Crypto Market Update: June 2024 Highlights

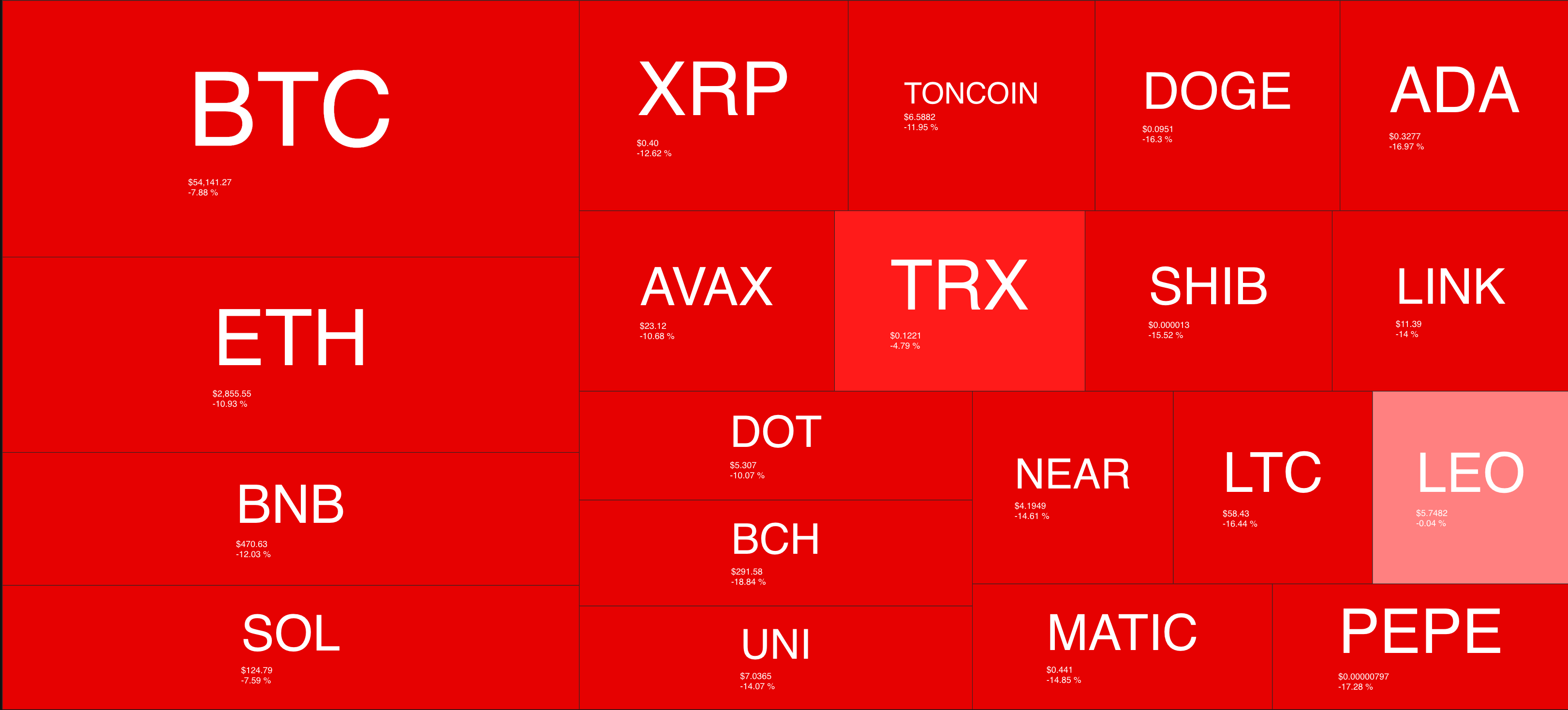

Bitcoin Erases Gains from Late June

June ended on a turbulent note for the cryptocurrency market, with Bitcoin (BTC) losing its gains from the last week of the month. By Friday morning, BTC had dropped below $55,000, trading at $54,211. The largest cryptocurrency by market capitalization saw a nearly 4% decline, attributed to German government transfers and increased selling activity by Bitcoin miners. The German government moved another 832.7 BTC, while on-chain data indicated heightened miner sales at the start of the week. This added to the market's bearish sentiment, causing BTC to drop by 23% over the course of the month.

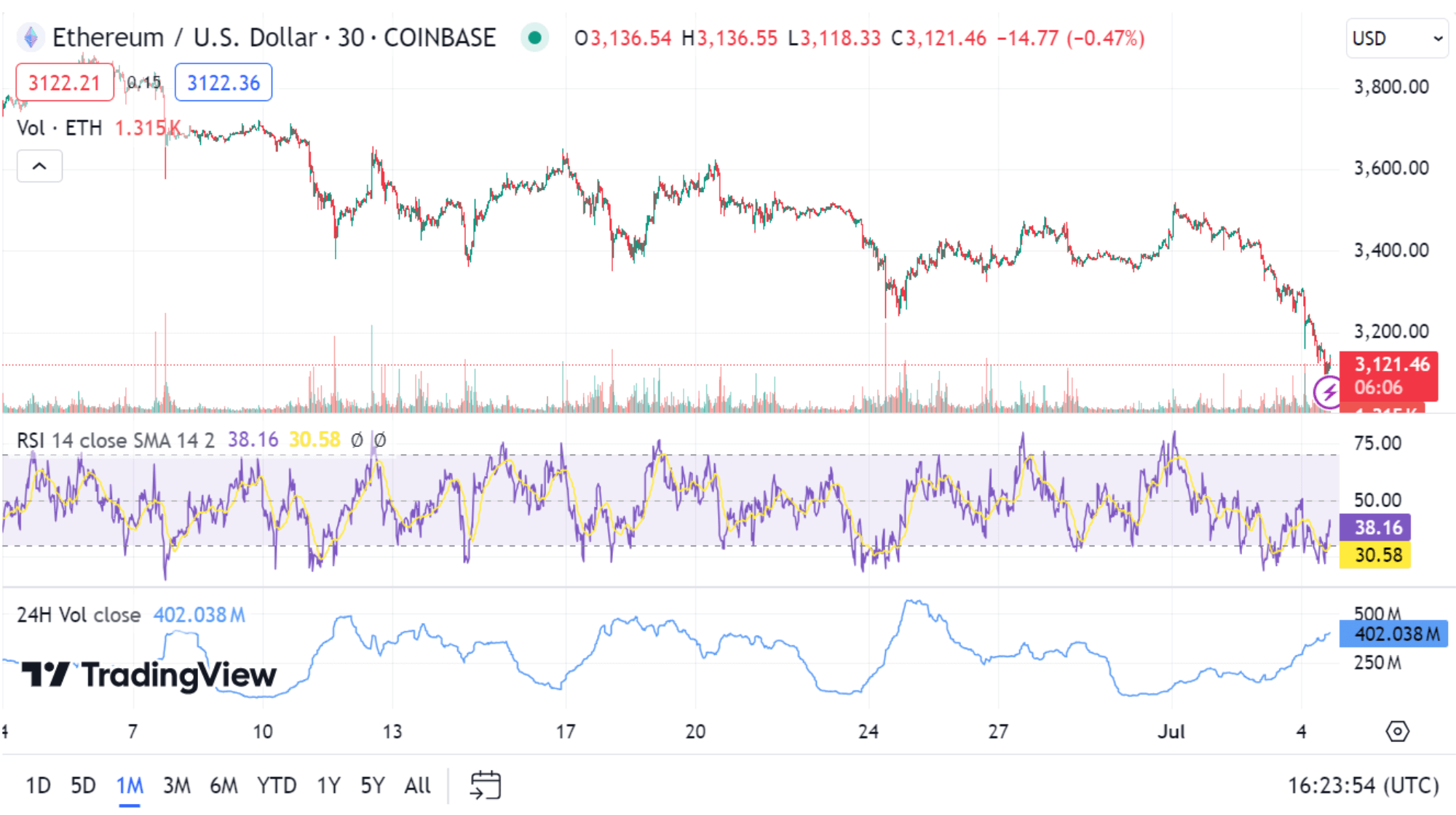

Ethereum and Altcoins Face Downward Pressure

Ethereum (ETH) also faced significant declines, trading at $2,897.97, down almost 10% on the day. Despite positive sentiment around the anticipated approval of a Spot Ether ETF by the US Securities and Exchange Commission (SEC), Ethereum couldn't break through key resistance levels. Ripple (XRP), followed suit and fell to trade at $0.4071, falling below its crucial $0.48 support level, dropping by 11.31% over the past 24 hours.

Lido Dao (LDO), the Ethereum staking token, experienced a downturn, projected to extend losses by nearly 6% to a Fair Value Gap (FVG) between $1.667 and $1.849. However, a potential rally towards $2.309 could result in over 30% gains if LDO sweeps liquidity in the FVG.

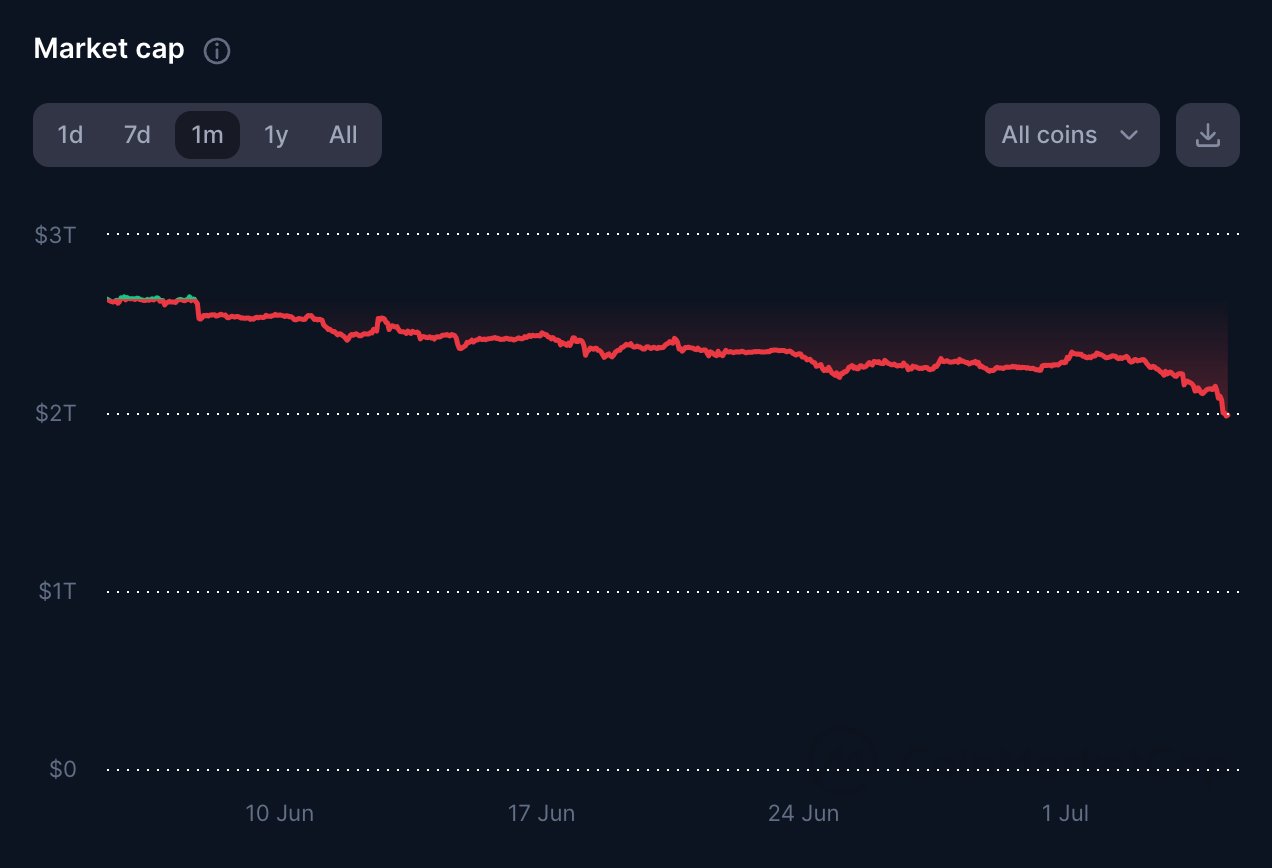

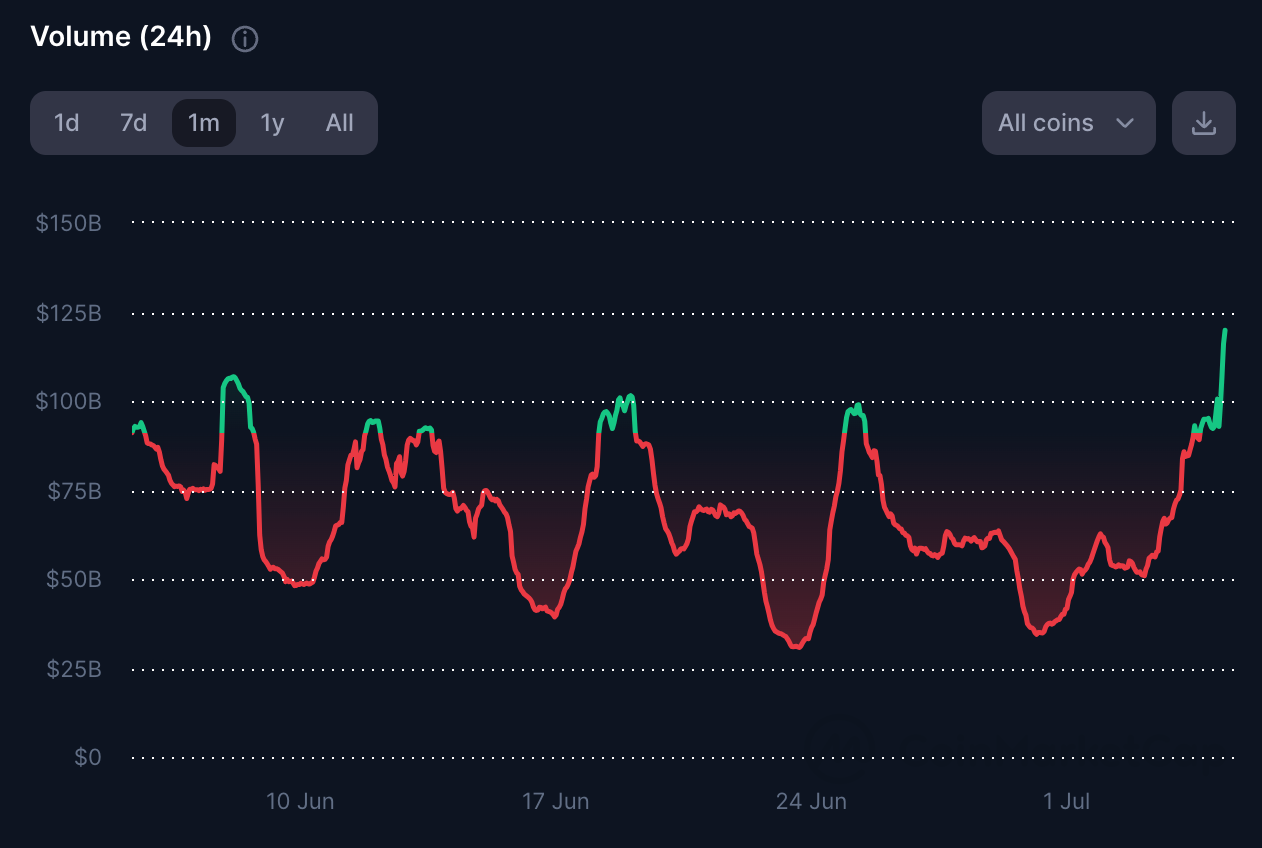

Market and Industry Updates

The crypto market saw varied performance in June, with Ethereum, Bitcoin, and the Tron network collecting the highest volume of fees. Ethereum led with $2.728 billion, followed by Bitcoin with $1.302 billion, and the Tron network with $459.39 million. Analysts suggested that the upcoming Ethereum spot ETF could strengthen ETH, though a price drop post-launch remains a risk. Vitalik Buterin, Ethereum co-founder, highlighted prediction markets and community notes as key technologies of the year.

In industry news, Polkadot faced criticism, addressed by Fabian Gompf, CEO of the Web3 Foundation, who clarified that project expenses are community-voted on-chain funds. Bittensor blockchain halted operations due to an exploit, while Chainlink announced a partnership with Fidelity International and Sygnum to provide on-chain data for a $6.9 billion money market fund.

Source: Quantifycrypto

Source: coinmarketcap

Source: coinmarketcap

Source: coinmarketcap

Bitcoin ETFs and Price Analysis

Bitcoin ETFs saw record inflows, suggesting potential price boosts in the coming weeks. BTC has been trading between $59,000 and $74,000 since April, impacted by sales pressure, ETF outflows, and negative retail sentiment. Despite a dip below $55,000 recently, some analysts remain bullish, predicting a rebound due to seasonal trends and potential ETF approvals.

Some analysts still predict BTC reaching $100,000 by year-end, driven by spot ETF demand, halving events, and anticipated Federal Reserve interest-rate cuts. This optimism persists despite concerns over large BTC sales from the Mt. Gox exchange, which is set to distribute assets from a 2014 hack later this month.

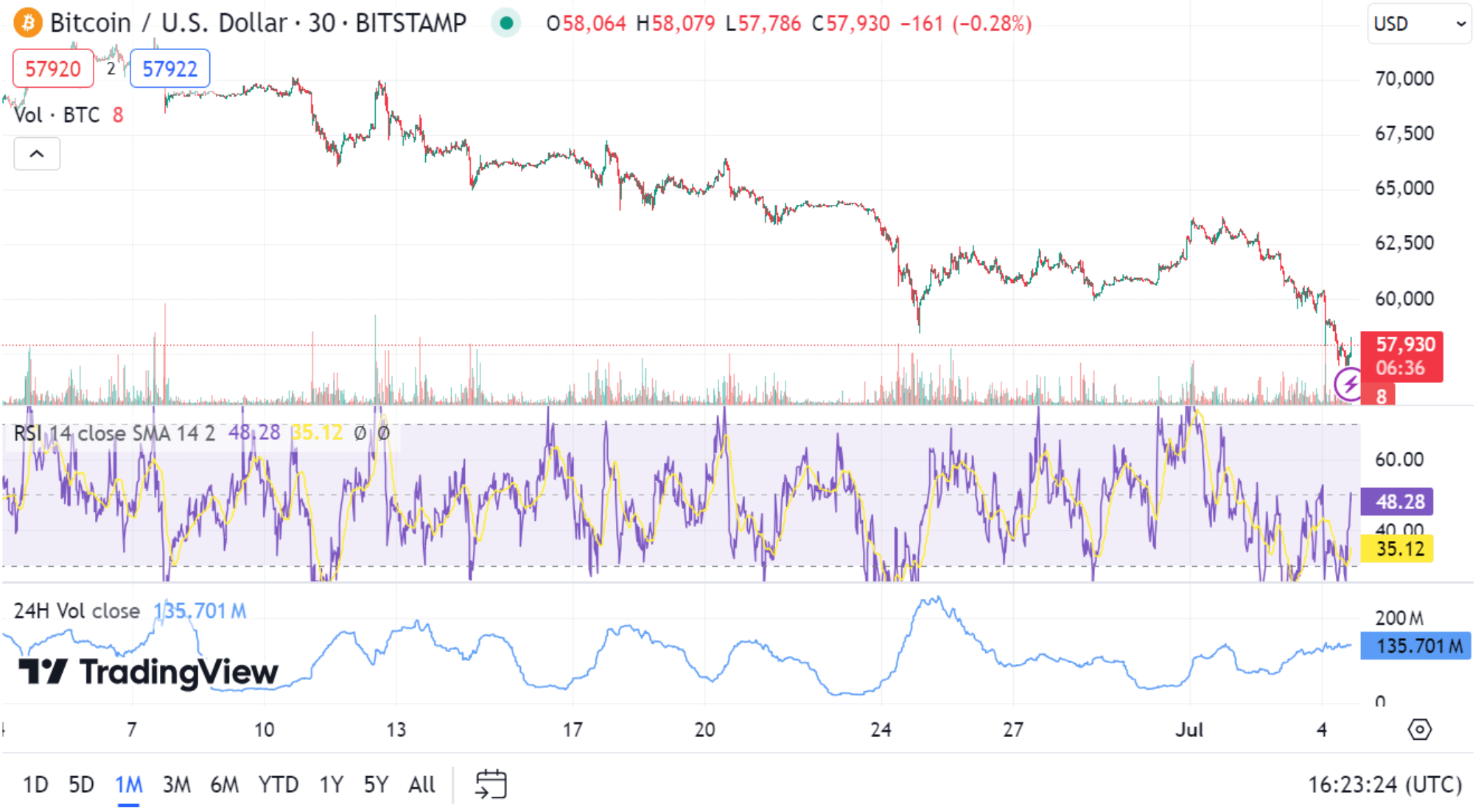

Technical Analysis and Bitcoin’s Trajectory

Bitcoin's recent price dip to $54,000 reflects ongoing market volatility. Trading at $54,211, BTC showed an 11.7% decrease. Key technical levels indicate a pivot point at $58,000, with immediate resistance at $59,030 and further barriers at $61,880 and $63,735. Support levels are identified at $56,695, $55,900, and $53,070.

The Relative Strength Index (RSI) at 35 suggests nearing oversold conditions, while the 50-day Exponential Moving Average (EMA) at $61,060 indicates potential resistance. The Bitcoin network shows signs of miner capitulation, a historical indicator of market bottoms. Miners face financial strain due to lower BTC prices, reduced block rewards, and falling transaction fees, leading to increased Bitcoin outflows and a declining hash rate.

Reports highlight a 7.7% drop in hash rate, the most significant since December 2022. Miner reserves are at their lowest since February 2010, with accelerated daily outflows suggesting ongoing selling pressure. This capitulation phase may reduce market selling pressure, potentially setting the stage for a price recovery. Historical patterns suggest that Bitcoin could see new all-time highs, with analysts predicting an extended cycle into 2025.

Conclusion

The cryptocurrency market in June 2024 was marked by volatility and significant developments. Bitcoin and Ethereum faced downward pressure despite optimistic long-term predictions. Industry updates showed continued growth and institutional interest, with new partnerships and technological advancements. As the market navigates these changes, close attention to economic indicators and regulatory developments will be crucial for investors.