trading close to its 200-day moving average, which is providing solid support. The Relative Strength Index (RSI) for Ethereum is currently in the mid-range, suggesting that there is still room for upward momentum.

However, the price of ETH may face resistance near $2,530, with traders watching for a potential breakout above this level. If Ethereum can push past this resistance, it could aim for the $2,700 mark in the near term. On the downside, failure to hold above its current support levels could result in a pullback to around $2,000, but the overall trend remains bullish given Ethereum’s role in DeFi and ongoing upgrades.

Source: TradingView

Looking Ahead: Potential Catalysts for Bitcoin and Ethereum

Looking ahead, several key macroeconomic and market developments could impact Bitcoin and Ethereum’s performance in the final quarter of 2024. The U.S. Federal Reserve’s recent rate cut, the largest since the COVID-19 pandemic, has injected fresh liquidity into the market, which may benefit risk assets like cryptocurrencies. Additionally, the upcoming U.S. elections in November are expected to bring increased market volatility, which could serve as a catalyst for further price movements in both Bitcoin and Ethereum. We believe that while short-term corrections are possible, the overall market sentiment remains positive, with many traders positioning for a post-election rally.

Source: Coinmarketcap

Source: Coinmarketcap

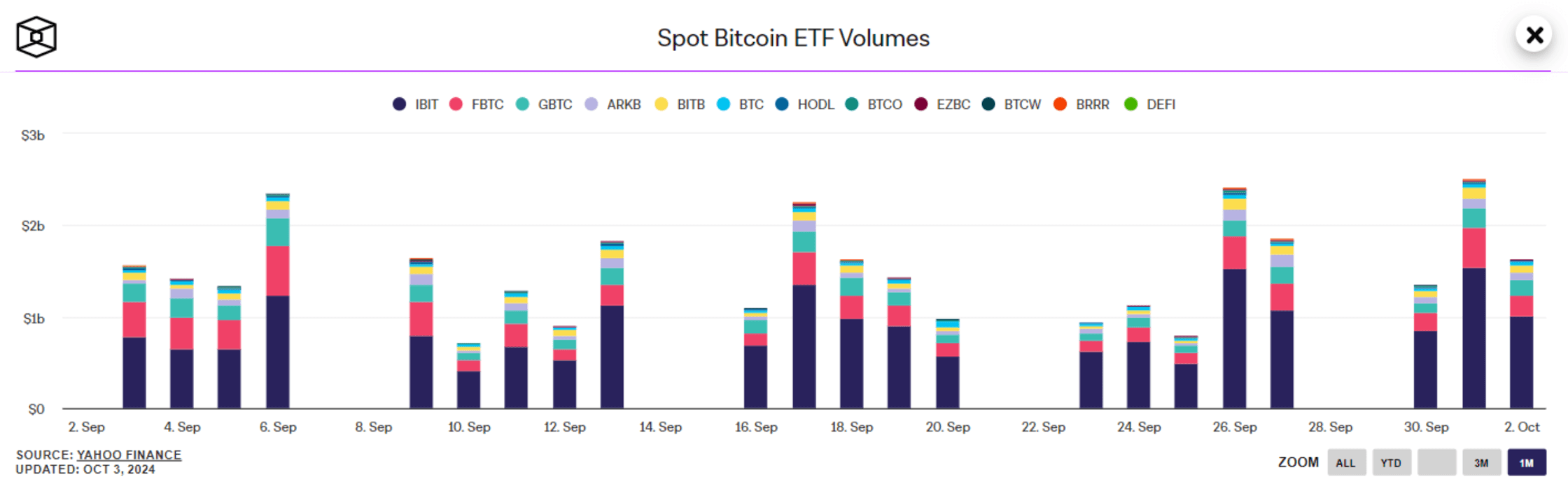

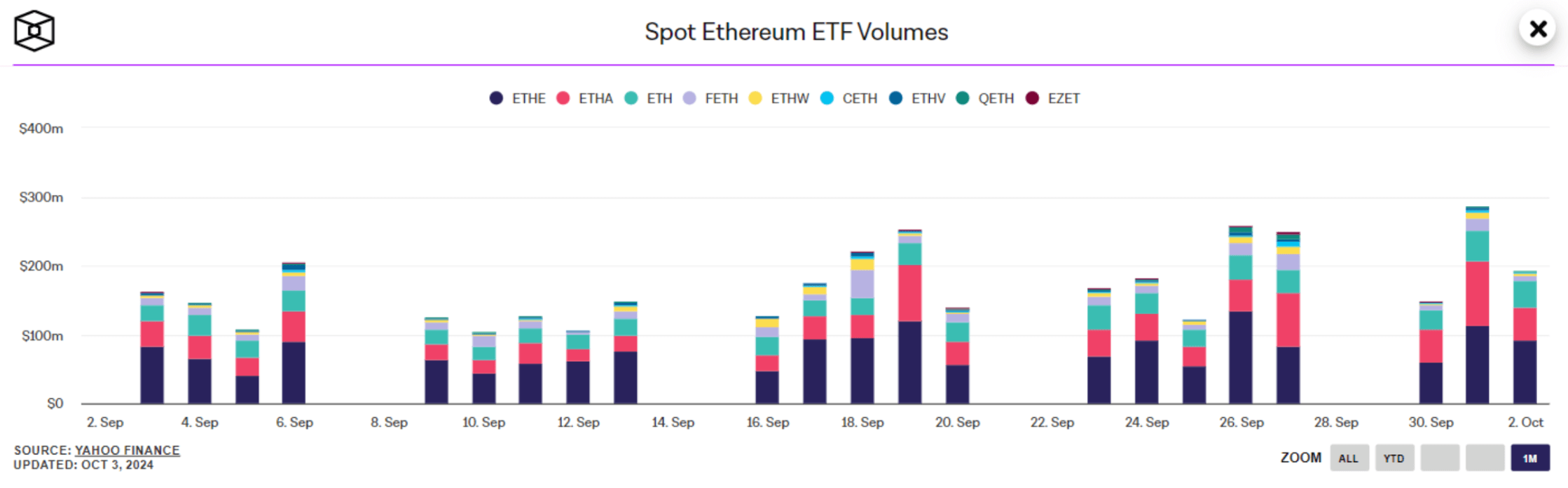

Bitcoin and Ethereum ETFs in September

September saw notable activity in Bitcoin and Ethereum exchange-traded funds (ETFs), reflecting increased institutional interest in these major cryptocurrencies. BlackRock’s iShares Bitcoin Trust (IBIT) led the month with an impressive daily inflow of $184 million on September 25, marking the largest inflow for any crypto ETF that month.

This surge in investment was part of a broader trend, as Bitcoin ETFs saw a cumulative inflow of nearly $500 million over a five-day period following the Federal Reserve’s decision to cut interest rates. Meanwhile, Ethereum-based ETFs experienced mixed performance, with some funds, such as the Grayscale Ethereum Trust (ETHE), witnessing outflows. However, the overall interest in crypto ETFs, particularly for Bitcoin, highlighted growing confidence in digital assets, positioning ETFs as key vehicles for broader market adoption.

Source: TheBlock

Source: TheBlock

September Developments on U.S. Elections and Crypto Regulation

In September, the U.S. political landscape and crypto regulation became increasingly intertwined as presidential candidates began outlining their positions on the future of digital assets. Vice President Kamala Harris, the Democratic presidential candidate, expressed her support for blockchain innovation and promised to promote emerging technologies like cryptocurrency, while focusing on consumer protection. Meanwhile, former President Donald Trump, a Republican contender, criticised the current regulatory environment, pledging to halt what he described as the "unlawful" crackdown on crypto if re-elected.

The regulatory landscape also saw intense scrutiny, particularly with SEC Chair Gary Gensler facing mounting criticism over his handling of crypto regulations, as Congress members called for clearer rules to foster innovation without stifling the industry. These political developments underscored the growing importance of crypto policy in the upcoming 2024 U.S. elections.

A Strong End to 2024 for Bitcoin and Ethereum?

As we enter the final months of 2024, both Bitcoin and Ethereum appear well-positioned for potential gains. Bitcoin’s strong September performance, coupled with its historical tendency to rally in Q4, suggests that the cryptocurrency could be on the verge of a breakout. Ethereum’s dominance in the DeFi space and its ongoing technical upgrades also provide a solid foundation for further growth. While there are potential risks, including regulatory uncertainty and market volatility, the outlook for both Bitcoin and Ethereum remains positive as investors continue to view them as key assets in the evolving digital economy.

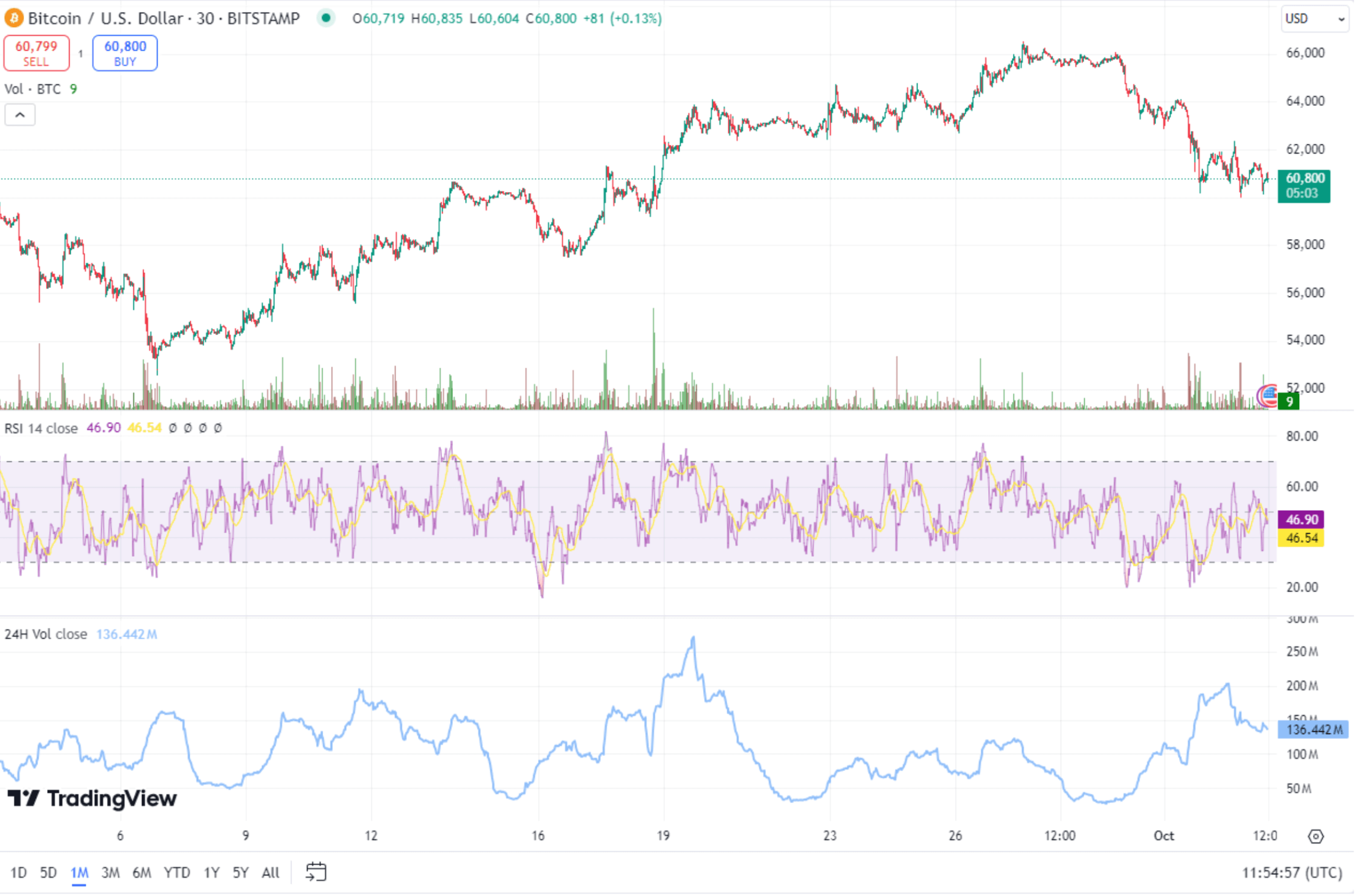

ICONOMI Strategies by 1M Return