Radiant Capital: An Overview of the DeFi Platform

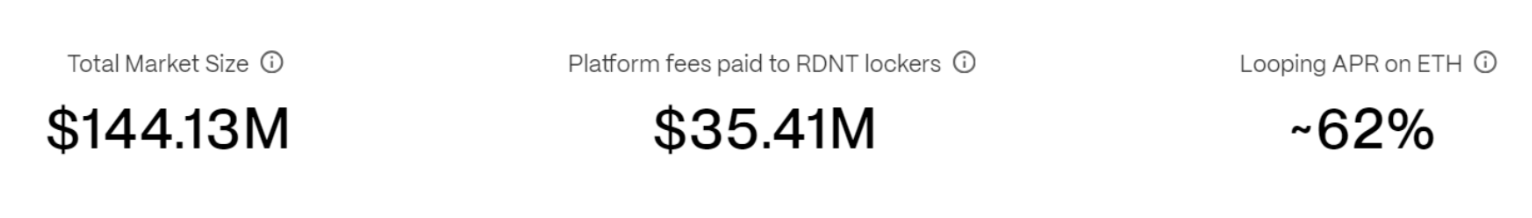

Radiant Capital is a decentralised finance (DeFi) protocol designed to enhance cross-chain liquidity and enable seamless asset borrowing and lending across multiple blockchain networks. As a unique omnichain money market, Radiant consolidates liquidity from various Web3 markets into one efficient platform. This approach allows users to earn interest and access flash loan fees by locking $RDNT tokens in dedicated RDNT lockers, while simultaneously supporting the borrowing and lending of these emissions. The platform accepts a range of top-tier assets, such as BTC, ETH, BNB, and stablecoins, making it accessible and efficient for diverse users. Security and community governance are fundamental aspects of Radiant Capital, reinforced through audits by top security firms like Zokyo, PeckShield, and Blocksec. The protocol uses LayerZero's cross-chain technology and Stargate Finance's stable router interface, which allows users to reclaim their collateral from any supported chain, further enhancing its flexibility and usability.

Source: radiant.capital

Source: radiant.capital

Key Features and Recent Developments

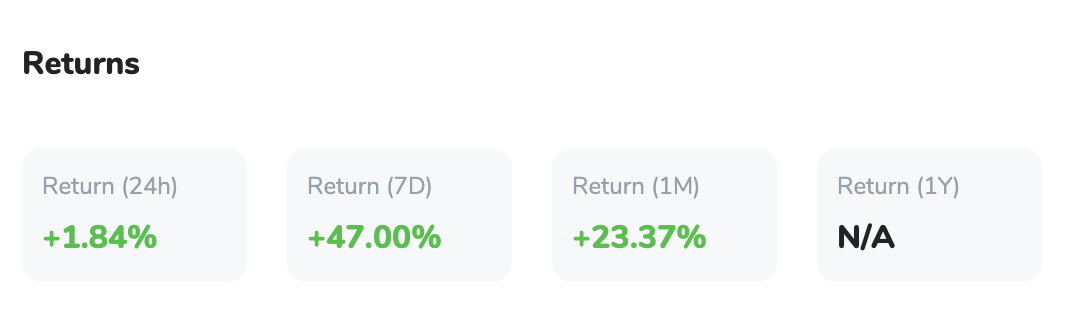

Radiant Capital recently transitioned from its V1 to V2 platform, upgrading its native token from the ERC-20 format to the LayerZero Omnichain Fungible Token (OFT). This significant update improves cross-chain functionality, fee sharing, and protocol utility. Moreover, the platform introduced a new liquidity proposal, RFP-44, to optimise RDNT token distribution and increase user engagement. The proposal shifts the airdrop allocation strategy from qLP to qRDNT, which represents the total locked RDNT across a user's portfolio. This adjustment aims to incentivize token holders to lock their assets, promoting greater liquidity and stability within the ecosystem. The proposal has already gained overwhelming community support, with the voting period running from August 31 to September 5, 2024. As a result, the RDNT token experienced a 20% price increase, reflecting investor optimism about these changes.

Source: X

Technical Analysis

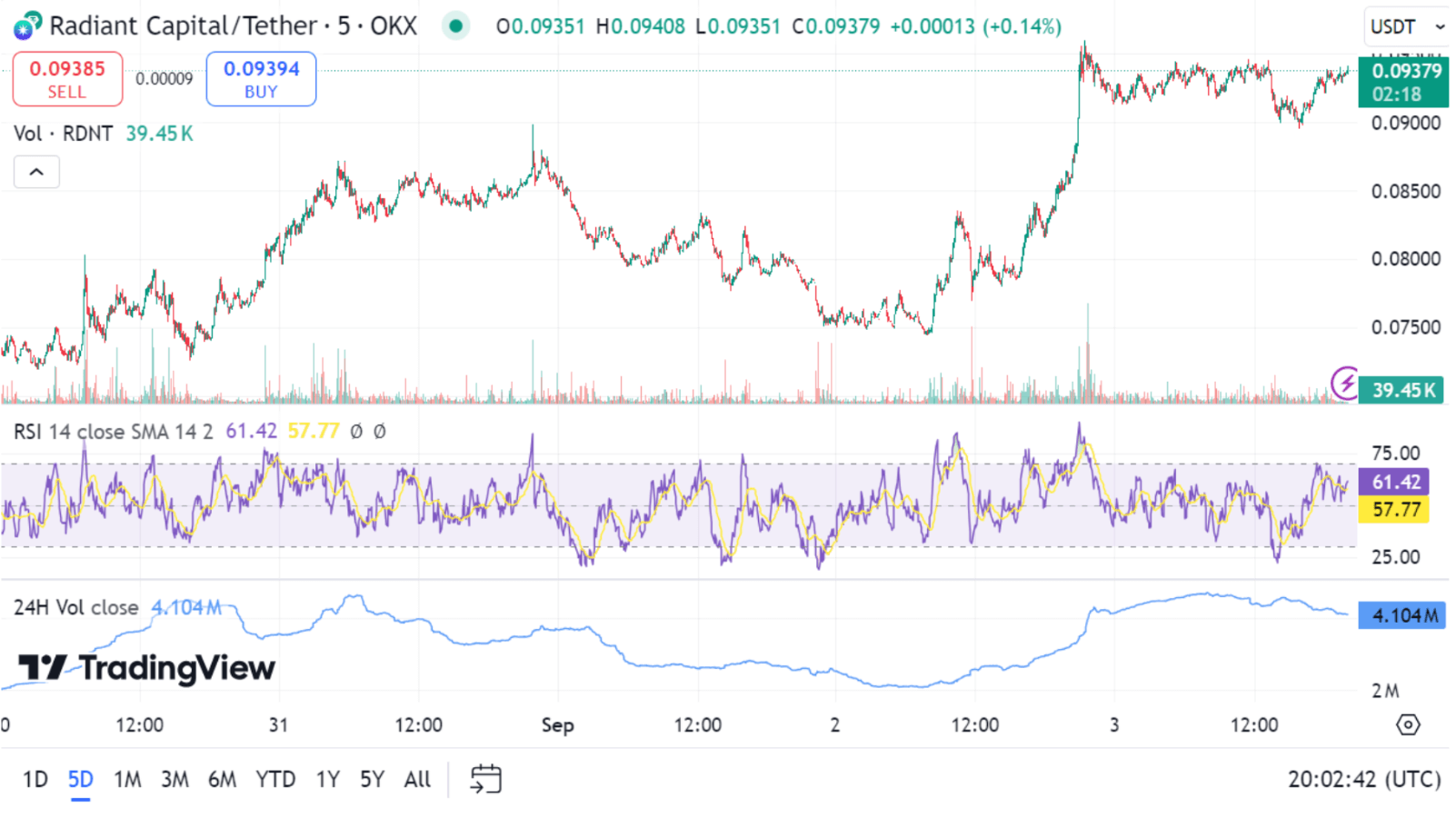

Radiant Capital's RDNT token has shown positive price momentum recently, reflecting strong potential for future growth. After the introduction of the new liquidity proposal, the RDNT token price rose from $0.078 to $0.095, representing a 20% increase. Although the price has since stabilised around $0.093, the token remains in an upward trend. In the past week, RDNT gained 28.67%, while over the last day, it increased by 9.32%. This growth indicates that the token is becoming a more attractive asset, particularly as the platform continues to innovate and enhance its ecosystem.

From a technical analysis perspective, RDNT is currently facing resistance around the $0.096 and $0.11 levels, which could act as psychological barriers for further upward movement. If the price manages to break through these resistance levels, it could pave the way for additional gains. On the downside, key support levels are identified at $0.084 and $0.079. These levels are crucial, as they provide a safety net for the price, preventing it from dropping further in a bearish scenario.

Source: TradingView

Basic technical indicators such as the Relative Strength Index (RSI) suggest that RDNT is neither overbought nor oversold, with the RSI hovering around 60. This neutral position indicates that there is room for either upward or downward movement depending on market sentiment and external factors. Additionally, moving averages, such as the 50-day and 200-day MA, will be important to watch; if RDNT's price stays above these averages, it would signal continued bullish momentum.

Integration with Chainlink for Enhanced Security

Radiant Capital has integrated Chainlink Price Feeds on the Base mainnet to further strengthen its security and stability. Chainlink’s decentralised Oracle network provides accurate and tamper-proof price data, which is critical in the DeFi industry to mitigate risks such as data manipulation and flash loan attacks. The integration includes a range of price feeds like ETH/USD, RDNT/USD, USDC/USD, and more. By leveraging Chainlink's reliable price data, Radiant Capital ensures its markets remain safe even during volatile market conditions or technical challenges. This move aligns with the platform's goal of creating a secure and efficient environment for its users.

Addressing Cross-Chain Liquidity Challenges

Radiant Capital aims to tackle the issue of cross-chain liquidity by providing a more efficient way to manage assets across multiple blockchains. The integration with Chainlink helps achieve this by using a decentralised Oracle network to obtain accurate pricing from multiple sources. Chainlink’s price feeds offer volume-weighted averages from various trading venues, reducing the impact of extreme values and preventing manipulation by any single exchange. This decentralised approach ensures that Radiant Capital can provide reliable and consistent liquidity solutions across its supported chains.

Conclusion: A Growing DeFi Player with Strong Fundamentals

Radiant Capital is rapidly emerging as a formidable player in the DeFi sector, with a robust platform that integrates cross-chain functionality, security, and community-driven governance. The platform’s recent upgrades, partnerships, and token optimizations have been met with enthusiasm from the community and investors alike, reflected in the significant price appreciation of its native token, RDNT. As the platform continues to evolve and expand its offerings, Radiant Capital is poised to maintain its momentum and potentially offer significant opportunities for both users and investors in the future.