August in Review: Key Developments in the Crypto Market

Bitcoin ETFs experienced net outflows

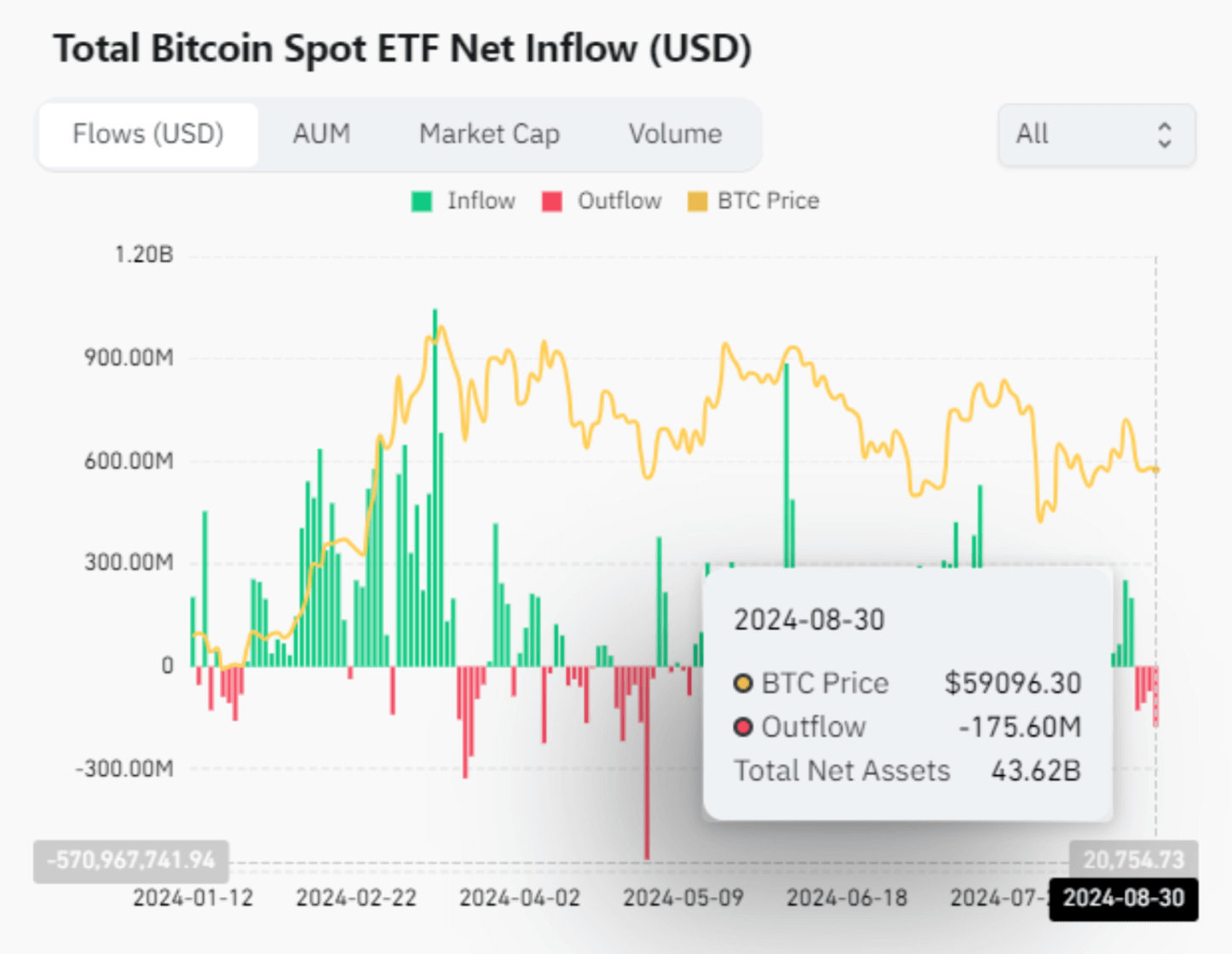

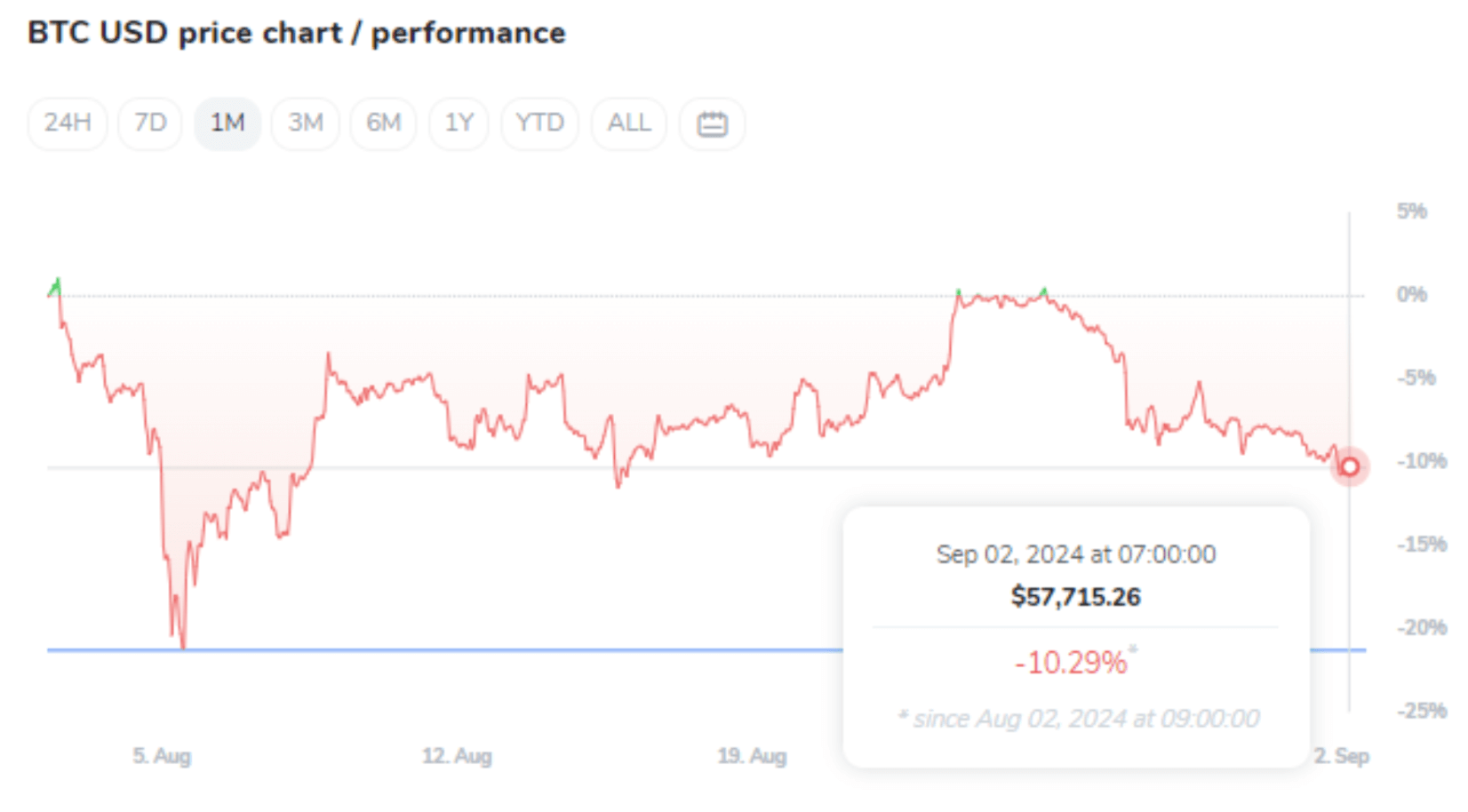

August was a turbulent month for the cryptocurrency market, marked by significant outflows, market downturns, and regulatory developments. Notably, U.S. spot Bitcoin exchange-traded funds (ETFs) experienced net outflows of approximately $94 million, reversing an earlier streak of positive inflows. Despite an encouraging performance on August 23, when inflows reached over $250 million, these gains were overshadowed by a sharp $237 million outflow earlier in the month. This trend was mirrored by a decline in Bitcoin’s price, which led to a reduction in assets held by Bitcoin funds by $4.24 billion, bringing the total to around $53.8 billion by the end of August. Ethereum-based ETFs also faced challenges, struggling with outflows since their launch in July and failing to attract substantial interest from institutional investors.

Source: Coinglass

Ethereum ETFs and Market Dynamics

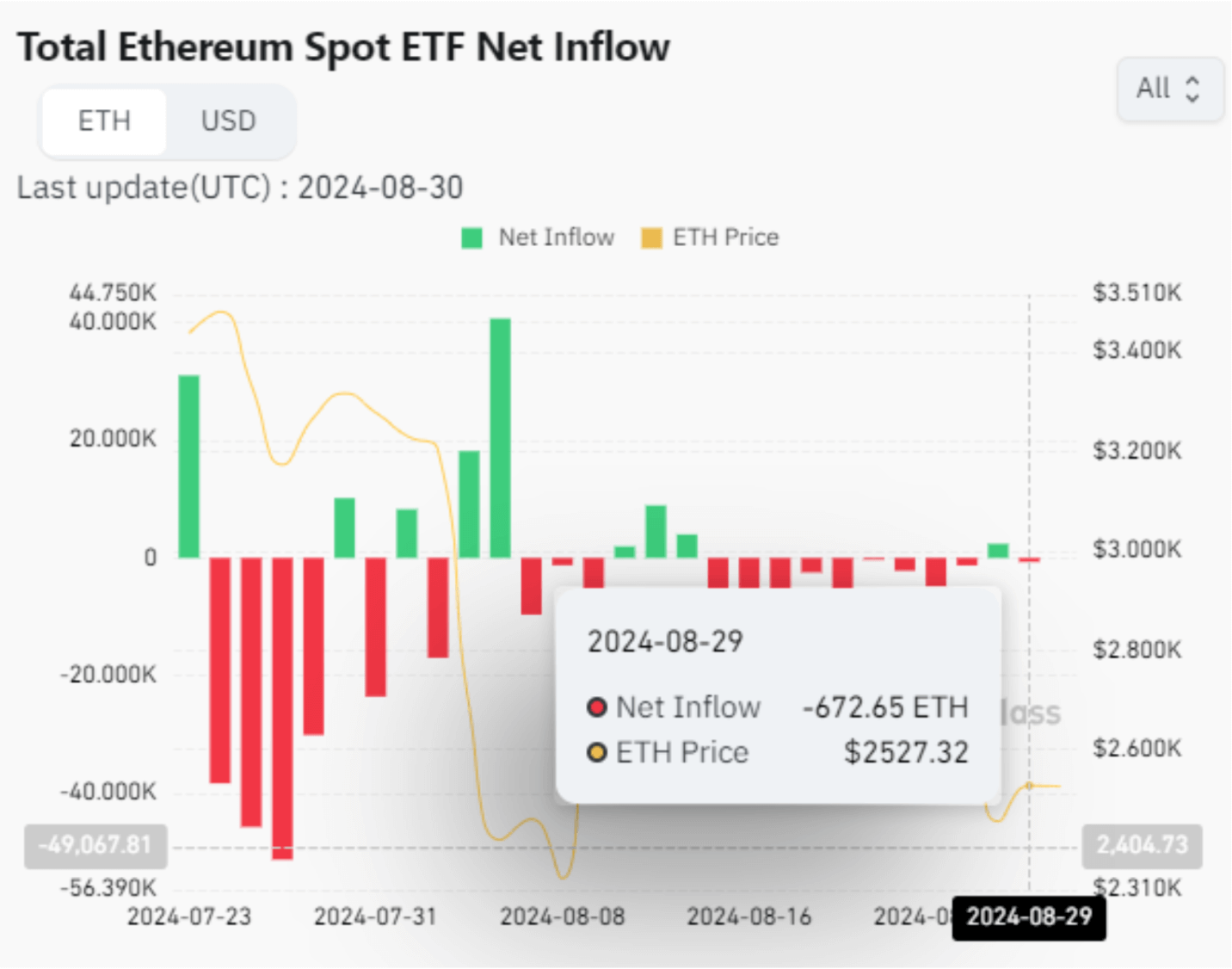

Ethereum spot ETFs, which began trading in the U.S. on July 23, continued to struggle throughout August, contrasting sharply with the performance of Bitcoin ETFs. Over the first five weeks of trading, Ether ETFs recorded net outflows of around $500 million, compared to the $5 billion inflows seen by Bitcoin ETFs during a similar period after their respective launches. JPMorgan attributed this disparity to Bitcoin's “first mover advantage,” the absence of staking options, and lower liquidity in the Ethereum market, which made Ether ETFs less appealing to institutional investors. As of the end of August, spot Ether ETFs held nearly $7 billion in assets, with Grayscale’s ETHE and ETH funds accounting for $5.4 billion of that total. While Ethereum ETFs logged over $1 billion in trading volume in their initial days, they have since seen a steady decline in activity.

Source: Coinglass

Crypto Security Under Siege: $300 Million Lost in August

August saw a staggering $300.6 million lost to hacks, scams, and other exploits, marking the second-highest monthly loss of 2024. According to Certik Alerts, the majority of these losses stemmed from vulnerabilities in decentralised finance (DeFi) protocols, with roughly $308.8 million attributed to various exploits. Notably, advanced attacks like flash loan exploits—where attackers manipulate markets by quickly borrowing and repaying assets—resulted in losses of around $1.2 million. Additionally, pump-and-dump schemes accounted for $0.8 million in losses. High-profile incidents included the Ronin Network hack, which led to losses of over $9.8 million, and the Nexera exploit, which cost traders $1.5 million. These events underscore the ongoing risks within the crypto ecosystem and highlight the need for stronger security measures to protect investor funds.

Stablecoins Gain Ground Amid Market Volatility

Amid a challenging month for cryptocurrencies, stablecoins emerged as a bright spot, continuing their upward trend in market capitalization. In August, the total market cap for stablecoins increased by 2.89%, reaching $169 billion, marking the eleventh consecutive monthly rise and the highest level since April 2022. Tether (USDT) achieved a new all-time high market cap of $117 billion, commanding 69.6% of the total stablecoin market share. Meanwhile, PayPal’s USD stablecoin also reached a new milestone, growing by 56.6% to a market cap of $960 million. However, despite these gains, stablecoin trading volumes fell by 14.2% to $848 billion, reflecting broader market volatility and concerns over traditional markets, such as fluctuations in the Japanese Yen trade.

Source: Coinmarketcap

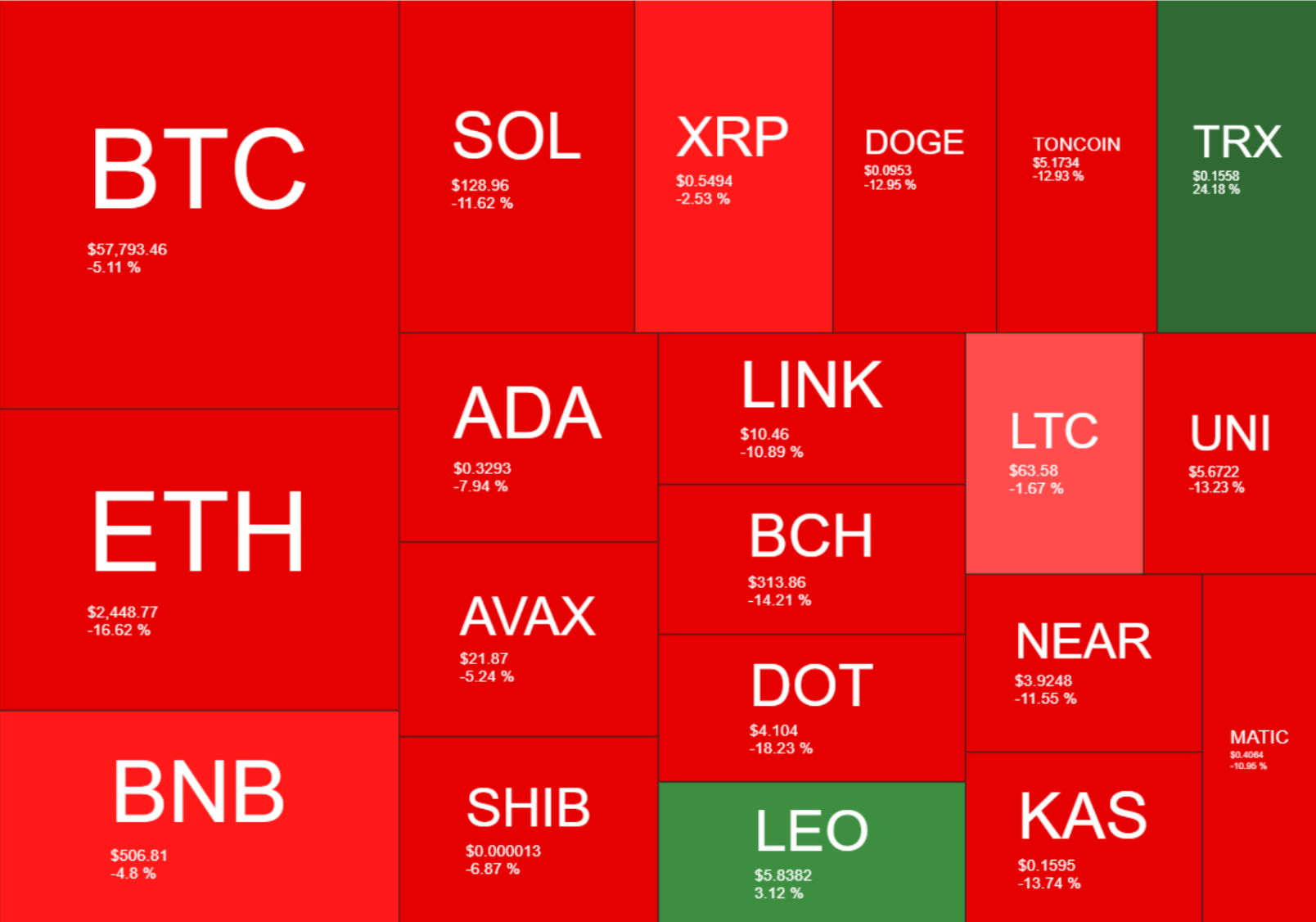

Monthly Heatmaps

Source: Quantifycrypto

Source: Coinmarketcap

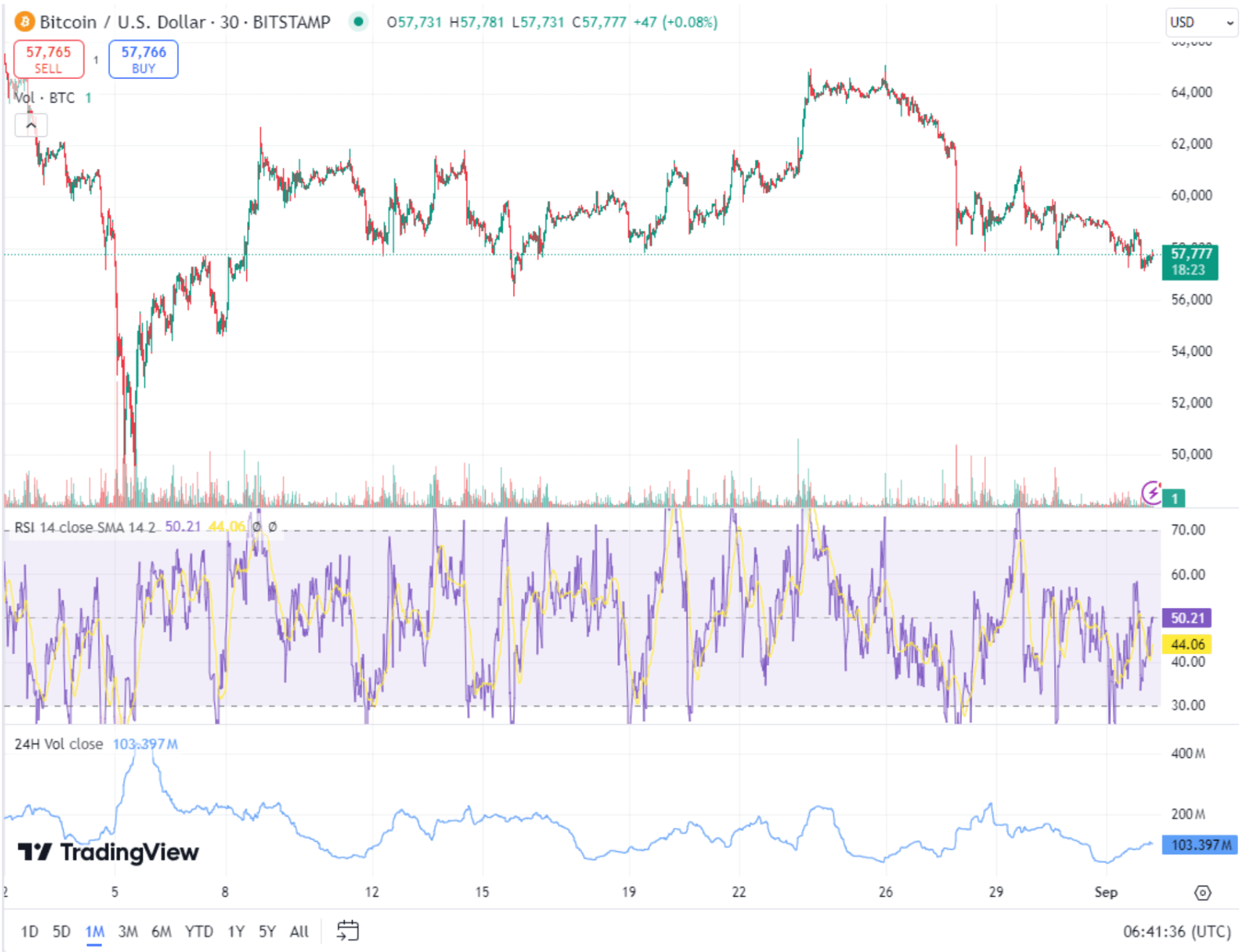

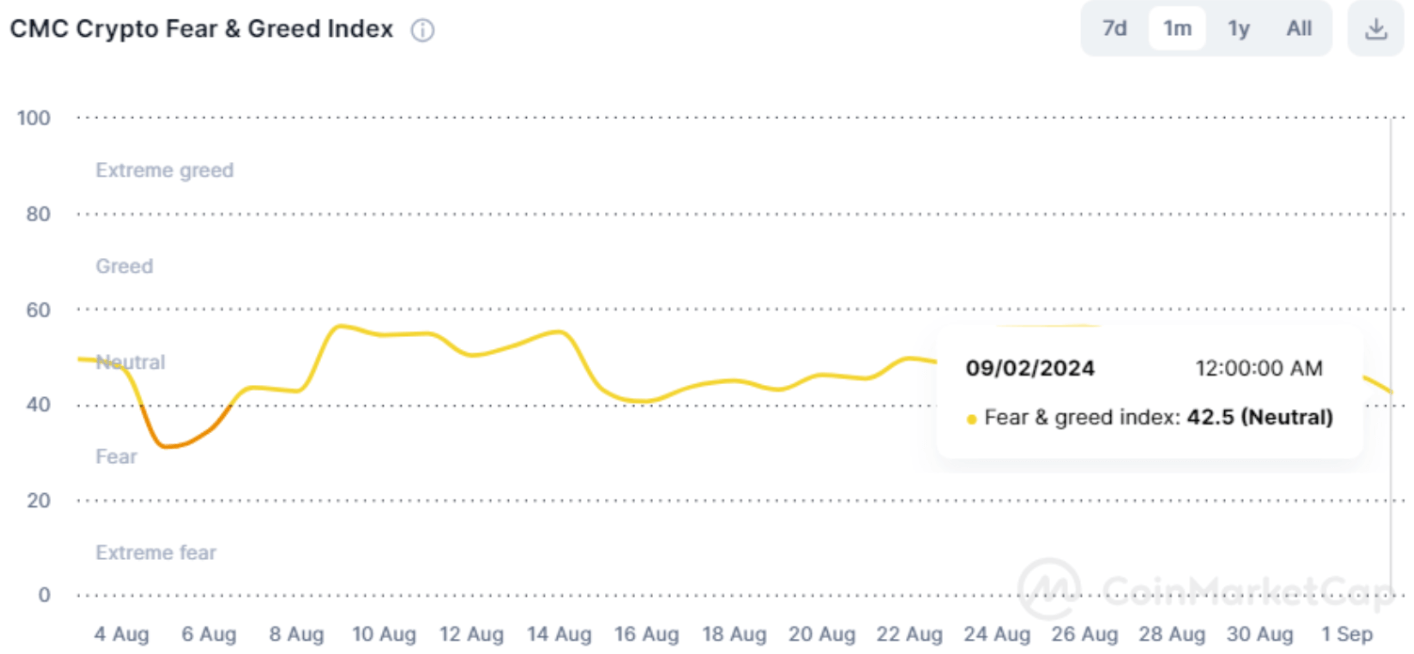

Bitcoin Technical Analysis: Signs of a Bottom?

Bitcoin's price action in August showed mixed signals but hinted at a potential bottom, mirroring patterns from previous cycles. Bitcoin's hash price—the revenue miners earn per terahash per second—reached conspicuously low levels, resembling conditions seen before the 2021 bull run. Historically, such periods have coincided with Bitcoin price bottoms, as witnessed during the COVID-19 market crash in 2020. The platform noted that miner behaviour is changing, with reserves recovering to levels not seen since June and accumulation picking up since August 24th.

This development suggests that miners are preparing for a potential price stabilisation or recovery. Additionally, the U.S. mining sector appears sustainable, with hash rates near all-time highs and the cost of mining in the U.S. at approximately $43,000 per Bitcoin. This data supports the notion that Bitcoin prices might stabilise if they remain above this threshold, aligning with historical trends of price recovery following periods of miner capitulation.

Source: TradingView

Market Structure and Moving Averages: Analysing Bitcoin's market structure, we can observe that it is currently trading within a consolidation range. The 200-day moving average (MA), a critical long-term trend indicator, is often considered a dividing line between bull and bear markets. Bitcoin has managed to hold above this MA for most of August, indicating potential bullish momentum building beneath the surface. If Bitcoin continues to trade above this level, it could act as a support, giving traders confidence to enter long positions, further bolstering the price.

Volume Analysis and Key Resistance Levels: Another important aspect to monitor is the trading volume. Over the past weeks, Bitcoin has seen declining volume during its price drops, suggesting that the selling pressure might be weakening. In contrast, periods of price increases have been accompanied by higher volume, indicating stronger buying interest. The next key resistance levels to watch are around $60,000 and $62,000, where significant past trading activity has occurred. Breaking through these levels with strong volume could confirm the beginning of a new bullish phase.

The technical analysis points towards a potentially favourable outlook for Bitcoin in the coming weeks, driven by miner accumulation, strong hash rates, and the support provided by the cost of mining. The market will need to sustain above key moving averages and break critical resistance levels to confirm a trend reversal.

Source: Coinmarketcap

Trump Delays Unveiling of U.S. Crypto Plan Amid Promotion of New Digital Ventures

Donald Trump’s delayed crypto announcement has sparked speculation among supporters and critics alike about his plans for the digital asset space. While some saw the delay as a strategic move to build suspense, others expressed disappointment over the lack of details provided by the former president. His promotion of the rebranded "World Liberty Financial" platform, along with the recent launch of another NFT collection, suggests that Trump may be seeking to blend his political and business ambitions in the burgeoning crypto market. However, without concrete proposals or specifics, it remains uncertain how he intends to position the U.S. as a global leader in cryptocurrency or whether this is primarily a branding exercise aimed at energising his base and attracting new supporters from the crypto community.

Conclusion

August has proven to be a challenging month for the crypto market, with significant outflows in Bitcoin and Ethereum ETFs, ongoing security vulnerabilities, and fluctuating asset prices. Despite these challenges, there are signals—especially within the Bitcoin market—that suggest a potential turnaround. Stablecoins continue to gain ground, underscoring their growing role as a stable asset class amid volatility. As the market heads into the latter part of the year, all eyes will be on key events such as the Bitcoin halving and regulatory developments, which could define the crypto landscape in 2024.